CRE Capital Markets: What to Expect by Q4

CBRE’s Darin Mellott explains why the second half of the year will look very different from the first.

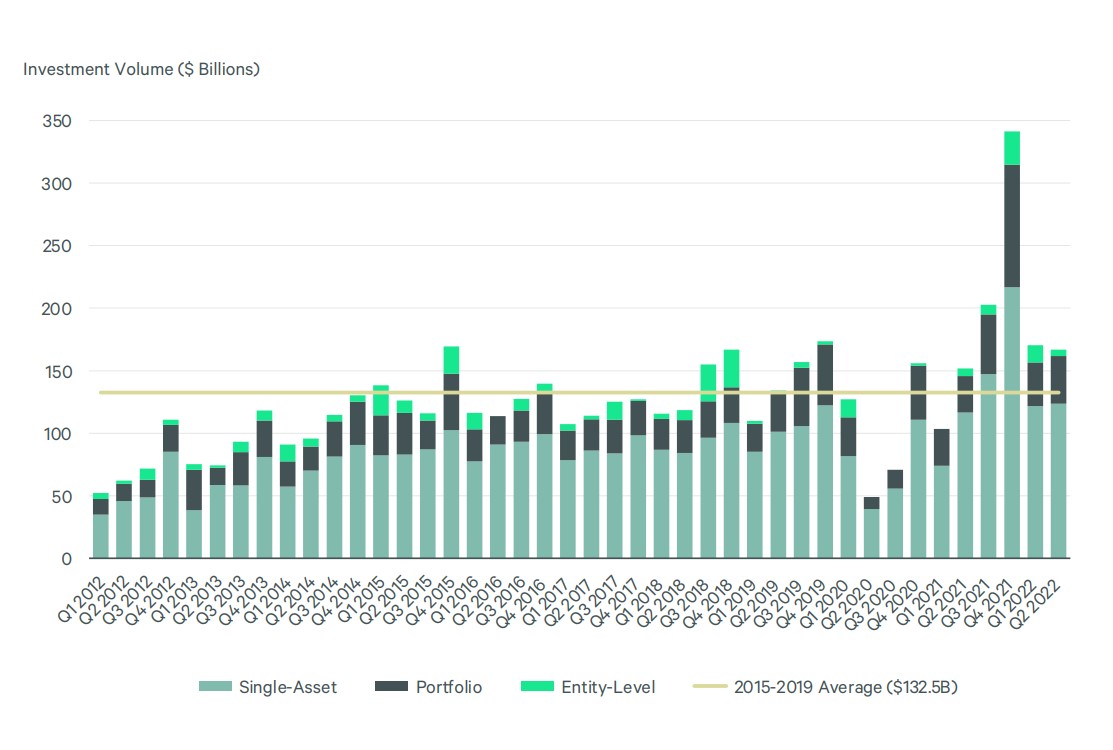

Investment activity held up nicely in the first six months of the year. Volume rose by 10 percent year-over-year in the second quarter to $167 billion, according to CBRE’s latest capital markets report. Monetary policies are expected to be the main driver influencing the finance and investment landscape in the next few months, particularly in the last quarter of the year.

Darin Mellott, senior director of Capital Markets Research at CBRE, analyzed the main factors affecting market fundamentals and the impact of industry volatility on capital markets. He also touched on the most financeable property types today and shifts in the lending environment.

What are three direct consequences of the interest rate hikes on capital markets?

Mellott: They are all somewhat related. The first thing that happened is we have seen the cost of capital go up, obviously. That is what it is meant to do.

Another thing that we are going to be watching is how this affects fundamentals going forward, because interest rates are a blunt instrument and so, they increase the cost of capital, yes, but that is going to filter through the economy and show up in real estate fundamentals as well. We expect, as that happens, to see some softening of demand for properties and some changes in broader property market fundamentals.

What we generally observe is that interest rates have an effect that is quite lagged. That is why it is a very tricky business. The Fed’s policies can have a lagged impact of six to nine months. So, it is obviously very difficult to know exactly what kind of conditions there will be at that time.

The third thing I would say is, because of all that, there is a lot more uncertainty and that can impact sentiment as well.

So, I would say those are the three main impacts: looking at the cost of capital, how it impacts real estate fundamentals and then how that filters in and affects market psychology.

READ ALSO: Charting CRE’s New Capital Markets Landscape

Tell us about other factors impacting capital markets at the moment.

Mellott: Interest rates are really the factor that is going to drive everything, and monetary policy is dictated by inflation reading. Obviously, we need to see what sort of an impact not only the interest rates are having on inflation, but also how some of the supply chain- and COVID-19-related issues get sorted out. That can help bring things down.

That is why when you saw any inkling of hope that inflation is coming down, when you saw a decent CPI—I say decent, but it was still relatively quite high—as energy prices pulled back, the markets really liked that kind of news. It was telling them that the Fed won’t have to go upward (with interest rates) indefinitely. That there’s a glimmer of hope.

What happens on the inflation story is what is going to drive interest rates and interest rates will drive the broader economy. And what is happening in the broader economy is going to impact both real estate fundamentals and sales volumes.

What shifts are you seeing in the lending environment due to these factors?

Mellott: The environment is very different from what it was at the start of the year. What we have seen, on fixed-rate loans, is interest rates going from the low 3 percent range to the high 4s—depending on where the long end of the curve is at—or even the low 5 percent range. Floating rate spreads have blown out to about 350 basis points, so that is on top of the SOFR (Secured Overnight Financing Rate) of around 2.25 and so, we’ve seen a meaningful increase in the cost of capital.

Also, lender preferences are showing up very clearly in the lending market right now. There is a clear preference for industrial and multifamily, even grocery-anchored retail centers. Those are quite financeable. And then some elements of healthcare and data centers. Other properties, such as office, are more difficult to finance right now.

In terms of what that has meant for LTV ratios, they are down from around the mid-60s to 50-55 percent right now, give or take a few percentage points, depending on the asset, its risk profile, property type etc. In terms of the lending environment, we have seen a shift in pricing, volumes have been impacted as financial conditions have tightened and we expect to continue to see the reverberations of those interest rate hikes in the market.

We expect total volumes for the year to probably be down 5 to 10 percent compared to last year. However, from a historical perspective, if we look at the five-year pre-pandemic average, this year’s volumes are still going to be quite healthy. They are going to be up 47 percent over that average. We had a very strong first half of the year. We expect those interest rate hikes to impact capital markets in a more pronounced way in the second half of the year.

Tell us about your outlook for the fourth quarter in terms of commercial real estate investment and capital markets trends.

Mellott: We think that activity is going to be slowing through the third quarter and in the fourth quarter we are definitely going to see a fuller impact from those interest rate increases. The thing that is really tricky is that 2021 was such an historical anomaly in terms of volumes. If you look at it on a chart it looks very out of place, especially when you consider that those volumes really started picking up in the third quarter and the fourth quarter was absolutely astronomical.

So, what we expect to see is, year-over-year, the fourth quarter is going to look quite ugly. But we think that, from a historical perspective, the year is going to end up looking pretty decent, despite the fact that we see the impact of rising interest rates in that last quarter of the year.

What sectors do you think will be most active?

Mellott: I think we are going to continue to see multifamily and industrial, but, of the two, multifamily is going to be the most resilient, for sure. There are a few different reasons for that, but one big reason is we haven’t built enough housing in the U.S. since the global financial crisis. So, there is a structural undersupply of housing and that is a very strong tailwind for multifamily, even in a very uncertain environment. That is not to say it won’t be impacted, but I think that’s sort of the underlying thing that is giving confidence to the market and to lenders.

The Federal Deposit Insurance Corp. announced it will take a closer look at banks with significant exposure to CRE loans, citing the economic impact of the COVID-19 pandemic. What are your views on this?

Mellott: Ever since the global financial crisis, regulators made sure that the financial sector is sound because of the broad impact that it can have on everyday lives, as we found out during that time. So, having a sounder financial system is in everybody’s best interest, but I think that what’s going to have to be watched is not just the fact that they’re doing these examinations. That’s not an issue. The questions that I would have in my mind is: How will this impact their guidance to banks? How are they looking at these risks?

In short, I would say this is not surprising, but we will be very interested to see the impact of that. I think that is yet to be determined.

Any other significant reflections, insights you want to share with our readers?

Mellott: The main thing is we do expect interest rates to bite in terms of the economy in the last half of this year and going into next year. As that growth slows, there will be impact on real estate fundamentals as well as on the capital markets and activity in the capital markets. We have seen a volatile first half of the year, but a lot of the impact of that volatility will be felt in the second half of the year. The historical perspective is also important—while we see things slowing, we’re quite healthy in terms of volume.

You must be logged in to post a comment.