CRE Investment Volume Climbs 10% in Q2

Both gateway and Sun Belt markets recorded strong growth.

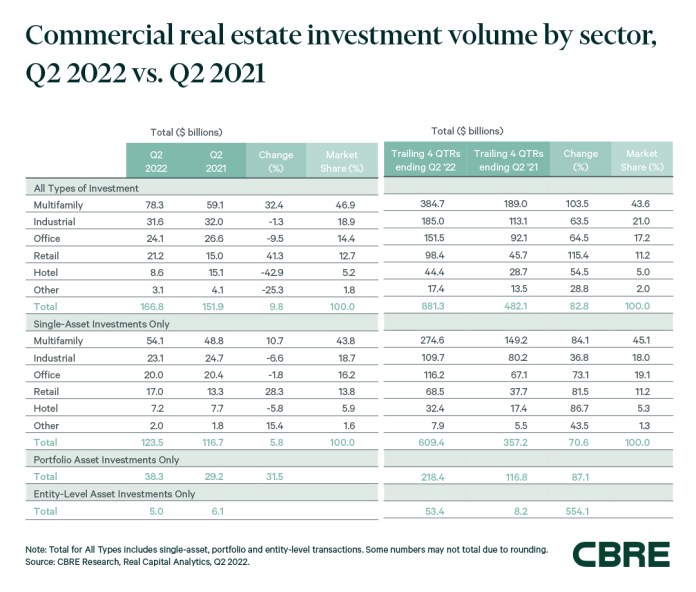

U.S. commercial real estate investment volume rose 10 percent year-over-year in the second quarter of 2022, to $167 billion, with industrial and logistics investments providing nearly $32 billion of the total and office $24 billion, according to a recent CBRE report. Trailing four-quarter volume totaled a record $881 billion.

CBRE found that the industrial sector saw its investment volume drop slightly, down 1.3 percent year-over-year from $31.6 billion in the second quarter of 2021. The office sector saw a bigger decrease—down 9.5 percent—from the second quarter of last year, when office investments reached $26.6 billion. Multifamily was the leading sector, with the total at $78 billion, a 32.4 percent year-over-year increase from $59.1 billion in the same time frame last year

“While we expect sales volumes in 2022 to end the year at a healthy level from a historical perspective, we do see some weakening in the remainder of the year amid higher interest rates and uncertainty as the macroeconomic landscape evolves,” Darin Mellott, senior director of capital markets research for CBRE, told Commercial Property Executive.

.

While portfolio transaction volume increased 41 percent, entity-level transactions fell by 17 percent year-over-year in the second quarter, largely due to higher borrowing costs. The Federal Reserve began raising interest rates in March, the first rate hike since the pandemic began—with a 25-basis-point increase, followed by a 50-basis-point increase in May and the three-quarter percentage point increase in June, the largest since 1994.

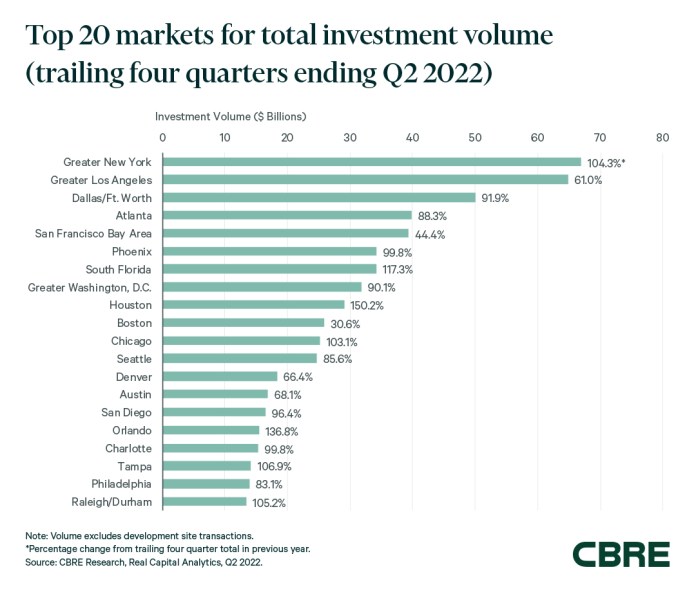

On a trailing four-quarter basis, New York was the top market, with $67 billion, up a strong 104.3 percent year-over-year. Los Angeles followed with total investment volume of $65 billion, up 61 percent. Rounding out the top 5 were Dallas-Fort Worth, at $50 billion, for an increase of 91.9 percent; Atlanta, at $40 billion, up 88.3 percent; and the San Francisco Bay Area, with just under $40 billion in volume, up 44.4 percent year-over-year.

READ ALSO: Top 10 Issues for CRE Executives

Houston had the biggest year-over-year increase in trailing four-quarter volume, at 150 percent, with about $29 billion in total investment volume. Other markets with big year-over-year increases in trailing four-quarter volume were: Orlando, Fla., $15.4 billion, up 136.8 percent; Las Vegas, Nev., $11 billion, up 132.5 percent; South Florida, $34 billion, up 117.3 percent; and Nashville, Tenn., with $12.1 billion in total investments, up 116 percent.

Prices, cross-border investment up

Institutional investors were net buyers last quarter, while private investors, REIT and cross-border investors were net sellers, according to the CBRE report. Private investors accounted for $102 billion, or 61 percent of the total. It was a 19.3 percent increase from the private investors’ volume of $85.4 billion during the same quarter last year. Institutional investors had a total investment volume of $39.9 billion in the second quarter, down 7.9 percent from $43.3 billion in 2021. REITs and public companies clocked in at $9.2 billion, a 5 percent decrease from $9.7 billion a year earlier.

READ ALSO: North America’s Hottest Tech Talent Markets

Inbound cross-border investment volume increased by 16 percent year-over-year, to $6.5 billion, but was down by 9 percent from the first quarter of the year due to the strengthening of the U.S. dollar. Multifamily was the leading sector for inbound cross-border investment, at $3 billion, followed by industrial with $2 billion and office at $1 billion.

Canada was the top country for U.S. inbound cross-border investment, with $24 billion in investments. Singapore followed, with $14 billion, and South Korea at $5 billion.

Prices were up across the board in the second quarter, the report showed. The RCA Commercial Property Price Index increased by 18.5 percent year-over-year. The industrial sector marked the biggest increase, up 27 percent year-over-year, followed by multifamily, with a 24.3 percent increase. Office property prices rose 10 percent for the second quarter year-over-year.

You must be logged in to post a comment.