CRE Bulls Will Continue

By Ken Riggs, President & CEO, RERC: According to public opinion polls, most Americans have never seen the world so chaotic. Despite these risks, U.S. consumers keep spending and investors keep investing.

By Ken Riggs, President & CEO, RERC

By Ken Riggs, President & CEO, RERC

According to public opinion polls, most Americans have never seen the world so chaotic. If increasing military action in the Middle East, territory disputes in Eastern Europe and Russia, and rising threats of terrorism weren’t enough, we also have major concerns about the economy in the euro zone, critical disruptions in currency values worldwide, and even fears about the possibility of Scotland (which has been part of the U.K. for more than 300 years) seceding. It is enough to keep the most steely-eyed investor on edge!

Despite these risks, U.S. consumers keep spending and investors keep investing while searching for the best alternative and resurrecting the slogan made famous by former British Prime Minister Margaret Thatcher, “There is no alternative.” In today’s world, the so-called TINA continues to dampen and wear down the bearish sentiment for the U.S. stock market, and in particular, the commercial real estate market for institutional investors for assets in the U.S. Given this era of TINA, it is not surprising that RERC’s investment survey respondents redirected their attention to less risky alternatives in second quarter 2014. On a scale of 1 to 10, with 10 being high, RERC survey investment ratings were 5.2 for stocks, 4.0 for bonds and 3.9 for cash investments. At 6.8, the highest-rated investment among the alternatives was once again CRE, as reported in the RERC Real Estate Report. CRE carries the bullish view from an investment alternative perspective.

The bearish view shows up with some investors believing that the price of CRE is beginning to outpace its value, as noted by RERC’s second quarter 2014 value vs. price rating for CRE, which declined slightly to 5.4 on a scale of 1 to 10, with 5 reflecting the midpoint of the scale and with 10 being high. In fact, as shown in the table at right, RERC’s value vs. price ratings for the office, industrial, retail and apartment sectors also declined, with the office, retail and apartment sector ratings dipping below the 5.0 point, indicating that the price of properties in these sectors is currently higher than the value.

The bearish view shows up with some investors believing that the price of CRE is beginning to outpace its value, as noted by RERC’s second quarter 2014 value vs. price rating for CRE, which declined slightly to 5.4 on a scale of 1 to 10, with 5 reflecting the midpoint of the scale and with 10 being high. In fact, as shown in the table at right, RERC’s value vs. price ratings for the office, industrial, retail and apartment sectors also declined, with the office, retail and apartment sector ratings dipping below the 5.0 point, indicating that the price of properties in these sectors is currently higher than the value.

This build-up of bearish views is hinged on the concern that rising interest rates will begin pushing up cap rates. Most of the world has held that a bubble for all assets is brewing that, if 10-year Treasury rates return to historical norms sooner than expected, could wreak havoc among all the markets.

However, it is becoming increasing likely—given the global risks—that low long-term interest rates could hold longer than expected, and recently some economists indicated that they could decline even further. If this happens, as RERC expects, investors should expect cap rates for CRE to hold in the already-fully-priced markets and to see additional downward pressure on cap rates and discount rates in non-coastal markets, or a broader downward pressure on average rates. Prices for CRE—a safe haven in times of great uncertainty—are likely to climb even higher on a broad market perspective. Eventually we will see better fundamentals triggered by demand-pull rental inflation as the economy improves. There is supporting investor sentiment for this CRE price support (TINA!).

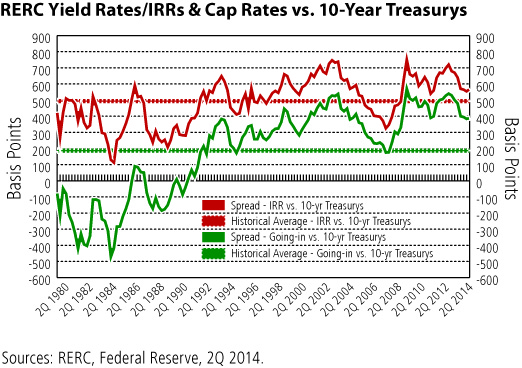

Even if interest rates do begin to increase sooner than expected, RERC maintains that long-term cap rate spreads relative to 10-year Treasuries demonstrate that cap rates will not increase until Treasury rates are at least 3.25 percent or higher. Even after that, cap rate expansion is unlikely to reflect a one-to-one relationship, and we would assume that a portion of the value erosion would be mitigated due to increasing NOI.

(As of the second quarter, RERC’s going-in capitalization rates averaged approximately 6.5 percent, which equates to an approximate spread of 400 basis points over the current 10-year Treasury of approximately 2.5 percent. As shown in the graph at left, the historical average for the going-in cap rate versus the 10-year Treasury spread has been approximately 200 basis points. As a result, it is reasonable to conclude that cap rates will not increase until Treasury rates are at least 3.25 percent.)

(As of the second quarter, RERC’s going-in capitalization rates averaged approximately 6.5 percent, which equates to an approximate spread of 400 basis points over the current 10-year Treasury of approximately 2.5 percent. As shown in the graph at left, the historical average for the going-in cap rate versus the 10-year Treasury spread has been approximately 200 basis points. As a result, it is reasonable to conclude that cap rates will not increase until Treasury rates are at least 3.25 percent.)

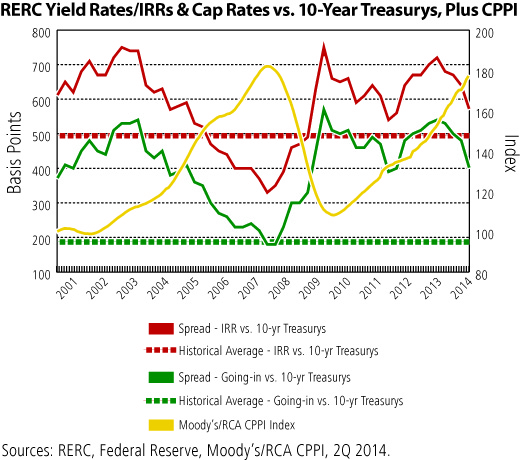

As shown at right, with the addition of the RCA/Moody’s Commercial Property Price Index (CPPI), prices are bullish and are on the run. Apartments have surpassed their price peak relative to the pre-credit crisis, and RERC expects other core properties to follow suit in the coming year.

As shown at right, with the addition of the RCA/Moody’s Commercial Property Price Index (CPPI), prices are bullish and are on the run. Apartments have surpassed their price peak relative to the pre-credit crisis, and RERC expects other core properties to follow suit in the coming year.

RERC expects continued pressures to keep interest rates and capitalization rates where they are today for at least another 12 months, and prices could increase even more during this time as the bulls broaden their chase for CRE in non-coastal markets. Given this time of TINA, the very reasonable risk-adjusted returns for CRE, the general safety of CRE, the fact that CRE serves as a hedge against inflation and the very competitive financing market for CRE, no wonder investors—both in this country and abroad—are willing to pay the kinds of prices being recorded today for top properties in the U.S.

That is the foundation for the bulls in CRE, and for the next 12 months, RERC suggests keeping out of their way!

You must be logged in to post a comment.