Construction Starts Drop

Fewer megaprojects broke ground in September, according to the latest report from Dodge.

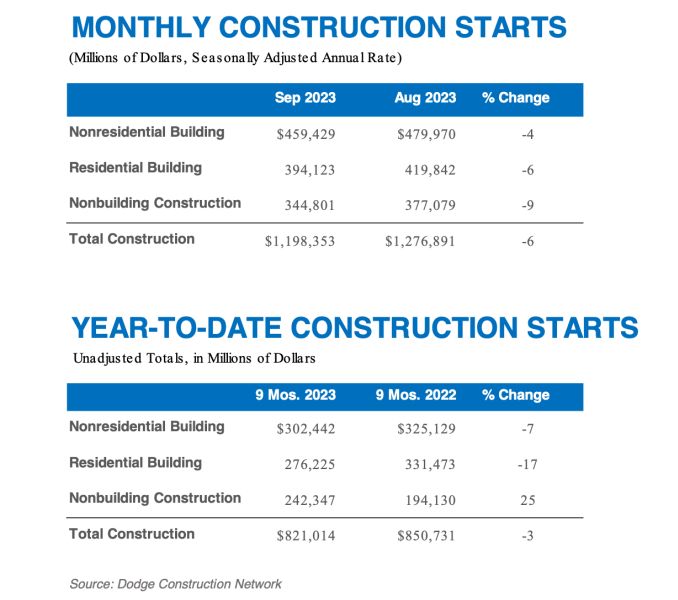

Dodge Construction Network’s latest report on construction starts showed a 6 percent decline, leading to a seasonally adjusted annual rate of $1.2 trillion. While nonresidential, residential and non-building construction starts all saw a dip for September, Dodge attributed some of the overall drop to a lower number of megaprojects breaking ground.

According to Dodge’s September numbers, non-residential construction starts were down 4 percent, residential starts dipped 6 percent and non-building saw the steepest decline at 9 percent. Looking at the year-to-date numbers, total construction starts saw a 3 percent decline, but the year-over-year overall number remained largely unchanged.

READ ALSO: Opportunistic Investors Are Waiting to Deploy $100B+ of Dry Powder

September did see a number of major projects break ground, including the $4.5 billion Sun Zia transmission line across Arizona and New Mexico that marked the largest non-building project to break ground last month. The $2.5 billion Hyundai/SK electric vehicle battery plant in Cartersville, Ga., earned the spot as the largest non-residential project to start construction in September, while the largest multifamily building to break ground was the $385 million first phase of the South Pier Residential Towers in Tempe, Ariz. According to Dodge, the Northeast, Midwest, South Atlantic and West regions all experienced drops with total construction starts, but the South-Central region saw a slight tick upwards.

Lack of megaproject starts

While the Sun Zia and Hyundai/SK projects qualify as megaprojects, Dodge noted that fewer megaprojects started construction in September. Sarah Martin, associate forecasting director at Dodge Construction Network, told Commercial Property Executive that megaprojects were those with a value of more than $1 billion.

“The presence, or absence, of megaprojects has contributed to the up-and-down trends in construction starts throughout 2023, with September marking a slower month for megaprojects breaking ground,” Martin told CPE.

Martin added that the overall drops in construction starts were attributed to the continued shortage of skilled labor and long permitting processes. Combined with the higher interest rates, tightening lending standards and uncertainty with higher energy costs, developers are feeling hesitant and have pushed back timelines, Martin also told CPE.

“As we move into mid-2024 when the Fed is expected to begin peeling back interest rates, conditions are likely to improve and support more construction starts,” Martin told CPE on the long-term outlook.

You must be logged in to post a comment.