Construction Sector Sees Signs of Recovery

The Dodge Momentum index shows a jump in the number of projects entering planning.

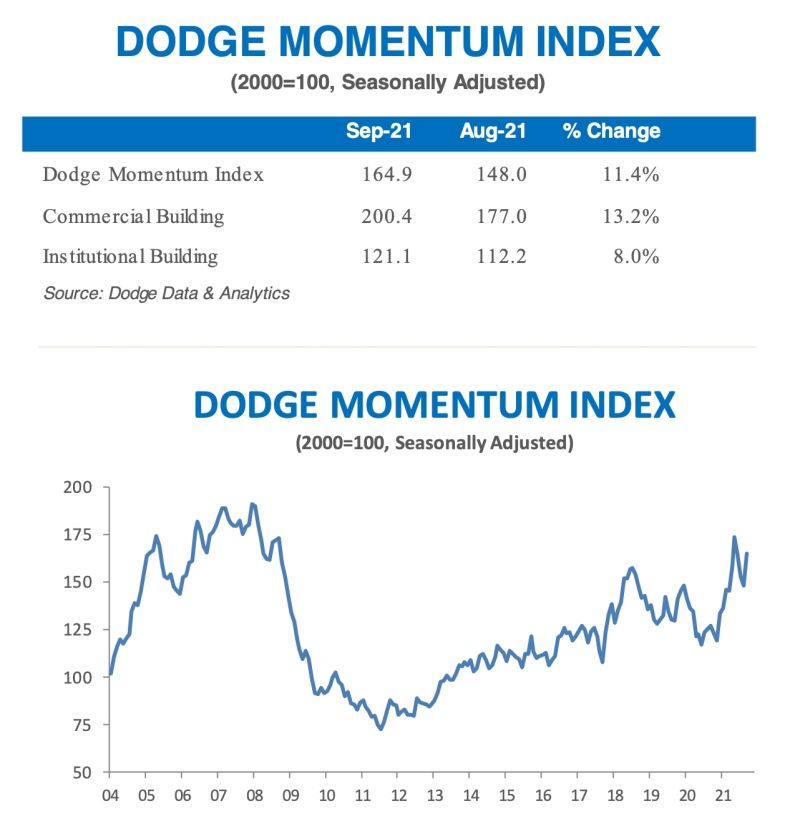

The nonresidential construction industry is seeing some positive momentum following consistent slowdowns in the summer months. Dodge Data & Analytics’ latest Momentum Index for the month of September showed an 11.4 percent increase to 164.9, up from August’s reading of 148.0.

READ ALSO: Construction Costs Will Keep Rising. Here’s How Much.

Dodge’s Momentum Index is a monthly measure of the initial report of nonresidential building projects in planning, which has proven to be a leading indicator (by a full year) of construction spending for such buildings, including commercial and institutional projects.

In September, the commercial planning component of the Momentum Index increased to 200.4, marking a 13.2 percent jump from the August reading of 177.0. The institutional planning component also rose 8 percent in September to 121.1, up from August’s reading of 112.2. The September readings offer the first signs of recovery after the Momentum Index showed slowdowns in the past three months, including a 6 percent decline in July.

When considering the year-over-year comparisons, the Momentum Index was 30 percent higher than in September 2020, with the commercial component also up 32 percent and the institutional component seeing a 25 percent increase.

The report noted that many sectors had major projects enter the planning phase during September, resulting in the positive construction momentum. However, Richard Branch, chief economist at Dodge Data & Analytics, told Commercial Property Executive that there was a pullback for the health-care sector specifically because fewer projects in that industry came into planning in September compared to recent months.

According to the report, 17 projects with a value of $100 million or more entered planning during September. The high-value commercial projects included the $500 million The Star office building in Los Angeles and the $250 million office project in Cambridge, Mass. The institutional side saw the first and third phases of a lab facility in Boston come into planning, which are valued at $450 and $225 million, respectively.

Uncertainty in the coming months

According to the report, the latest uptick in the construction momentum was a sign that owners and developers are looking past the concerns about pricing, the delta variant of COVID-19 and the politics that could impact the industry. Instead, they are moving forward with projects to meet the market’s demand.

The report also noted that there could still be problems ahead for the industry as well as month-to-month volatility in the data in the coming months. Branch told CPE that labor will be the most unpredictable element moving forward despite the job availability in the construction industry.

“The problems ahead for the construction sector continue to be higher material prices, shortages of products used by the construction sector, and continued scarcity of labor,” Branch also told CPE. “Clearly, in the construction sector, the jobs are there for the taking. However, the combination of COVID and skill gaps makes filling those positions over the short term uncertain.”

Read the full report by Dodge Data & Analytics.

You must be logged in to post a comment.