Commercial, Multifamily Mortgage Delinquencies Decrease

MBA’s latest survey offers a snapshot of loan performance by the major asset categories.

The commercial and multifamily real estate market continues to slowly recover this spring. Vaccination rates are rising, state and local economies are re-opening and COVID-19 cases are slowly declining.

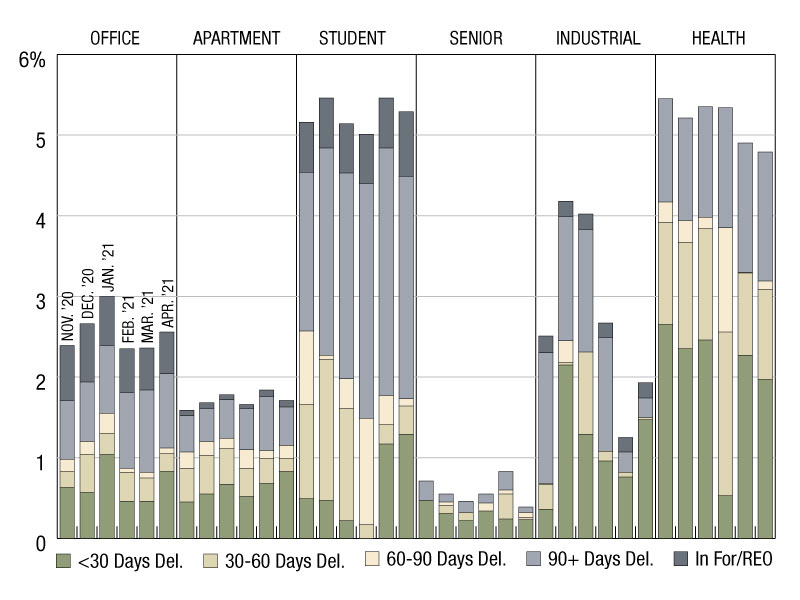

MBA’s latest CREF Loan Performance Survey found that delinquency rates for mortgages backed by commercial and multifamily properties are also declining, and in April reached the lowest level since the onset of the COVID-19 pandemic.

As we’ve seen throughout the pandemic, loans backed by lodging and retail properties continue to see the greatest stress. One positive sign on that front is that while stress exists, those two property types also saw the most improvement in performance.

New and early-stage delinquencies have fallen significantly from earlier in the pandemic, but later-stage delinquency rates have stayed high, as lenders and servicers work through the options for troubled properties. Vaccine rollouts, strong consumer balance sheets, and pent-up demand are all positive signals, both for new delinquencies and for working out troubled properties.

Let’s hope these trends continue as we head into a summer with quickening economic growth, a heavily-vaccinated population and more people getting back to work.

Jamie Woodwell is the Mortgage Bankers Association’s vice president of commercial real estate research.

You must be logged in to post a comment.