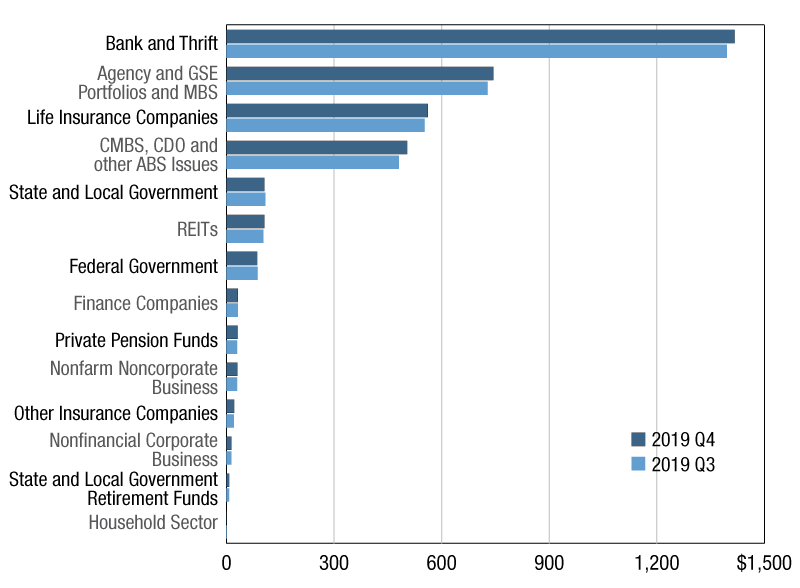

2019 Commercial/Multifamily Mortgage Debt Outstanding

Total commercial/multifamily debt outstanding rose by 7.3 percent at the end of the fourth quarter.

$ in billions

Sources: Mortgage Bankers Association, Federal Reserve Board of Governors, Wells Fargo Securities LLC, Intex Solutions Inc. and FDIC

As the calendar turns to April, the uncertainty about the present and future scope of the coronavirus outbreak on the economy and commercial real estate sector is one big wildcard. Will the economic impacts last through spring and summer? Or will there be a “V” shaped recovery, as activity bounces back strongly in the coming months as “stay at home” rules slow the spread of the virus and limit the overall damage to the economy? At this point, it’s still too early to tell.

Going back to better times, MBA recently released its Commercial/Multifamily Mortgage Debt Outstanding quarterly report for the final three months of 2019. Last year, the amount of mortgage debt backed by commercial and multifamily properties grew by the largest annual amount since before the Global Financial Crisis. Every major capital source increased their holdings, and some by double digits. Furthermore, continuing the recent trend, the growth in multifamily mortgage debt outpaced that of other property types.

Overall, commercial/multifamily mortgage debt outstanding at the end of last year was $248 billion (7.3 percent) higher than at the end of 2018. In last year’s fourth quarter alone, total mortgage debt outstanding rose by 2.1 percent ($75.0 billion) compared to the third quarter. Multifamily mortgage debt grew by $30.4 billion (2.0 percent) to $1.53 trillion during the fourth quarter, and by $116.7 billion (8.2 percent) for the entire year.

This month’s chart looks at commercial and multifamily debt outstanding by sector in last year’s fourth quarter. You’ll see that commercial banks continue to hold the largest share (39 percent) of commercial/multifamily mortgages at $1.4 trillion. Agency and GSE portfolios and MBS are the second largest holders of commercial/multifamily mortgages, at $744 billion (20 percent of the total). Life insurance companies hold $561 billion (15 percent), and CMBS, CDO and other ABS issues hold $504 billion (14 percent).

Jamie Woodwell is the Mortgage Bankers Association’s vice president of commercial real estate research.

—Posted on Apr. 1, 2020

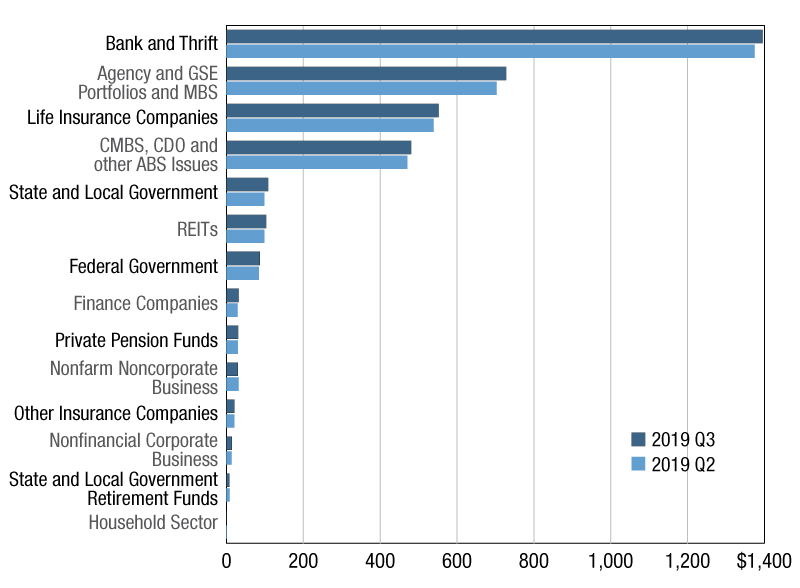

$ in billions

Sources: Mortgage Bankers Association, Federal Reserve Board of Governors, Wells Fargo Securities LLC, Intex Solutions Inc. and FDIC

Strong property markets, low interest rates, and low mortgage delinquencies continue to draw more capital to commercial and multifamily mortgages. In the third quarter of 2019, the sustained rise continued. Commercial/multifamily mortgage debt outstanding rose by $75.7 billion (2.2 percent), according to MBA’s latest Commercial/Multifamily Mortgage Debt Outstanding quarterly report, released in December.

Every major capital source increased their holdings of commercial real estate debt during the third quarter, led by Fannie Mae, Freddie Mac and the Federal Housing Administration (FHA). The growth of investor-driven lenders is also evident, with mortgage REITs on pace to soon become the fifth-largest source of capital for commercial and multifamily mortgages.

Total commercial/multifamily debt outstanding rose to $3.59 trillion at the end of the third quarter. Multifamily mortgage debt alone increased $40.6 billion (2.8 percent) to $1.5 trillion from the second quarter.

In the accompanying chart, you can see the total commercial and multifamily mortgage debt outstanding by sector in the second and third quarters of last year. Commercial banks continue to hold the largest share (39 percent) of commercial/multifamily mortgages at roughly $1.4 trillion. Agency and GSE portfolios and MBS are the second largest holders of commercial/multifamily mortgages (20 percent) at $728 billion. Life insurance companies hold $552 billion (15 percent), and CMBS, CDO and other ABS issues hold $481 billion (13 percent).

Jamie Woodwell is the Mortgage Bankers Association’s vice president of commercial real estate research.

—Posted on Jan. 16, 2020

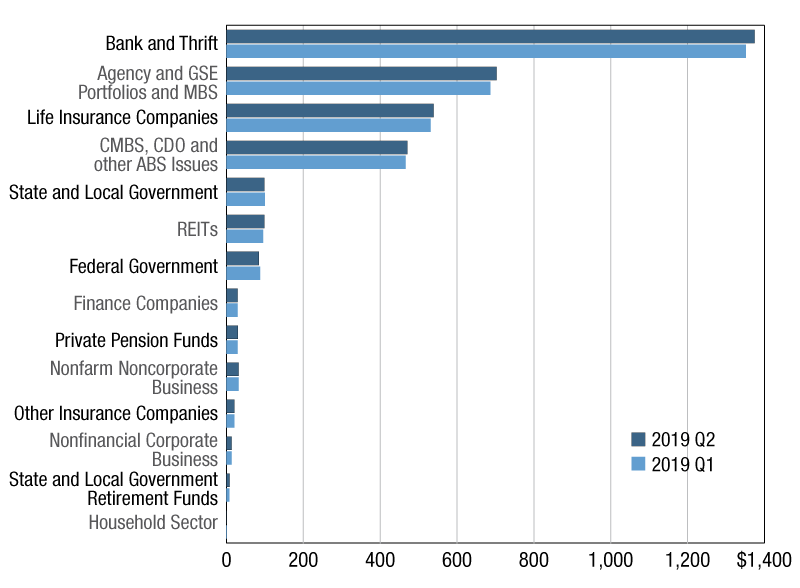

$ in billions

Sources: Mortgage Bankers Association, Federal Reserve Board of Governors, Wells Fargo Securities LLC, Intex Solutions Inc. and FDIC

The level of commercial/multifamily mortgage debt outstanding rose by $51.9 billion (1.5 percent) in the second quarter of 2019, according to the Mortgage Bankers Association’s (MBA) latest Commercial/Multifamily Mortgage Debt Outstanding quarterly report.

At the end of the first half of 2019, total commercial/multifamily debt outstanding was at $3.5 trillion. Multifamily mortgage debt alone increased $24.4 billion (1.7 percent) to $1.5 trillion from the first quarter.

Strong borrowing and lending, coupled with relatively low levels of loan maturities, are helping to boost the amount of commercial and multifamily mortgage debt outstanding. All four major capital sources increased their holdings during the quarter. With strong demand expected to continue, debt levels are likely to climb even more and end the year at a new high.

Commercial banks continue to hold the largest share (39 percent) of commercial/multifamily mortgages at $1.4 trillion. Agency and GSE portfolios and MBS are the second largest holders of commercial/multifamily mortgages (20 percent) at $703 billion. Life insurance companies hold $539 billion (15 percent), and CMBS, CDO and other ABS issues hold $471 billion (13 percent).

Jamie Woodwell is the Mortgage Bankers Association’s vice president of commercial real estate research.

—Posted on Oct. 24, 2019

You must be logged in to post a comment.