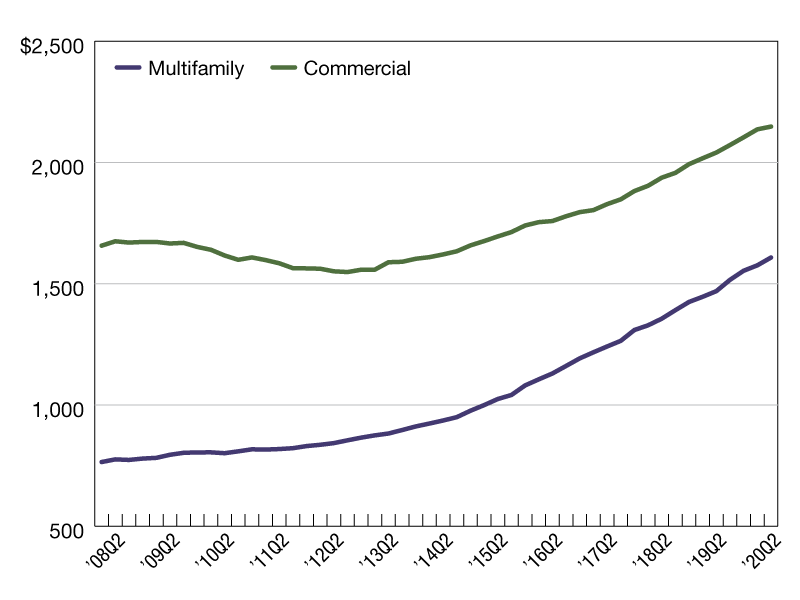

Commercial/Multifamily Mortgage Debt Continued Rise in the Second Quarter of 2020

The level of commercial/multifamily mortgage debt outstanding increased by $43.6 billion (1.2 percent) to $3.76 trillion at the end of the second quarter.

$ in billions

Despite a drop off in new commercial and multifamily mortgage originations in the second quarter, the total amount of mortgage debt outstanding continued to rise amidst the COVID-19 pandemic and subsequent economic uncertainty.

That is according to the Mortgage Bankers Association’s recently released Commercial/Multifamily Mortgage Debt Outstanding quarterly report for this year’s second quarter. The level of commercial/multifamily mortgage debt outstanding increased by $43.6 billion (1.2 percent) to $3.76 trillion at the end of the second quarter. Multifamily mortgage debt alone increased $32.2 billion (2.0 percent) to $1.6 trillion from the first quarter of 2020.

It is clear from our data that the pandemic is having different impacts on various property types and capital sources. Loans backed by multifamily properties accounted for almost three-quarters of the total growth in the second quarter, and Fannie Mae, Freddie Mac, and FHA accounted for nearly three-quarters of that amount.

Commercial banks continue to hold the largest share (39 percent) of commercial/multifamily mortgages at $1.5 trillion. Agency and GSE portfolios and MBS are the second largest holders of commercial/multifamily mortgages (21 percent) at $775 billion. Life insurance companies hold $574 billion (15 percent), and CMBS, CDO and other ABS issues hold $518 billion (14 percent).

Looking solely at multifamily mortgages in the second quarter, agency and GSE portfolios and MBS hold the largest share of total multifamily debt outstanding at $775 billion (48 percent) , followed by banks and thrifts with $474 billion (30 percent), life insurance companies with $167 billion (10 percent), state and local government with $93 billion (6 percent), and CMBS, CDO and other ABS issues holding $53 billion (3 percent). Nonfarm non-corporate businesses hold $21 billion (1 percent).

With the industry as a whole still grappling with the economic fallout from the virus, originations and debt trends will continue to be closely followed.

Jamie Woodwell is the Mortgage Bankers Association’s vice president of commercial real estate research.

You must be logged in to post a comment.