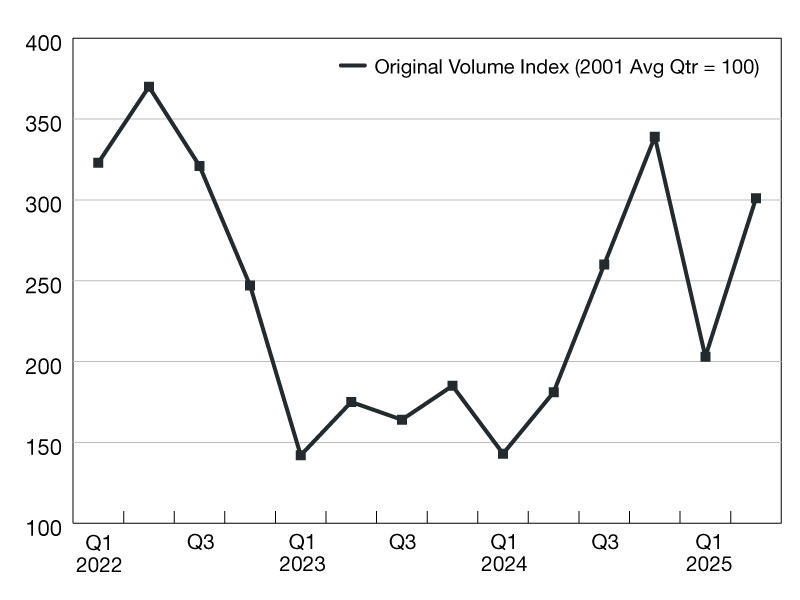

Commercial/Multifamily Borrowing Increased 66 Percent in Q2

Among investor types, the dollar volume of loans originated for depositories increased by 108 percent year-over-year.

Commercial and multifamily mortgage loan originations were 66 percent higher in the second quarter of 2025 compared to a year earlier, and increased 48 percent from the first quarter of 2025, according to the Mortgage Bankers Association’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations, released earlier this month.

Compared to a year earlier, a rise in originations for office, health care and industrial properties led to an overall increase in commercial/multifamily lending volumes. There was a 140 percent year-over-year increase in the dollar volume of loans for office properties, a 77 percent increase for health-care properties, a 53 percent increase for industrial properties, and a 30 percent increase for retail properties. Originations for multifamily properties decreased 35 percent, and hotel property loan originations decreased 30 percent compared to the second quarter of 2024.

Breakdown by investor and property type

Among investor types, the dollar volume of loans originated for depositories increased by 108 percent year-over-year. There was a 93 percent increase in loans for investor-driven lenders, a 72 percent increase in loans for life insurance companies, a 59 percent increase in government sponsored enterprises (Fannie Mae and Freddie Mac) loans, and a 10 percent decrease in commercial mortgage-backed securities (CMBS) loans.

On a quarterly basis, second-quarter originations for industrial properties increased 102 percent compared to the first quarter of 2025. There was a 90 percent increase in originations for health-care properties, a 58 percent increase for retail properties, and originations for hotel properties were unchanged compared to the first quarter of 2025. Originations for office properties decreased 18 percent, and multifamily originations decreased 41 percent compared to the first quarter of 2025.

—Posted on August 25, 2025

You must be logged in to post a comment.