Commercial/Multifamily Borrowing Falls in Q3

Compared to last year’s third quarter, commercial and multifamily originations were 47 percent lower.

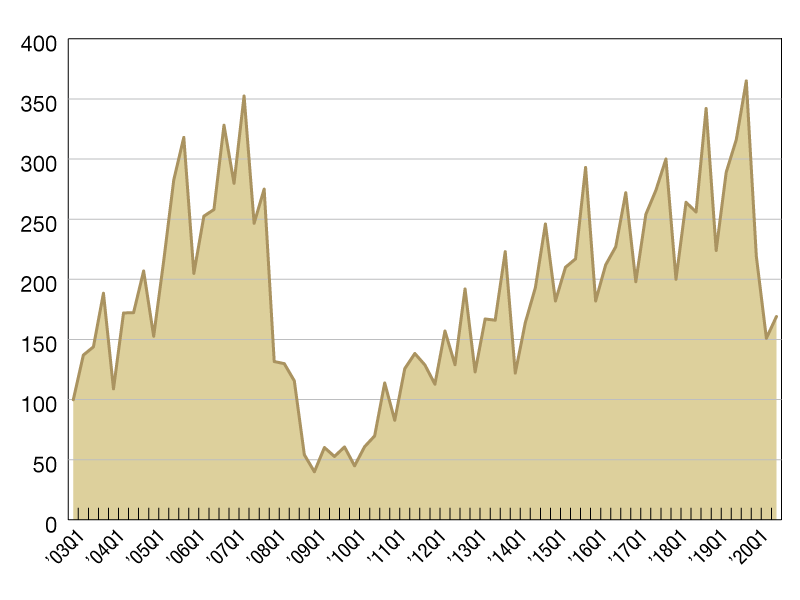

2001 quarterly average = 100

The COVID-19 pandemic continues to impact new originations of commercial and multifamily mortgages. Compared to last year’s third quarter, commercial and multifamily originations were 47 percent lower, according to the Mortgage Bankers Association’s (MBA) Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.

Every major property type and capital source recorded a year-over-year decline. Originations backed by industrial and multifamily properties saw smaller declines than other property types, with multifamily lending buoyed by loans made for Fannie Mae, Freddie Mac and FHA.

The sliver of good news? Although from a low level and still very subdued overall, originations did increase 12 percent in the third quarter compared to the second quarter. Furthermore, according to MBA’s CREF Loan Performance Survey, commercial and multifamily mortgage performance improved in October, but there continues to be evidence of elevated stress, especially among loans backed by retail and lodging properties.

All property types showed a decline in the third quarter in commercial/multifamily lending volumes when compared to the third quarter of 2019. The third quarter saw a 94 percent year-over-year decrease in the dollar volume of loans for hotel properties, an 83 percent decrease for retail properties, a 58 percent decrease for office properties, a 51 percent decline for health care properties, a 31 percent decrease in multifamily properties, and a 23 percent decrease for industrial property loan originations.

Among investor types, the dollar volume of loans originated for commercial bank portfolio loans declined by 68 percent year-over-year. There was a 58 percent decrease for Commercial Mortgage-Backed Securities (CMBS), a 55 percent decrease in life insurance company loans, and an 8 percent decrease in the dollar volume of Government Sponsored Enterprises (GSEs – Fannie Mae and Freddie Mac) loans.

On a quarterly basis, third quarter originations for industrial properties increased 67 percent compared to the second quarter 2020. There was a 35 percent increase in originations for office properties, a 32 percent increase for health care properties and a 4 percent increase for multifamily properties. Originations for retail properties decreased 27 percent, and originations for hotel properties declined 45 percent.

Among investor types, between the second and third quarter of this year, the dollar volume of loans for CMBS increased 749 percent, loans for GSEs increased 3 percent, originations for life insurance companies decreased 9 percent, and the dollar volume of loans for commercial bank portfolios decreased last quarter, by 21 percent.

Can the commercial and multifamily lending market show improvement to close out 2020? It remains to be seen – and likely depends on effective treatment or a vaccine to slow the spread of the pandemic. There is still a lot of uncertainty around the pandemic and how everyone responds to it.

Jamie Woodwell is the Mortgage Bankers Association’s vice president of commercial real estate research.

You must be logged in to post a comment.