Commercial Mortgage Delinquency Rates Decreased in Q3

Much of the declines are from the resolution of loans with later-stage delinquency status, according to MBA’s latest report.

Origination Volume Index; 2001 Quarterly Average = 100

The commercial real estate sector continues to improve markedly from the depths of the pandemic-induced recession in Spring 2020.

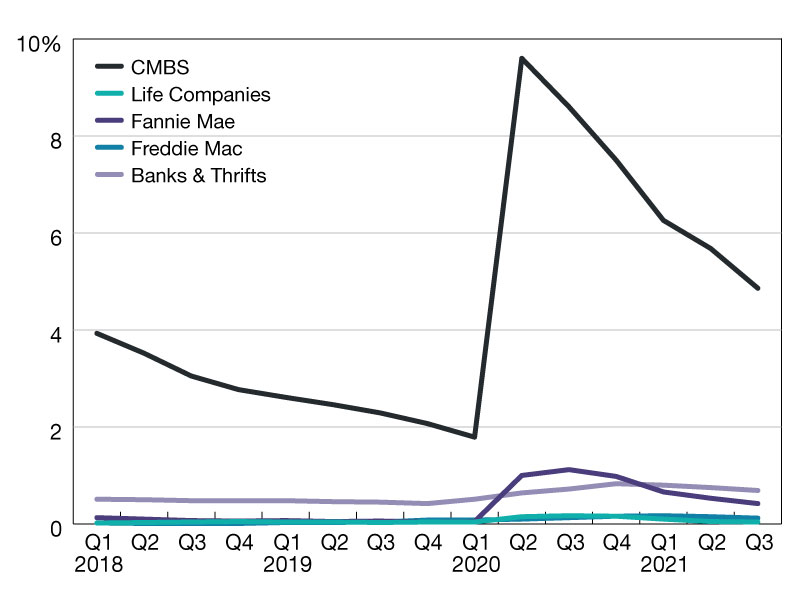

In the third quarter of this year, commercial mortgage delinquencies declined further across all investor groups, according to MBA’s latest Commercial/Multifamily Delinquency Report.

MBA’s quarterly analysis looks at commercial delinquency rates for five of the largest investor groups: commercial banks and thrifts, commercial mortgage-backed securities (CMBS), life insurance companies, and Fannie Mae and Freddie Mac.

The trend continues. Commercial mortgage delinquency rates for every major capital source have come down since the early months of the pandemic. With low numbers of loans becoming newly delinquent, much of the declines are coming from the resolution of loans with later-stage delinquency statuses. Despite successive waves of COVID-19, the economy has shown solid growth, and it is hard to imagine a return to the extraordinary shutdowns in early 2020 that negatively impacted some sectors of commercial real estate.

Jamie Woodwell is the Mortgage Bankers Association’s vice president of commercial real estate research.

You must be logged in to post a comment.