CMBS Market Update

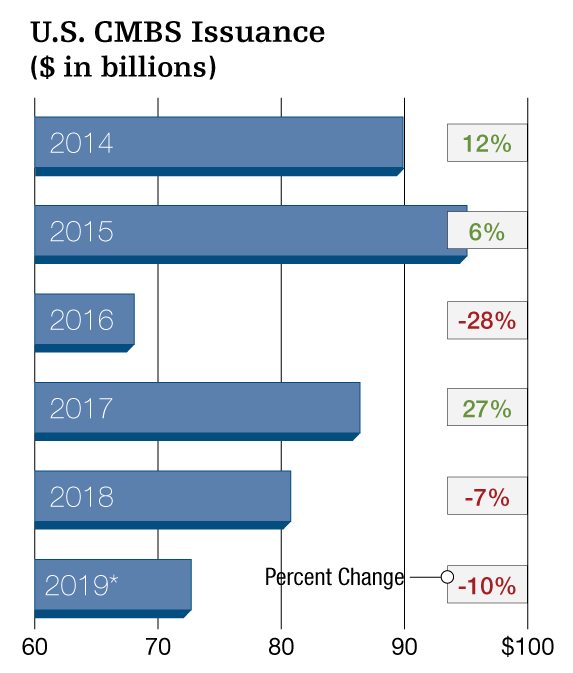

Commercial mortgage-backed securities origination has declined significantly in early 2019, though the falloff in volume this year may yet turn out to be more modest than the 10 percent initially projected. Read our latest CMBS Update.

How will CMBS origination in 2019 stack up? After the first several months of 2019, signs continue to point to a significant decline in volume, though some observers contend that the reduction could be less severe than expected. Volume is just one of the trends we are following in our CMBS Market Update.

CMBS market performance in the early going this year appeared to confirm the likelihood of a decline, initially projected in the 10 percent range. Issuance slipped to $16 billion during the first quarter, down from $19 billion during the same period of 2018, reported Jamie Woodwell, vice president of research and economics at the Mortgage Bankers Association. CMBS, CDO and other ABS issues hold $466 billion, or about 14 percent of commercial and multifamily mortgages, according to MBA.

A key indicator for CMBS origination volume is the spread between the yield for investing in AAA bonds and the comparable swap rate, Woodwell noted. Tight spreads tend to coincide with strong investor demand and increased volume; wider spreads generally signal the opposite. True to that pattern, the first-quarter falloff in CMBS originations comes at a time when spreads for AAA-rated bonds have widened from 70 basis points in 2018 to 92 basis points at most recent report.

The proximate cause of the current slowdown stems from late 2018, when rising interest rates caused hesitation among bond investors to buy CMBS, Orest Mandzy wrote in a research note for Trepp. That prompted a reluctance among CMBS lenders to originate loans, and the market has yet to bounce back entirely. “Because it often takes a little while to get origination machines back in gear, securitization activity early this year was relatively weak,” wrote Mandzy, who holds to the consensus projection of a 10 percent downturn.

Better Than Expected?

Other observers interviewed for our CMBS Market Update expect a more modest decline in CMBS origination than appeared likely at the beginning of the year. “Now that first quarter results are in, we actually saw a higher number of deal submissions than we initially projected,” said Joe Baksic, an associate managing director for primary ratings with Moody’s CRE-CMBS team. “So it seems as though 2019 might be better than first thought. The consensus view was colored by Fed activity at the end of the year. Now that the Fed has backed off, and financial markets have improved, it wouldn’t surprise me for the year to look better than we originally expected.”

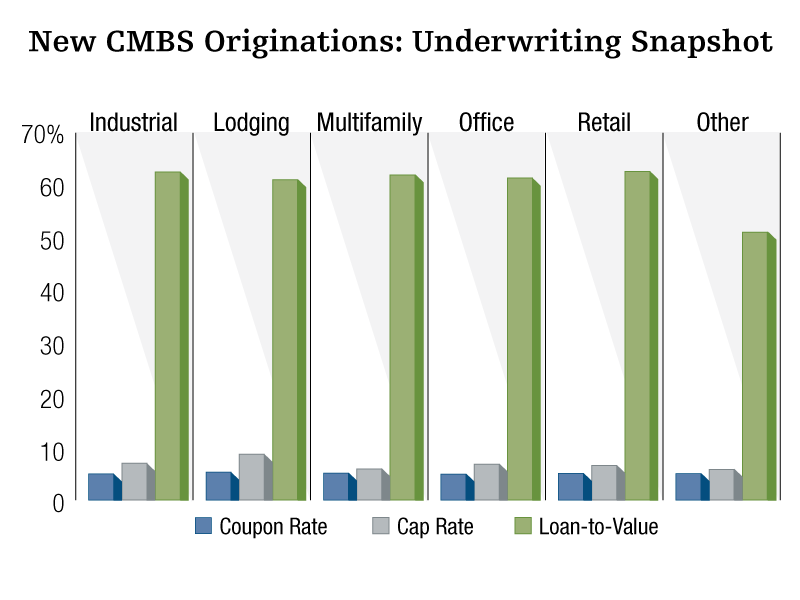

Based on average securitized values of CMBS loans originated from June to December 2018.

Source: Trepp

Other factors may be contributing to the decline in origination, as well. From 2007 to 2017, more CMBS loans were paid off or paid down than were originated. As a result, the volume of mortgages in CMBS declined by nearly one half, from some $800 billion to slightly more than $400 billion, said Woodwell. “Since the beginning of 2017, that trend has reversed, and we’ve seen more new loans than we’ve seen payoffs and pay downs,” he said. “The balance of CMBS loans has been rising.” Also contributing to the decline in volume is a smaller inventory of product from a decade ago to refinance, noted Jodi Schwimmer, a partner in the financial industry group at Reed Smith. Given the uptick in interest rates, and proceeds limited to 60 to 65 percent, borrowers may be evaluating whether now is the best time to refinance with CMBS shops, since alternatives may offer similar rates and proceeds, she said.

Some borrowers have leeway in refinancing their debt and are opportunistic in optimizing equity in their properties, Schwimmer said. Others may have less flexibility, the result of terms that require refinancing at a specific time. Single-Asset Single-Borrower and shorter-term floating rate paper will be issued at a similar pace to last year, and CRE CLO paper will increase in issuance, due to investor demand for shorter-term, higher-yield paper, Schwimmer said.

Change and Continuity

In the recent past, CMBS lenders have made several changes to loan structures. “For example, we saw a dramatic increase in interest-only lending and loosening of certain legal protections going into 2019,” Baksic said.

The composition of CMBS portfolios is expanding—if slowly—beyond the five hospitality, industrial, multifamily, office and retail, as well as the occasional specialty category, like self storage. “What we are beginning to see today are more frequent requests to opine on lower-quality regional malls, marinas, shipyards and other esoteric property types,” Baksic noted. “However, the volume of esoteric property lending in CMBS is still very low.”

*Projected 2019 total, based on consensus estimate 10% decline.

Sources: Commercial Real Estate Direct, Mortgage Bankers Association

So far in 2019, our CMBS Market Update finds much the same cast of participants as in recent years. Large banks such as J.P. Morgan, Wells Fargo and Barclays remain the leaders, said Mitch Paskover, president of Continental Partners, a Los Angeles, Calif.-based mortgage banking firm. “Shops that opened with a line of credit or borrowing money to do loans are languishing because big banks’ cost of capital is lower,” he said.

One new twist to the playing field: After several years of contributing to CMBS deals led by other banks, Barclays began leading some deals for the first time in late 2018, Baksic noted. “As far as non-bank lenders, (Cantor Commercial Real Estate) has begun to step up their participation over the past four quarters after having been relatively quiet for the past few years.”

During the first quarter, Citigroup led CMBS loan originations with 74.3 loans valued at $2.9 billion, sufficient to earn a 15.5 percent share of the market and first place among CMBS bookrunners, Mandzy noted. All told, 24 lenders contributed loans to the market during the first quarter, up from 21 during the same period of 2018.

Delinquency Downturn

Another noteworthy trend is the steady decline in CMBS delinquency rates, Since end of 2017, delinquency rates on conduit deals have consistently declined and have reached the lowest point since October 2009, said Matt Halpern, vice president & senior credit officer for Moody’s CRE-CMBS group. As of February 2019, that rate stood at 3.78 percent in February 2019, per Moody’s Delinquency Tracker.

Overall, the conduit delinquency rate has generally declined over the past several years, thanks mainly to two factors: low delinquency rates for post-2009 CMBS loans and the continued resolution of pre-crisis loans, Halpern said. Delinquency rates remain high for loans generated before the financial crisis, but they also represent a small portion of outstanding CMBS. And that share will continue to shrink as delinquent loans are resolved.

MBA’s study of CMBS loans delinquent 30 or more days or in REO during the fourth quarter of 2018 found the number to be 2.77 percent, a decrease of 0.28 percent compared with the third quarter. Individual capital sources arrive at their delinquency rates in different ways, resulting in numbers that are not apples-to-apples comparisons, Woodwell said. “When you cut through the differences, the CMBS delinquency rate is very comparable to the rates of banks.”

You must be logged in to post a comment.