The Rising Prominence of CRE CLOs

Commercial real estate CLOs enjoyed a banner 2018 as year-over-year volume nearly doubled. Deal size has also been increasing, but some uncertainty surrounds the vehicles’ prospects for 2019.

Triangle Plaza, a two-building, 634,993-square-foot office property located near O’Hare International Airport and about 15 miles northwest of Chicago’s CBD. Valued at $72.4 million as of the CLO’s closing, Triangle Plaza’s mortgage is the largest loan in the second CRE CLO issued by Värde in 2018.

Nitin Bhasin doesn’t like to use the term “resurgence” to describe activity in the collateralized loan obligations market in recent years.

“This is not resurgence from our perspective,” said Bhasin, senior managing director & co-head of CRE securitizations at Kroll Bond Ratings Agency. He prefers to call 2018 a breakout year. “This is a new form of CMBS securitization that hasn’t been done before in any meaningful form pre-crisis.” But no one can deny that issuance has increased significantly since 2012.

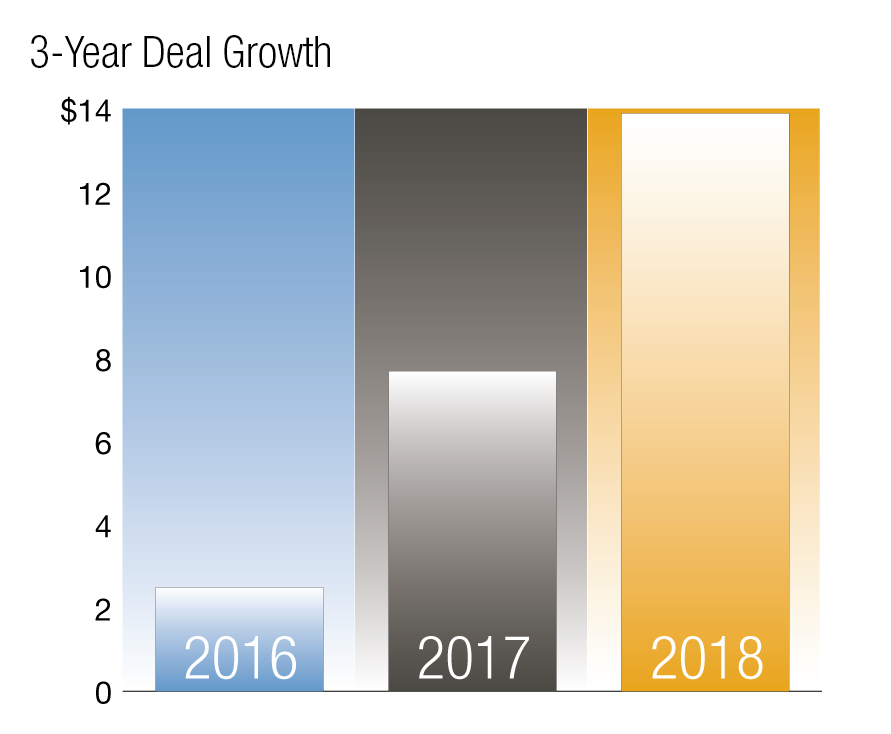

A recent watershed came when year-over-year volume jumped from 18 transactions and $7.7 billion in 2017 to 25 deals valued at $13.9 billion last year. “When you see issuance double from 2017 to 2018, that is something to take note of. When people see a market that is growing, they take notice, especially people within the industry,” said Joe McBride, director of research and applied data at Trepp Inc.

Volume has been climbing steadily for most of the decade. In 2012, three CRE CLO transactions were issued by three sponsors for $1.1 billion. Between 2013 and 2015, issuance hovered between $3 billion to $5 billion a year. In 2016, there was a dip to about $2.5 billion because of challenges in the capital markets at that time.

“Every year it was going up marginally, until the dip in 2016. But as 2017 and 2018 came along there was this expectation of rising interest rates from historical lows. There was a shift in preference for investors toward looking at shorter duration, floating-rate investments. This product was more suited to that,” Bhasin said. As more investors accepted the product, pricing tightened, which enticed others who were in the transitional CRE lending space to consider them, he noted.

Strength in Numbers

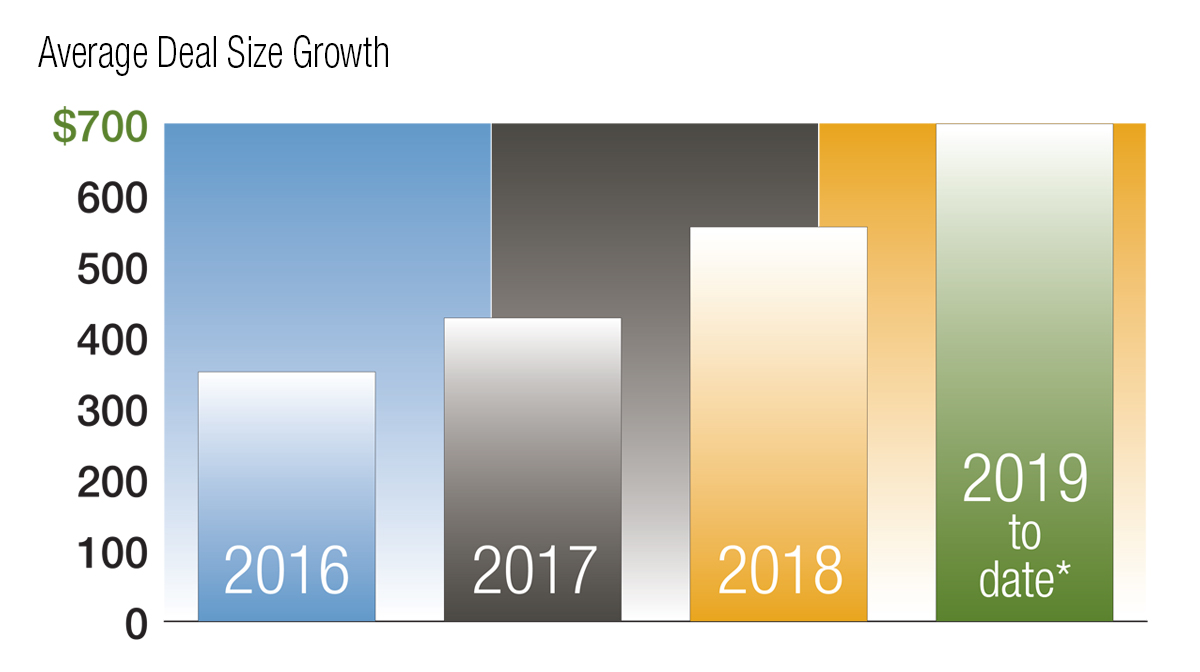

Deal size has also risen rapidly, from $351 million in 2016 to to $555 million in 2018. As of early March, the average deal size for 2019 was $700 million.

In 2017, there was one $1 billion transaction, and in 2018 three deals totaled $1 billion or more. The 2018 number would have ended up higher but Bridge Investment Group, which was set to launch a CRE CLO in December, pulled it back because of volatility in the capital markets. (That $600 million transaction finally closed in February with 24 loans featuring an aggregate initial loan balance of $538.8 million and $61.2 million of cash.)

As of early March, four deals totaling $2.8 billion had been announced, including Bridge’s, according to Kroll. Two others have closed: Granite Point Mortgage Trust’s $825 million CRE CLO and Annaly Capital Management’s $857.3 million CRE CLO. Bancorp Bank has announced a $518.3 million static CLO, which is also being rated by KBRA, but it had not closed at press time.

*2019 number includes three closed deal and one announced as of March 7

Source: Kroll Bond Rating Agency

CLOs vs. CDOs

The current generation of CRE CLOs shares some characteristics with its pre-crisis counterparts, the vehicles known as collateralized debt obligations, but there are meaningful distinctions. “From a credit risk perspective and collateral perspective, CRE CLOs are very different,” Bhasin said. Unlike today’s CRE CLOs, the pre-crisis CRE CDOs were primarily collateralized by subordinate loan and debt securities, and often had a mix of what Bhasin and others call the “kitchen sink” for collateral. In sharp contrast, CRE CLOs are entirely collateralized by first-lien bridge loans secured by transitional real estate.

“These are all first mortgages—no mezzanines, no junior notes, no securities,” said Joseph Iacono, managing partner of Crescit Capital Strategies. “It’s a lot simpler, and that reduces the leverage.”

“From an investor perspective, it looks like a good value play as well as being short in duration,” Iacono added. That quality is particularly attractive in a rising interest-rate environment. Floating-rate terms take away rate risk, and the replacement period is relative short. “Because bonds are floating-rate, you don’t have rate risk and your expected repayment is relatively short. It’s been the driver of demand.”

Other key changes include the decline in the reinvestment period, which has declined from five or six years to two years, and the preference for managed rather than static transactions. “When the market first came back, most were closed to reinvestment,” Iacono said. “Now there are more managed deals. You can identify the parameters of loans that can be included.”

Static transactions were the most common CLO deals from 2012-2014. A static structure provides no means to reinvest principal proceeds, so that when a loan prepays or pays off at maturity, those proceeds go to pay down the bond, there is no ability to acquire new assets.

The lightly managed structure arrived around five years ago, Bhasin notes. In this transaction type, principal proceeds can only be used to acquire companion participations of loans that already exist within the transactions.

Managed CRE CLOs typically have a reinvestment period of two to three years, during which the collateral manager can use principal proceeds to acquire previously unidentified loans. Some of these transactions also have a ramp-up feature.

In 2012, almost all deals were static. Between 2014 and 2017, lightly managed transactions prevailed. By 2017, about one-third of the transactions were managed, a share that exceeded 50 percent in 2018. All three transactions completed by early March 2019 were managed. The Bancorp deal, which had not yet closed at press time, is static.

“Most issuers are transitioning to managed deals from previously static transactions, as this structure is being accepted by investors and the pricing concessions in the financing via these structures is competitive with other options,” said Greg Haddad, senior vice president for CMBS at Morningstar Credit Ratings.

Issuers Roundup

Greystone, which closed a record-breaking $1.1 billion in bridge loans in 2018, issued two CRE CLOs between 2017 and 2018, including the first backed exclusively by healthcare-related properties. The $300 million, three-year actively managed CRE CLO closed in September with an initial pool of 20 whole loans totaling $249.2 million that Greystone originated. The loans were secured by mortgages on 25 skilled nursing, assisted living and independent living facilities. Greystone invested the remaining $50.8 million into additional loans.

The firm’s inaugural CRE CLO was issued in March 2017. The $366.6 million actively managed CRE CLO was collateralized by a pool of 26 CRE whole loans and one pari passu participation on 27 properties with a 2.5-year reinvestment period.

“By issuing multiple CLOs, Greystone has been able to expand its financing alternatives and price loans more competitively in the market,” said Jeff Baevsky, senior managing director, Greystone. “We see the CLO market continuing to expand in 2019 and anticipate issuing another CLO transaction.”

In 2015, Värde Partners created an origination platform to source loans ranging from $10 million to $100 million loans, noted Missy Dolski, director of capital markets and structured finance at the global alternative investment firm. Those loans are now mostly floating-rate bridge loans with the majority going into two CRE CLOs issued in 2018. “We’ve found that an attractive diversification of the financing tools available to us,” she said.

Värde’s first deal, valued at $368 million, had a mortgage asset pool of 25 short-term, floating-rate, whole or pari passu mortgage assets secured by 28 properties. Värde’s second CRE CLO, which closed at $462 million, had an asset pool of 25 floating rate mortgages secured by 27 properties and an aggregate unpaid balance of $457.8 million. Both CRE CLOs comprised mainly office and multifamily assets, as well as a handful of hotels. Retail loans tend to be for grocery-anchored properties in high demographic areas. Dolski noted that the loan size was a bit larger in the second issuance. “It’s a good way to clean down our warehouse lines.”

While she declined to discuss CRE CLO plans for this year, she said, “We’re actively in the business of originating loans. We like this product as a diversification as to how we finance the business. We will continue to look at it as long as it’s open.”

Crescit is exploring CRE CLO issuance. “It’s a really good vehicle for us,” Iacono said. “We originate these types of assets. A good portion of them would be appropriate for this type of vehicle.” Iacono expects strong demand for CRE CLOs this year, on both the investors’ and issuers’ sides, as originations to feed the transactions remain plentiful. Others, though, raise capital markets concerns. Greg Cioffi, head of the asset securitization and CLO practice at the Seward & Kissel law firm, is cautiously optimistic but warned of a possible 5 to 10 percent drop in deal volume.

Timber Hollow, a 368-unit multifamily community in Fairfield, Ohio. The asset serves as collateral for a $29 million first mortgage ($28.1 million as of CLO closing); that loan is part of the second CRE CLO issued by Värde in 2018.

Bhasin noted that the capital markets in 2019 are expected to be generally more challenging than 2018, which could result in a relatively flat issuance year. He predicted that 2019 will present a resilience test for the vehicles “to see if there can be sustained issuance of the product in a (slightly) choppier market.”

Cioffi expects no Congressional action that might impact the CLO markets this year. “People investing in CLOs are not moms and pops. We’re talking about institutional investors in the CLO market,” he said.

Ratings Snapshot

KBRA analyzes most CRE CLO transactions on a preliminary basis, even if it does not end up rating them, Bhasin reported. During 2018, the agency rated 21 of 25 deals in 2018, in a process that usually takes about six to eight weeks. “We take a commercial real estate centric, ground-up approach and spend significant time in analyzing the property and loan collateralization,” he said. “This is where we believe there is meaningful credit. The real estate analysis is complemented with that of the deal’s structure through our credit modeling process. In doing so, we also consider the key transaction parties.”

Morningstar Credit Ratings is developing a rating methodology for CRE CLOs, Haddad reported. “We did not previously have standalone methodologies or credit models for individual asset types. Last year the decision was made to separate each transaction type into its own criteria and credit model.”

While the firm has not rated any CRE CLOs yet, Haddad said, “We have been actively been providing preliminary transaction level feedback.”

“We model the priority of payments in the liability waterfall and the construction in interest and coverage tests. For pools that permit reinvestment or include ramp up periods, we review the eligibility criteria proposed by the issuer and consider the potential impact of downward credit migration on the pools enhancement levels,” Haddad said.

“The goal for all analytical approaches at Morningstar is to be transparent and consistent in how we apply our criteria to any given transaction which we believe is beneficial to all market participants.”

You must be logged in to post a comment.