2025 CMBS Delinquency Rates

Trepp's monthly update. Read the report here.

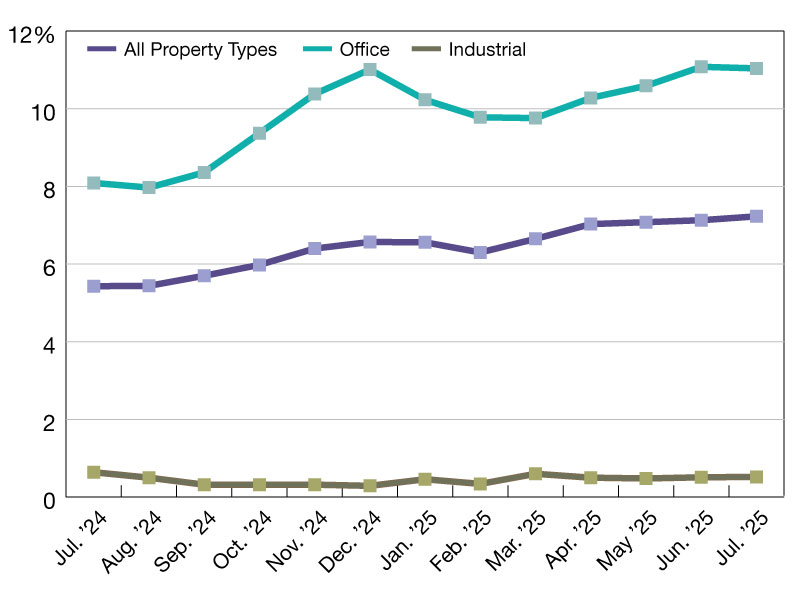

In July, the overall delinquent balance was $43.3 billion, and the outstanding balance was $598.9

billion; both up from $42.3 billion and $593.4 billion, respectively, in June.

READ ALSO: Commercial/Multifamily Borrowing Increased 66 Percent in Q2

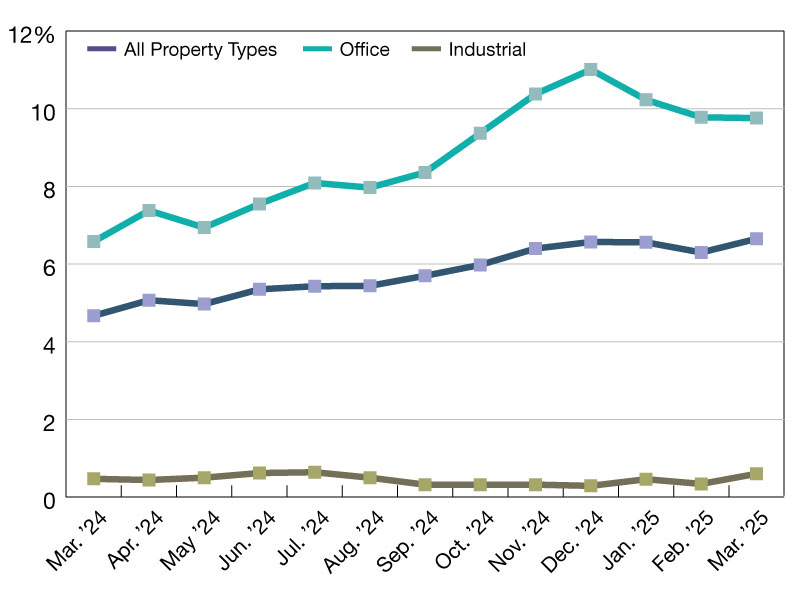

Across property types, rate movement was rather limited, with none of the five major property types moving higher or lower by more than 25 basis points. The multifamily rate was the only one to increase, rising 24 basis points to 6.15 percent. Both lodging and retail experienced modest declines, with lodging down 22 basis points to 6.59 percent and the retail rate receding 16 basis points to 6.90 percent. Though only retreating 4 basis points to 11.04 percent, the decline was a small sigh of relief for the office rate, which had reached an all-time high of 11.08 percent one month ago.

Newly delinquent loans

When analyzing the data at the loan level, however, the volume of newly delinquent loans totaled north of $4.4 billion in July, far outpacing the volume of loans to cure, or move out of the delinquency bucket, over the same period, which was about $3.0 billion. The mixed-use, retail, and office sectors all had more than $800 million worth of loans turn newly delinquent in July, each at least $150 million higher than their respective balance of cures.

In July, the balance of the top 10 newly delinquent loans totaled more than $2.1 billion, representing about 50 percent of the monthly overall balance. In total, there were 129 loans that became newly delinquent in June.

If we were to include loans that are beyond their maturity date but current on interest, the delinquency rate would be 9.36 percent, up 65 basis points from June.

The percentage of loans in the 30 days delinquent bucket is 0.30 percent, up 2 basis points from June.

Our figures assume defeased loans are still part of the denominator unless otherwise specified.

—Posted on August 26, 2025

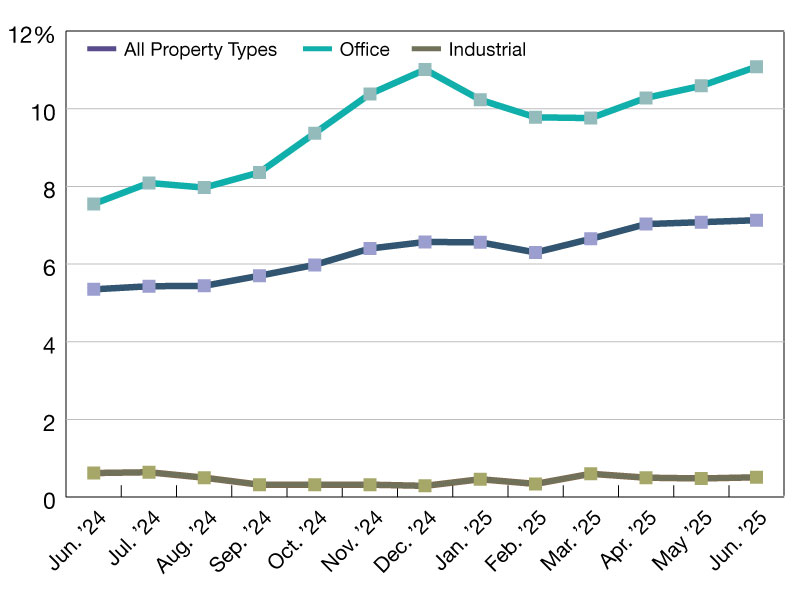

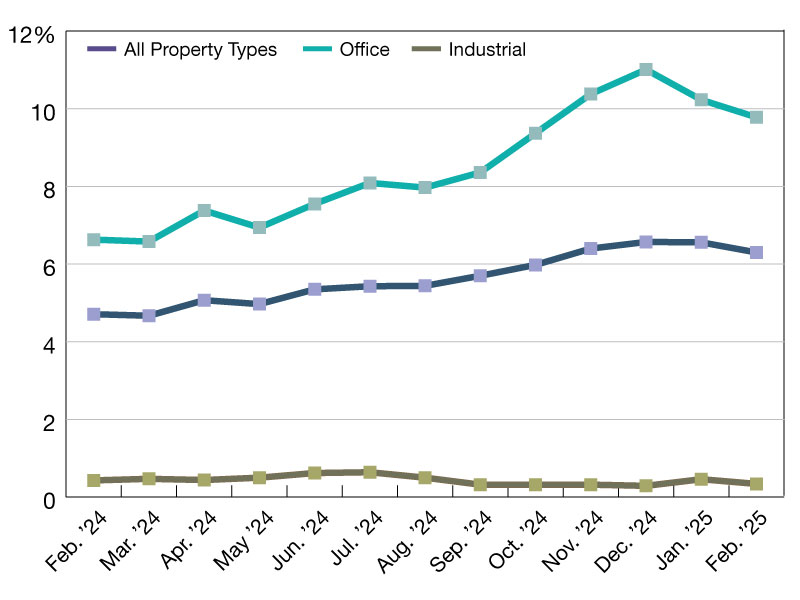

The Trepp CMBS Delinquency rose once more in June 2025, with the delinquent portion of the outstanding balance increasing 5 basis points to 7.13 percent.

In June, the overall delinquent balance was $42.3 billion, down from $42.6 billion in May, and the outstanding balance was $593.4 billion, down from $601.6 billion in May.

READ ALSO: Return-to-Office Rebounds

In May, four of the five main property type delinquency rates decreased, but the opposite happened in June. The delinquency rates for four of the five rose, with only the multifamily rate pulling back, by 20 basis points.

The sector that had the highest rate increase was the office sector, climbing 49 basis points to 11.08 percent and reaching another record high, surpassing its previous peaks of 11.01 percent in December 2024, and 10.70 percent in July 2012.

Lodging delinquency has been quite volatile in recent months, rising 42 basis points to 6.81 percent in June after shedding nearly 150 basis points in May.

Office and mixed-use drive growth

In June, the main contributor to the rise in the headline rate was the reduction in the overall balance, with the overall delinquent balance minimally changed. At the loan level, $4.2 billion in loans cured while $4.1 billion became newly delinquent, which resulted in a net improvement of $0.1 billion. However, this overall stability masked some sector-level differences in office and mixed-use.

The office sector saw a net deterioration of $0.8 billion, as $1.8 billion in loans went delinquent while only $1.0 billion cured. Conversely, mixed-use showed a net improvement of $1.1 billion, as$1.6 billion in loans cured compared to just $500 million becoming delinquent.

If we were to include loans that are beyond their maturity date but current on interest, the delinquency rate would be 8.71 percent, up 7 basis points from May.

The percentage of loans that are 30 days delinquent is 0.28 percent, down 21 basis points from May.

Our numbers assume defeased loans are still part of the denominator unless otherwise specified.

—Posted on July 24, 2025

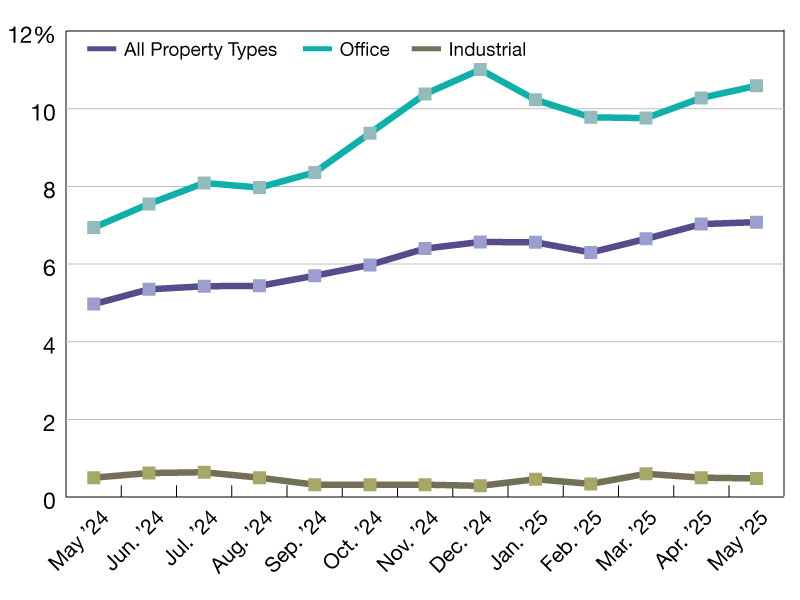

The Trepp CMBS Delinquency Rate was up slightly in May 2025, with the overall rate increasing five basis points to 7.08 percent.

In May, the overall delinquent balance was $42.6 billion, up from $41.9 billion in April.

After reaching a four-year high in April, the overall rate rose again, despite four of the five main property types sustaining decreases to their respective rates. The lodging rate saw the largest decline, dropping 146 basis points to 6.39 percent after four consecutive monthly increases that pushed the rate to a three-year high of 7.85 percent.

The multifamily rate pulled back 46 basis points to 6.11 percent but is still 441 basis points higher than it was one year ago. Retail and industrial delinquency also retreated, but by smaller amounts.

Office and mixed-use drive growth

The two property types driving the overall increase were office and mixed-use. The office rate was up another 31 basis points to 10.59 percent in May. Although down from the all-time high of 11.01 percent reached last December, the office rate is still over 350 basis points higher than one year ago. On the other hand, nearly $2 billion worth of mixed-use loans became newly delinquent in May, lifted higher by a couple of big loans.

If we were to include loans that are beyond their maturity date but current on interest, the delinquency rate would be 8.64 percent, up 27 basis points from April.

The percentage of loans in the 30-days delinquent bucket is 0.49 percent, unchanged from April.

Our numbers assume defeased loans are still part of the denominator unless otherwise specified.

—Posted on June 30, 2025

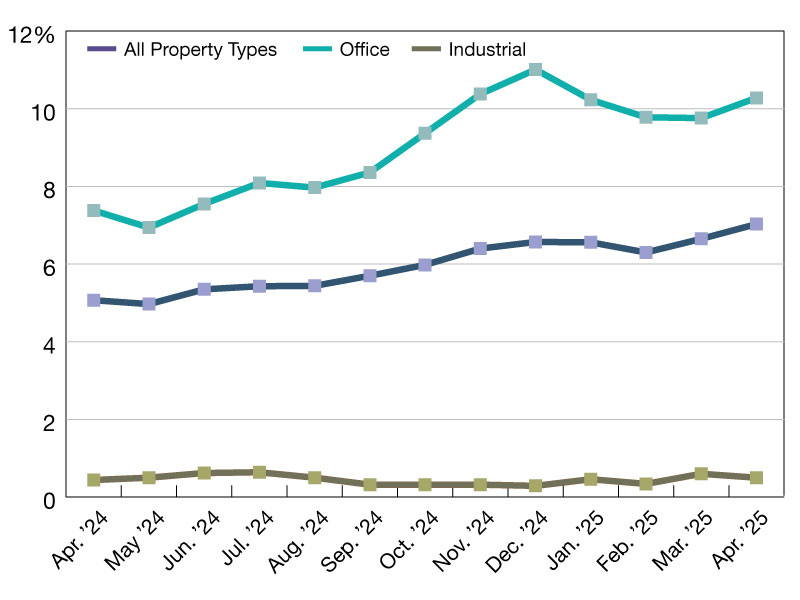

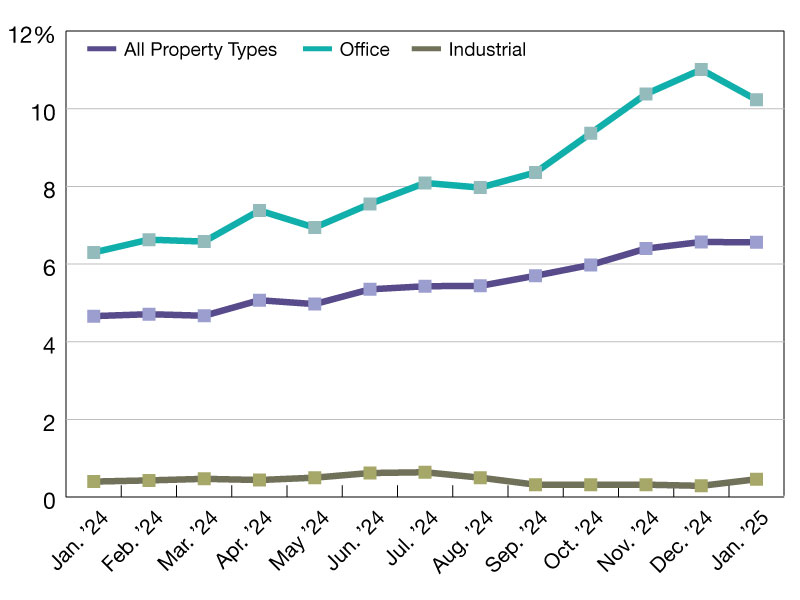

The Trepp CMBS Delinquency Rate rose again in April 2025, with the overall rate increasing 38 basis points to 7.03 percent.

In April, the overall delinquent balance was $41.9 billion, up from $39.3 billion in March.

The office sector experienced a significant jump, with office delinquency rising 52 basis points to 10.28 percent. The office rate had been decreasing for the past three months after hitting a record high of 11.01 percent in December 2024. The only property type to experience relief was retail, with that rate dropping 70 basis points to 7.12 percent. The less volatile industrial rate also declined, down 10 basis points to 0.50 percent.

If we were to include loans that are beyond their maturity date but current on interest, the delinquency rate would be 8.37 percent, unchanged from March. The percentage of loans in the 30 days delinquent bucket is 0.49 percent, up 16 basis points from March.

Our numbers assume defeased loans are still part of the denominator, unless otherwise specified.

—Posted on May 28, 2025

The Trepp CMBS Delinquency Rate ticked back up in March, with the overall delinquency rate increasing 35 basis points to 6.65 percent.

In March, the overall delinquent balance was $39.3 billion, up from $36.0 billion in February.

Prior to this month, the overall rate had fallen for two consecutive months; it is now back up near its four-year high. One driver of the increase was the multifamily sector, which is up 98 basis points in March to 5.44 percent. The multifamily rate has now climbed 360 basis points over the past year, from 1.84 percent to its current level—the highest the rate has been since December 2015, when it stood at 8.28 percent.

Another property type to experience material change was the lodging sector, with that rate jumping 76 basis points to 7.19 percent. Both the industrial and retail delinquency rates were up moderately, increasing 26 basis points and 33 basis points, respectively.

READ ALSO: NYU REIT Symposium Special Report: 6 Takeaways

The office sector experienced more relief, retreating two basis points to 9.76 percent; this is the third consecutive decline in the office rate. On the loan level, the largest newly delinquent loan was a massive multifamily portfolio loan with an outstanding balance just under $1 billion.

If we included loans that are beyond their maturity date but current on interest, the delinquency rate would be 8.37 percent, up 19 basis points from February.

The percentage of loans in the 30 days delinquent bucket is 0.33 percent, down six basis points from February.

Our numbers assume defeased loans are still part of the denominator unless otherwise specified.

—Posted on April 28, 2025

The Trepp CMBS Delinquency Rate decreased again in February 2025, with the overall rate falling 26 basis points to 6.30 percent.

This is the second consecutive month in which the overall delinquency rate decreased, following a stretch of six straight months of increases. The fall in the overall rate was driven again by the office sector with its rate falling 45 basis points to 9.78 percent. This continues to be welcome relief for the sector, which reached an all-time high of 11.01 percent delinquent at the end of last year.

READ ALSO: Potential Federal Building Sale Adds Uncertainty to Office Sector

Outside of the office sector, three of the remaining four major property types also experienced decreases to their delinquency rates, with the exception of lodging. Rate movements were relatively muted in February, with lodging’s 20-basis-point increase standing as the second-largest change. On the loan level, the largest loan to become newly delinquent was a mixed-use single-asset, single-borrower loan with a current balance of $395 million.

If we included loans that are beyond their maturity date but current on interest, the delinquency rate would be 8.18 percent, down 11 basis points from January. The percentage of loans in the 30 days delinquent bucket is 0.39 percent, unchanged from the month prior.

Our numbers assume defeased loans are still part of the denominator unlessotherwise specified.

—Posted on March 27, 2025

The Trepp CMBS Delinquency retreated slightly in January 2025, with the overall delinquency rate decreasing 1 basis point to 6.56 percent.

This pullback follows six straight months of increases to the overall delinquency rate, during which the rate rose almost 120 basis points. The decrease in the overall rate was driven by the office sector, with the office rate falling 78 basis points to 10.23 percent. This was some welcome relief for the sector, which had reached an all time high to end last year.

READ ALSO: Best Capital Stack Strategies for 2025

Outside of the office sector, the remaining four of five major property types all experienced increases to their respective delinquency rates. These increases were relatively tame however, with only the industrial rate increasing more than 10 basis points. On the loan level, the largest loan to become newly delinquent was a single-asset single-borrow office loan worth $525 million.

If we included loans that are beyond their maturity date but current on interest, the delinquency rate would be 8.29 percent, down 29 basis points from December. The percentage of loans in the 30 days delinquent bucket is 0.39 percent, up 13 basis points for the month.

Our numbers assume defeased loans are still part of the denominator unless otherwise specified.

—Posted on February 27, 2025

You must be logged in to post a comment.