CMBS Delinquencies

With historic flooding from Hurricane Harvey to Harris County (Houston and its surrounding suburbs) we reviewed the S&P Global Delinquent exposure.

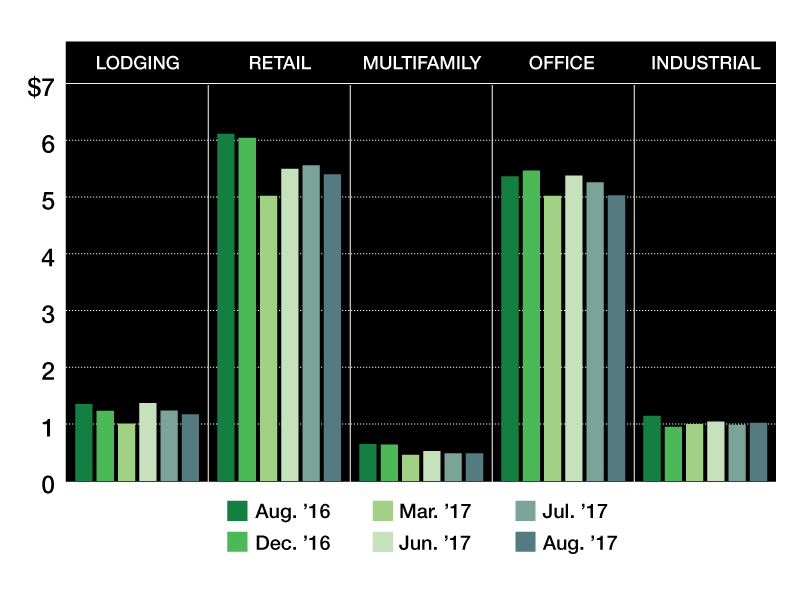

CMBS delinquencies by property type; $ in billions

With historic flooding from Hurricane Harvey to Harris County (Houston and its surrounding suburbs) we reviewed the S&P Global Delinquent exposure. Currently, there are 234 loans in S&P Global deals located within Harris County. Of these loans, the current delinquency rate is 1.7 percent with an outstanding balance of $4.7 billion. In total, there are 11 delinquent loans in the county. The largest delinquent loan in Harris County is Intercontinental Center with a balance of $18.5 million. S&P Global Ratings will continue to monitor the related loans as reports come in on their condition.

The overall delinquency rate for S&P Global-rated CMBS fell 22 bps to 9.3 percent or $14.1 billion, on August remits. New delinquencies totaled $917 million during the month compared with $1123 million in resolutions. The total delinquent balance fell with lodging, retail, office and multifamily and rose with industrial month-over-month— lodging (-$66 million); retail (-$161 million); office (-$227 million); multifamily ($-1 million); and industrial ($33 million). The conduit DQ rate is now 16.5 percent, or $13.9 billion, down from last month’s conduit DQ rate of 16.8 percent.

Average August loss severity on $445 million in liquidated loans in S&P-rated CMBS was 38 percent. Of the $1.6 billion in delinquent resolutions, 72 percent became current while 28 percent were liquidated. The average loss severity rate year to date is 37.6 percent, which is up slightly from last year’s loss severity rate over the same time period of 37.1 percent. In total 44 loans liquidated at a loss this month, a decrease from last month’s 71. Three loans liquidated at a loss percentage in excess of 90 percent for an aggregate total of $30.5 million: Kailula Trade Center with a balance of $3.2 million, Las Vegas Tech Center with a balance of $10.5 million and Marketplace of Matteson Shopping Center with a balance of $16.8 million.

You must be logged in to post a comment.