CMBS Delinquencies

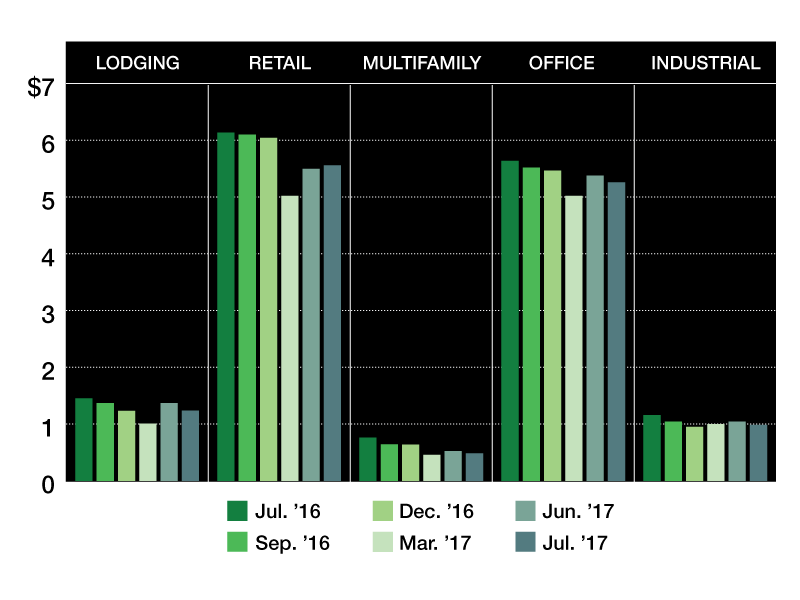

The total delinquent balance fell for multifamily ($-38m, $484.1m), lodging (-$134m, $1.2b), office (-$122m, total $5.3b), industrial (-$59m, $1b), and rose for retail ($61m, $5.6b).

CMBS delinquencies by property type; $ in billions

The delinquency rate for S&P Global-rated CMBS fell 7 bps to 9.55 percent ($14.8b) on July remits. New delinquencies totaled $1,424m during the month compared with $462m in resolutions. The total delinquent balance fell for multifamily ($-38m, $484.1m), lodging (-$134m, $1.2b), office (-$122m, total $5.3b), industrial (-$59m, $1b), and rose for retail ($61m, $5.6b). The conduit DQ rate is now 16.8 percent ($14.6b), up from last month’s conduit DQ rate of 16.7 percent. Loans over $100m that became delinquent this month include 400 Atlantic Street (office property in CT; $265m) in GSMS 2007-GG10, and Independence Mall (retail property in MO; $200m) in WBCMT 2007-C33.

Average July loss severity on $1319m in liquidated loans in S&P-rated CMBS was 38 percent. Of the $1.8b in delinquent resolutions 26 percent became current while 74 percent were liquidated. The average loss severity rate year to date is 37.6 percent, which is up from last year’s loss severity rate over the same time period of 36.3 percent. In total 71 loans liquidated at a loss this month, an increase from last month when 38 loans liquidated at a loss. The total amount of liquidations, at $1.3b, was the highest that it has been since January 2016, when there were $4.5b in loan liquidations.

You must be logged in to post a comment.