Building Construction Starts Gain Momentum: Dodge

The manufacturing sector saw the most significant increase year-to-date, according to the firm’s latest report.

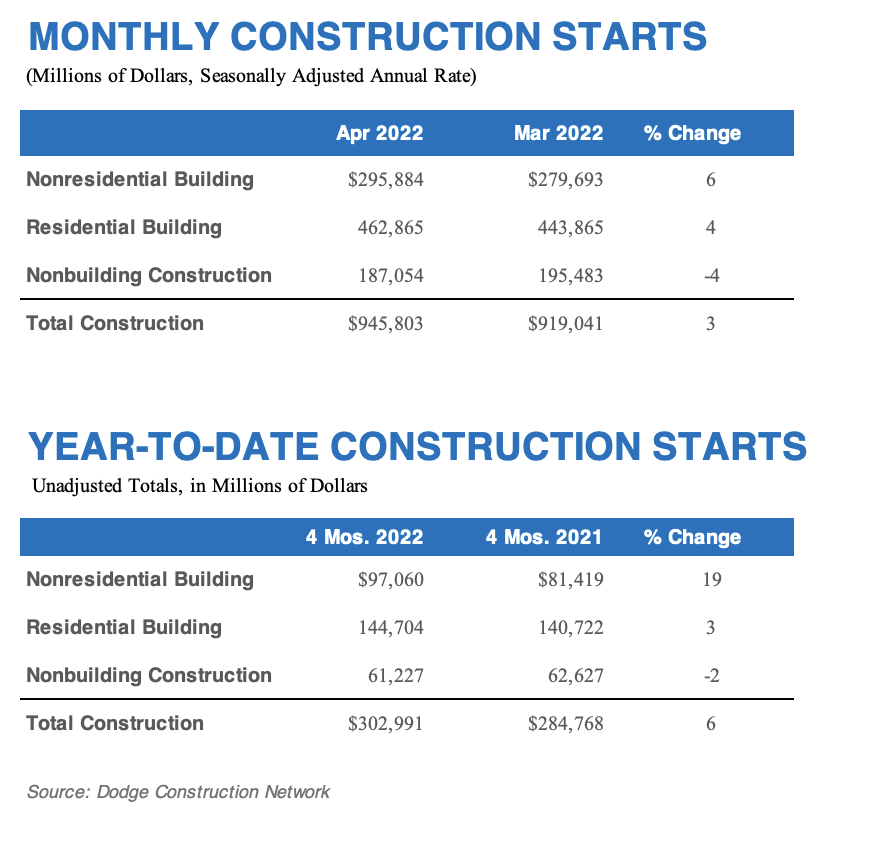

The construction sector seems to have brought its first-quarter momentum into the second quarter of 2022, according to Dodge Data & Analytics. The firm’s latest research study looking at the total construction starts across the U.S. in April showed an overall uptick of 3 percent, to a seasonally adjusted annual rate of $945.8 billion, following a dip in March.

According to the report, nonresidential building starts in April were up 6 percent and residential starts were also up 4 percent. However, the nonbuilding sector saw a 4 percent decline in the number of construction starts.

When looking at the year-to-date numbers, total construction starts were up 6 percent compared to the same period in 2021. As for a 12-month period ending in April 2022, the total construction starts were also up, 12 percent higher than the 12-month period ending in April 2021.

READ ALSO: Do Not Bet Against the US Economy

Richard Branch, chief economist for Dodge Construction Network, said in prepared remarks that the construction industry doesn’t seem to fear the higher interest rates and a potential recession. He added that most of the sectors have already shifted toward recovering since the underlying economic growth and hiring are solid.

Nonresidential and residential building starts up

According to Dodge, nonresidential building starts rose 6 percent in April to a seasonally adjusted annual rate of $295.9 billion. Commercial projects saw 2 percent more starts, the institutional sector saw 8 percent more starts, while the manufacturing sector saw a 16 percent increase in construction starts.

The manufacturing sector’s construction starts are more prominent when looking at year-to-date numbers since it saw a 189 percent increase, compared to the 11 percent jump from commercial and the 1 percent bump up in institutional starts. Similarly, manufacturing starts on a 12-month rolling sum basis jumped 163 percent up, while commercial starts’ 19 percent increase and institutional starts’ 11 percent rise looked meager by comparison.

Dodge noted that the largest nonresidential building projects to break ground in April were the $500 million Caesars Virginia hotel and casino in Danville, Va., the $430 million Aggie Square life science building in Sacramento, Calif., and the $400 million The Rose Gaming Resort in Dumfries, Va.

As for residential projects entering planning, there was a 4 percent jump in construction starts in April to a seasonally adjusted annual rate of $462.9 billion. Single family starts saw a 1 percent uptick, while multifamily saw a 13 percent increase. On a year-to-date sum basis, multifamily starts were up 16 percent, while single family slipped 2 percent. On a 12-month rolling sum basis, single family starts were 6 percent higher and multifamily starts were 27 percent higher.

The report noted that the largest residential projects to break ground in April were the $420 million 2-10 54th Ave. apartments in Long Island City, N.Y., the $400 million Civic Square condominiums in Seattle, and a $300 million mixed-use building that’s also in Long Island City.

Nonbuilding starts and the coming months

In April, nonbuilding construction was the only category to drop 4 percent in starts, to a seasonally adjusted annual rate of $187.1 billion. The environmental public works category was up 8 percent and the utility/gas plant starts saw a 10 percent increase. The overall sector was held back in April by highway and bridge projects falling 14 percent, with miscellaneous starts dropping 2 percent.

Branch said in prepared remarks that the recovery momentum should continue in the coming months due to the expanding pipeline of projects in planning. He also noted in prepared remarks the concern of the Federal Reserve forcing the U.S. into recession later this year that could disrupt momentum for construction starts.

On a regional level, total construction starts rose in the Northeast, South Atlantic and South Central regions, but declined in the Midwest and West.

You must be logged in to post a comment.