Construction Starts Show Q1 Uptick: Dodge

The underlying trend is evident despite higher costs and shortages of skilled labor.

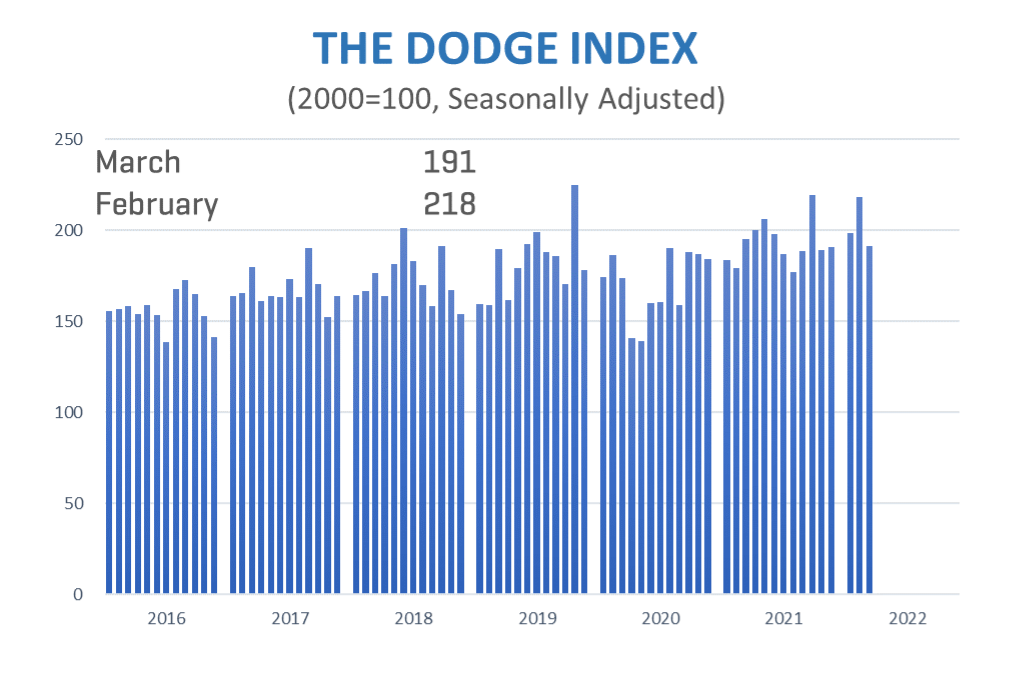

Following a strong February, total construction starts fell 12 percent in March to a seasonally adjusted annual rate of $903.8 billion, according to the latest Dodge Construction Network report.

Dodge notes nonresidential building starts lost 29 percent in March, but that is largely due to three large manufacturing facilities starting construction in February. With those projects removed, nonresidential construction starts would have risen 10 percent.

Year-to-date, total construction was 9 percent higher in the first three months of 2022 than in the same period of 2021, with nonresidential building starts rising 26 percent. Year-over-year, total construction was also up, increasing by 15 percent, and nonresidential starts were up by 25 percent over the 12 months ending in March 2021.

READ ALSO: How Commercial Construction Challenges Are Mounting

Regionally, total construction starts in March rose in the South Atlantic but fell in all other regions.

Richard Branch, chief economist for Dodge Construction Network, said in prepared remarks the volatility caused by the ebb and flow of large projects is masking an underlying strength in construction starts. He said nonresidential construction is benefiting from growing confidence that the worst of the pandemic has passed and the pipeline of projects waiting to start is increasing, suggesting the trend will continue. But Branch noted higher prices and a shortage of skilled labor is slowing the progress of those projects through the design and bidding stages, which is resulting in the moderate growth in starts activity.

By the numbers

When broken down by sector, nonbuilding construction starts had the lowest decline for March, dropping 2 percent to a seasonally adjusted annual rate of $194.5 billion. Dodge reports starts in the environmental public works category rose the most for the month, increasing 35 percent. Miscellaneous nonbuilding improved by 10 percent but starts for highway and bridge projects declined by 7 percent and utility/gas plant starts were down 40 percent.

Year-over-year for the period ending in March, total nonbuilding starts were down 1 percent from March 2021. Environmental public works projects were again up the most, rising 11 percent for the year, while utility/gas plant starts rose 2 percent and highway and bridge starts increased by 4 percent year-over-year. Miscellaneous nonbuilding starts dropped 30 percent for the 12-month period ending in March 2022.

Dodge stated the largest nonbuilding project to break ground in March was the $522 million second phase of the IH 35E Corridor project in Dallas, followed by the $475 million first phase of the Mammoth Solar project in Indiana.

Nonresidential building starts in March dropped 29 percent to a seasonally adjusted annual rate of $274.8 billion, coming on the heels of the increase in February, when three large plants broke ground. Commercial starts were up 8 percent for the month, when there were increased starts in office, hotel and warehouse developments. Dodge said institutional starts increased 9 percent in March as all sectors moved higher.

Year-over-year nonresidential building starts increased 25 percent for the 12-month period ending in March 2022. Commercial starts increased 21 percent, institutional starts rose by 12 percent and manufacturing starts were up a whopping 162 percent on a 12-month rolling sum basis, according to Dodge.

The $505 million second phase of the Switch Supernap data center in Sparks, Nev., was the largest nonresidential building project to break ground in March, followed by the $460 million second phase of the Park 303 office building in Glendale, Ariz.

Residential starts

Multifamily construction starts were stronger than single family both on a monthly basis in March and yearly. Overall residential starts fell 3 percent in March to a seasonally adjusted annual rate of $435 billion. Multifamily starts were up 4 percent for the month, while single-family starts dropped by 5 percent.

For the 12 months ending in March 2022, multifamily starts were again stronger than single family, rising 29 percent compared to 11 percent for the single-family starts. Overall, residential starts rose 15 percent year-over-year.

Dodge reports the largest multifamily project to break ground in March was the $212 million 550 10th Ave. mixed-use building in Manhattan. A $140 million mixed-use project in Manhattan’s Financial District at 7 Platt St. was also among the top multifamily structures breaking ground in March, along with the $200 million Kauanoe O Koloa condominium project in Koloa, Hawaii.

Read the full Dodge Construction Network report.

You must be logged in to post a comment.