Behind Turnbridge’s $500M Industrial Park

Managing Principal Ryan Nelson on the strategy that’s guiding this 3.5 million-square-foot Maryland project.

Propelled by shifts in consumer behavior, technological innovations and the growth of the logistics sector, the industrial market has undergone significant changes and advancements. More recently, this sector has seen remarkable growth, with developers actively seeking available land to establish warehouses and distribution centers that cater to the storage, packaging and efficient delivery of goods.

In a land-constrained market such as Washington, D.C., a joint-venture has embarked on an ambitious journey. Turnbridge Equities and Manekin, together with PCCP LLC and Qatar Investment Authority, broke ground earlier this month on National Capital Business Park, a project in Bowie, Md., that is set to include 3.5 million square feet of Class A industrial space. Built on a 280-acre portion of a 442-acre site in Upper Marlboro, the development is designed to meet a wide range of needs—from manufacturing, data centers and cold storage, to last-mile and regional distribution users.

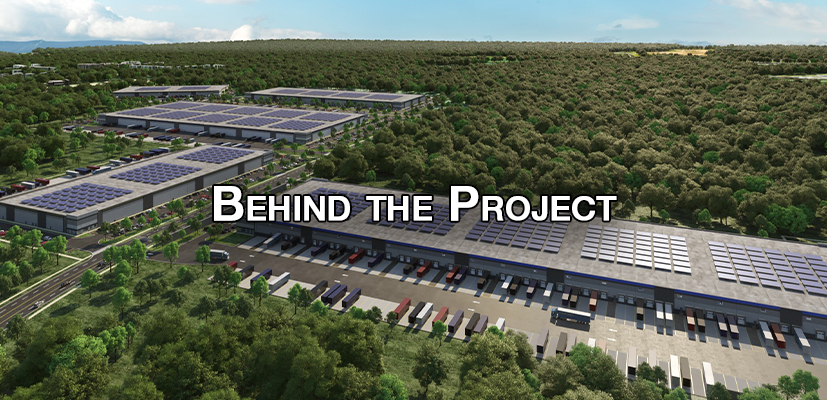

At full buildout, NCBP will include up to 3.5 million square feet of Class A industrial space. Image courtesy of Turnbridge Equities

Valued at $500 million, the project was strategically planned in two phases. The imminent Phase I, expected to be operational early next year, will introduce 1.3 million square feet of industrial capacity across five warehouse buildings, all designed with solar panels on their rooftop. At full build-out, National Capital Business Park will encompass 3.5 million square feet of Class A industrial space, with the project seizing one of the few remaining expansive sites of its kind in the region.

Commercial Property Executive asked Turnbridge Equities Managing Principal Ryan Nelson to reveal details about the project and its potential tenants.

READ ALSO: Is There More Room for Growth in the Phoenix Industrial Market?

Turnbridge Equities has already signed a prelease agreement for 360,000 square feet at the upcoming park, according to Ryan Nelson. Image courtesy of Turnbridge Equities

Tell us why you chose to expand to Maryland. Why was this state the best location for the project?

Nelson: Our industrial investment strategy has been focused solely on the high barriers to entry, urban industrial markets, where proximity to major population centers is paramount and where traffic constraints drive warehouse occupiers to be as close to the end user as possible. Thus, our focus has been on the largest urban population centers of New York City and Northern New Jersey, Los Angeles and Washington, D.C.

For our National Capital Business Park project, we’re able to develop a project of scale, incredibly close to Washington, D.C., and the surrounding markets. It’s incredibly hard to develop anywhere in this market, so to have a site with this much scale is incredibly rare.

You and partner Manekin acquired the development site in December 2020, when the pandemic was still wreaking havoc across CRE markets. Has the health crisis impacted the project’s trajectory in any way?

Nelson: We actually had the site under contract prior to this, but closing was subject to some entitlement work, so we closed in December 2020 once it was approved. The pandemic only accelerated the rise of e-commerce and helped growth and absorption significantly during the last three years.

How did you choose the development team for this project?

Nelson: We’ve worked with ARCO, our design build contractor, on our recent ground-up projects in New York City. They’re as good as it gets. They have a great design and construction team, but also operate with the highest integrity, which is of utmost importance for us. On the civil engineering front, Bohler is also one of the most reputable firms in the region and we relied on their background and experience when choosing them.

LISTEN TO: Investment Matters—Taking the Long View

Where there any difficulties in securing project financing for such a large-scale project, considering the economic environment today?

Nelson: Financing in this environment was difficult, but we were fortunate to partner with top notch firms such as Apollo, Qatar Investment Authority, PCCP and Cushman & Wakefield. We have deep relationships with all of these firms, which were integral in executing in this environment.

Have you begun talks with potential tenants at the property? What type of businesses are most suitable to occupy the campus?

Nelson: We’ve already signed a prelease with Ferguson for approximately 360,000 square feet. We’re in discussions with multiple other companies for the remaining space. The project’s design allows us to appeal to a wide range of businesses. It’s difficult to find a business that wouldn’t fit well on the campus.

Can you share more about the next phase of the project? How do you expect NCBP to impact the D.C. industrial market once completed?

Nelson: Phase 2 of NCBP will be approximately 1.3 million square feet. We’re currently designing the buildings, so they won’t compete with Phase I, potentially targeting cold storage users as well as a large, cross dock facility. We’re also designing the plan to be flexible, should we want to pivot to traditional dry storage. We think Phase 2 will meet an underserved niche in the market.

What would you identify as one of the primary obstacles in developing industrial projects today?

Nelson: In certain locales, especially Prince George’s County, the largest obstacle is the entitlement and permitting process. It’s an extremely complex and lengthy process, it’s not for the faint of heart nor someone hoping to go quickly. Outside of that, financing and construction costs are still the biggest obstacle in developing projects.

Are there any other potential development opportunities you’re considering within the state? What about other areas?

Nelson: We’re currently looking at multiple other opportunities in the DC-DMV market. We’re also very active in the New York-New Jersey markets and Los Angeles. We have both an Industrial Outdoor Storage aggregation strategy in all of these markets, as well as our value add and ground-up industrial strategies. We’re very active in all of these areas.

You must be logged in to post a comment.