Bank Multifamily Lending Down in 2017

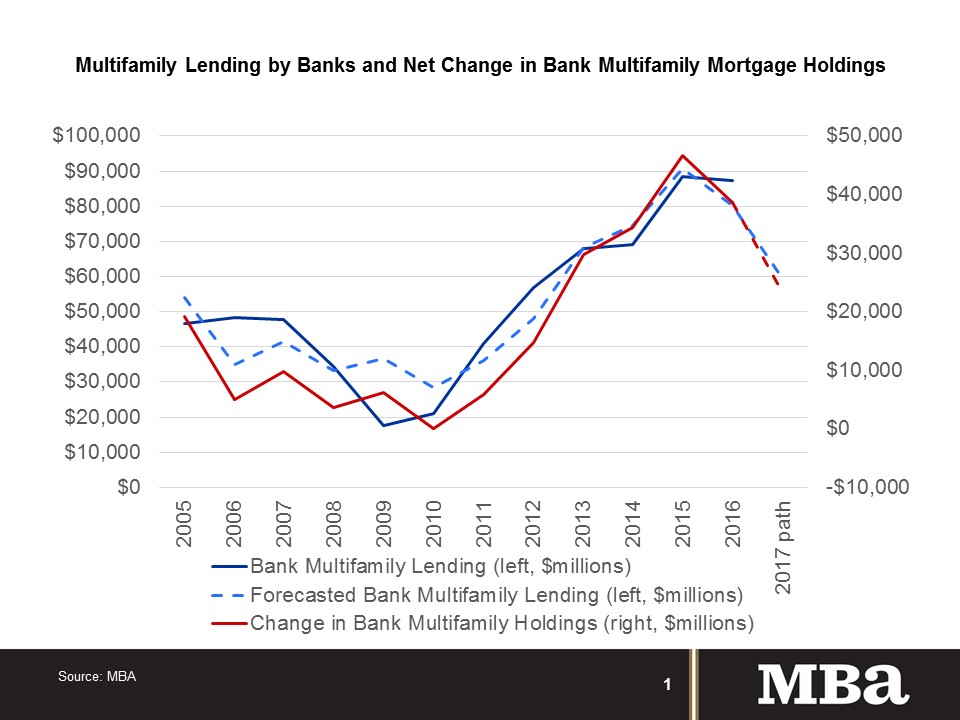

Multifamily lending activity last year is likely to total just under $60 billion, compared to $87 billion in 2016, according to a Mortgage Bankers Association analysis.

One of the key puzzle pieces in sizing the multifamily lending market is assessing the level of multifamily lending taking place for bank balance sheets in real time. A thorough look at bank portfolio lending—which accounted for one of every $3 of multifamily lending in 2016—comes only with the release of the Home Mortgage Disclosure Act (HMDA) data in October of the following year. But there are clues to the level of lending; While not perfect, changes in portfolios appear to give a strong hint of lending activity. Based on data from the Federal Reserve Board’s H8 series, bank multifamily portfolios have grown by 6.4 percent through the end of November 2017, after growing by more than 13 percent in 2016. Based on historical relationships, that would indicate a 2017 multifamily lending level of just less than $60 billion, compared to 2016’s $87 billion. The projection isn’t destiny, but does give a first look at what we might expect when the actual numbers come in 10 months from now. – Jamie Woodwell, MBA vice president of commercial real estate research

You must be logged in to post a comment.