Michelle Matteson

Yardi Buzz Sessions Chicago MR

Join a FREE buzz session in your area hosted by Yardi. Get insight into your local market from real estate experts.

2017 Investment Sales Volume

What was the total investment sales volume (US$) for the following fiscal years?

Direct Private Real Estate Returns

In 2016, direct private real estate returned 7.4 percent but across major metropolitan markets there was considerable variation due to differences in local market conditions.

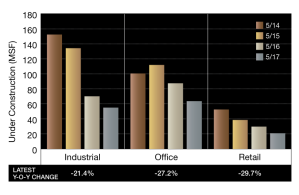

Development

The retail sector peaked in May 2014 at 52.5 million square feet, but experienced a 27 percent decline in construction in the following year.

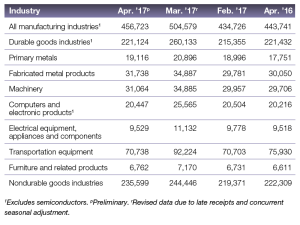

Industrial Demand

The new orders for all manufacturing industries decreased on a month-over-month basis by 9.5 percent or nearly $48 billion.

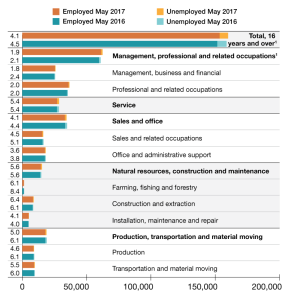

Employment Picture

For unemployment, the most significant decrease was in the Farming, Fishing and Forestry occupations with 28.3 percent. The overall unemployment rate dropped 8.9 percent year-over-year.

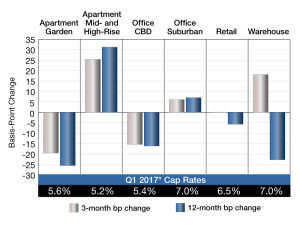

National Vacancies

Forecasts show that net absorption is expected to rise in the first quarter of 2018 only in the West region (33.5 percent) and is expected to decrease in the rest of the regions.

CMBS Delinquencies

Retail properties had the largest decline, at $639 million, while office decreased by $518 million.

Direct Private Real Estate Returns

In the earlier part of the decade, the UK market had been one of the strongest performers but in a precipitous decline aided by the Brexit referendum result, the country recorded the lowest total return in the Global index at 3.9 percent in 2016.