Chris Nebenzahl

Chris Nebenzahl is the Editorial Director at Yardi Matrix, and is responsible for overseeing market research and data analytics, as well as editorial composition for Yardi Matrix, Commercial Property Executive and Multi-Housing News. Mr. Nebenzahl facilitates the expansion of the Yardi Matrix reporting suite and provides in-depth analytical tools for clients across the commercial real estate industry. His focus includes data analytics and reporting for the multifamily, office, self storage and industrial asset classes. Before joining Yardi, Mr. Nebenzahl served as a portfolio manager for the Bank of New York Mellon, managing fixed income portfolios for municipal and public sector clients across the U.S. He holds a Bachelor’s degree in economics and a Master’s degree in finance, both from the University of Denver.

Yardi Matrix Reports: 2010s Will Be a Tough Act to Follow

Can the 2020s continue a 10-year winning streak? Chris Nebenzahl of Yardi Matrix sizes up what’s ahead.

In Office and Multifamily, Dealmaking Momentum Continues

Economic expansion, new household formation and a favorable capital environment boosted first-quarter transaction activity and values for these sectors.

The Fed’s Rate Hikes: Questions Remain Despite Short-Term Stability

Chairman Jerome Powell’s press conferences improve communications with the financial markets, but the Fed’s policy of flexibility raises uncertainties about future rate changes, writes Chris Nebenzahl, associate director of research for Yardi Matrix.

Rise in Office Jobs Boosts Listed Rents, Occupancies

Expanding employment in financial services, professional services and IT is lifting asking rates and lowering vacancies, especially in some secondary markets.

Steady Performance, Long-Distance Runners

Despite crosswinds, current conditions—including positive trends in household and job formation—favor continued growth for the commercial and multifamily property sectors.

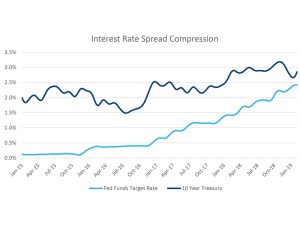

How High Can Long-Term Interest Rates Rise?

Real estate borrowing rates are still relatively low, but the 2017 tax reform package and 2018 trade issues have led to economic volatility and long-term concern.

Where Are Transactions Moderating?

Supply has remained in check throughout the recovery, and overall fundamentals remain steady, although slowing deal flow may persist for some property types, according to Yardi Matrix’s Chris Nebenzahl.

Crossborder Capital Flows in US Real Estate Markets

Chris Nebenzahl of Yardi Matrix offers an analysis of what’s driving increased competition for deals among offshore capital providers.

2017 Top 50 Commercial Owners

While geopolitical, macroeconomic and real estate market uncertainty contributed to a modest slowdown in commercial real estate transaction activity to start off 2017, volume picked up as the year progressed, with prices remaining high and cap rates and interest rates still at historic lows.

The Unknown Future of Housing Finance Reform

The consensus at the Mortgage Bankers Association 2017 Annual Convention and Expo in Denver is that housing finance reform needs to occur, and that conservatorship of the GSEs should end.