As Grocers Grow Faster, Investor Interest Heats Up

Private capital will remain the dominant player, but JLL expects institutional buyers to become more active in this ever-expanding market.

The grocery retail scene as we enter 2024 is marked by an aggressive expansion on the parts of several large chains—especially Aldi—and by a strong likelihood that investor interest in the sector, particularly perhaps by institutional investors, will be revitalized, among other trends, according to JLL’s new Grocery Report 2024.

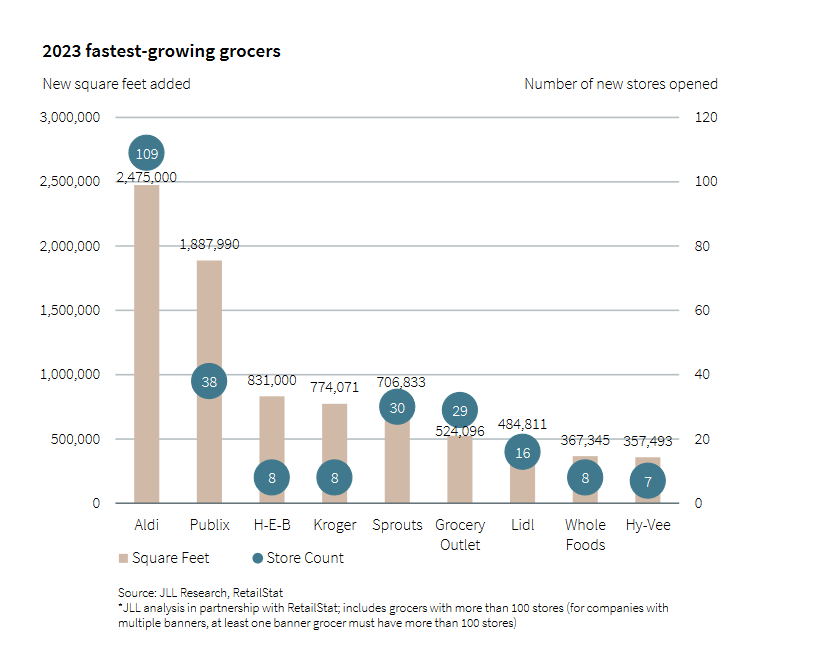

This past year, JLL remarks, the nation’s fastest-growing grocers opened 253 new stores totaling right around 8.4 million square feet of new space.

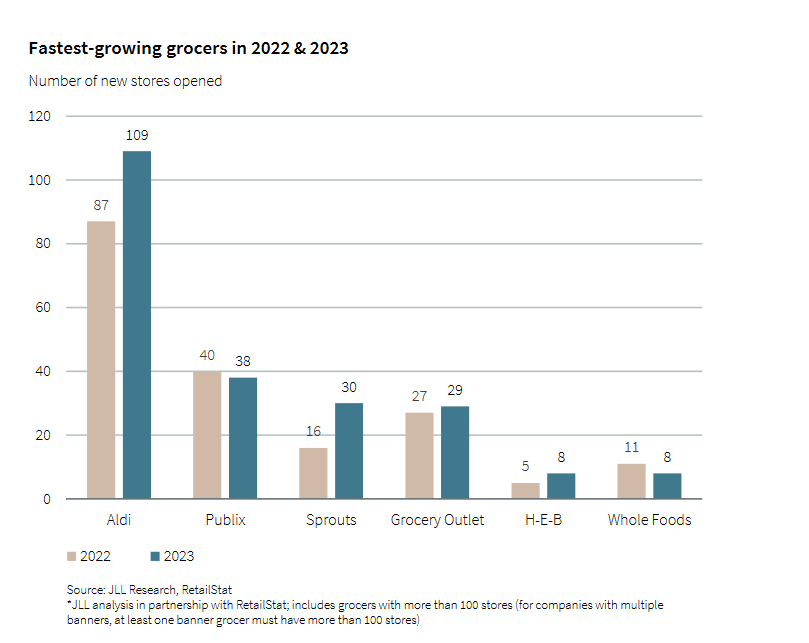

Aldi has been the leader in that race, with 109 new stores totaling nearly 2.5 million square feet, followed by Publix, at 38 new stores totaling 1.9 million square feet. H-E-B, Kroger and Sprouts are well behind, at about 700,000 to 830,000 square feet each. Sprouts’ total number of new stores was relatively high, at 30, because of a new model of smaller, more efficient stores.

Mergers, both likely and perhaps not, are potentially a huge factor in grocery retail this year.

It was back in October 2022 that Kroger announced plans to acquire Albertsons in a $24.6 billion deal. That was followed by the September 2023 announcement by C&S Wholesale Grocers that it would acquire 413 stores, eight distribution centers, two regional offices, and other assets as part of the Kroger-Albertsons merger. Last month, however, the Federal Trade Commission sued to block the merger, contending that it would eliminate competition and raise grocery prices.

READ ALSO: Is Retail 2024’s Sleeper Hit?

Perhaps overlooked because of the Kroger-Albertsons coverage, in August 2023 Aldi announced plans to acquire 400 Winn-Dixie and Harveys Supermarket locations, as part of a larger divestiture by Southeastern Grocers. Subject to FTC approval, this deal could close in the first half of this year.

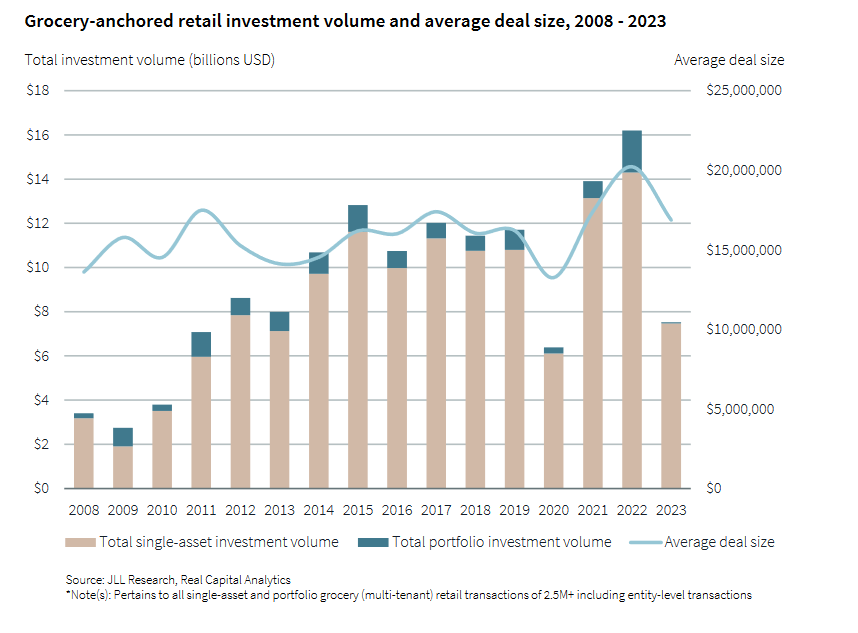

On the investment front, JLL reports that grocery retail investment volume in 2023 saw a major decline (as did all core real estate property sectors) because of a difficult transaction environment. The drop was significant, especially in comparison with the boom years of 2021 and 2022, and brought investment volume to just $7.5 billion, or more than a 50 percent decrease from the previous year.

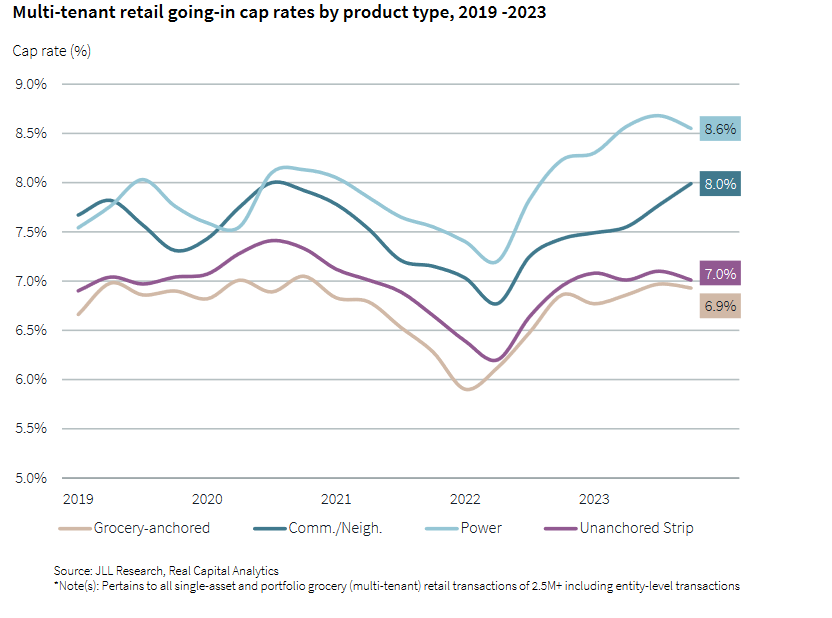

Going forward, however, JLL expects grocery retail’s portion of total investment volume to rebound as the sector’s durable returns and tenant stability continue to attract investors.

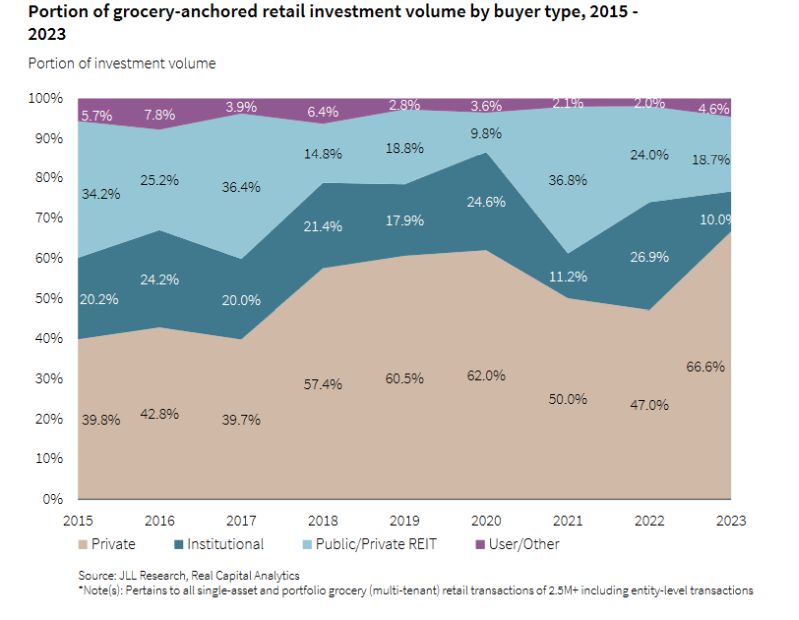

Along with that, private capital is expected to remain the dominant player and institutional investors are forecast to become more active in the grocery retail market, driven by the sector’s ability to provide stable income streams and a recession-resistant and lower-risk profile, according to JLL.

Grocers as landlords

Finally, we come to a nascent trend of grocers themselves acquiring retail centers, as part of their omni-channel retail strategy and a goal of diversifying revenue streams.

JLL cites the example of Publix’s January purchase for $26.5 million of a new shopping center that the chain anchors. This type of deal allows Publix and other acquisitive grocers to extend their control over real estate assets to optimize tenant mixes and create synergies between their grocery operations and other businesses within these centers. According to JLL, grocers are expected to close a greater number of acquisitions as part of their expansion and diversification strategies.

You must be logged in to post a comment.