Today’s Top Tech Strategies: The CPE 100 Weigh In

Our survey of industry leaders focuses on AI, prospects for early 2024 and more.

Technology, especially artificial intelligence, has been a dominant theme for commercial real estate this year, as it has been in many corners of industry. The latest CPE 100 survey shows that improving customer  service is the No. 1 goal of technology and artificial intelligence is widely pursued but by no means the only area of technology that the industry is prioritizing.

service is the No. 1 goal of technology and artificial intelligence is widely pursued but by no means the only area of technology that the industry is prioritizing.

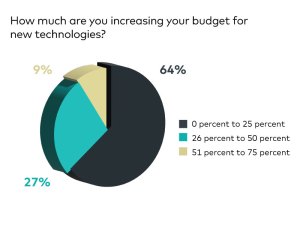

The industry is investing robustly in technology, according to the survey of the CPE 100, an invited group of industry leaders. A large majority of respondents, 64 percent, report increasing their technology spend by as much as one quarter. A much smaller  group, 27 percent, is boosting their investment by 30 to 50 percent.

group, 27 percent, is boosting their investment by 30 to 50 percent.

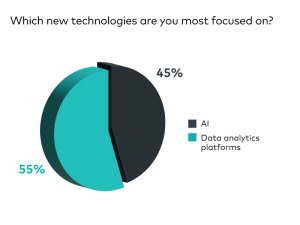

Despite many months of attention from the media as well as from business, AI is not necessarily the runaway favorite among technology priorities, however. Slightly less than half of respondents, 45 percent, name AI as their main technology focus. For the majority, 55 percent, data analytics is the top focus at their companies.

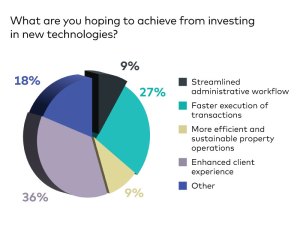

The goals for applying technology across the board turn out to be as varied as CPE 100 members,  who represent the broad spectrum of commercial real estate business areas and asset categories. Enhancing the client experience was the purpose named by 36 percent of respondents, the most of any category. Perhaps surprisingly, only about half as many—18 percent—cited operations-related reasons, such as streamlined workflow or greater efficiency at the property level.

who represent the broad spectrum of commercial real estate business areas and asset categories. Enhancing the client experience was the purpose named by 36 percent of respondents, the most of any category. Perhaps surprisingly, only about half as many—18 percent—cited operations-related reasons, such as streamlined workflow or greater efficiency at the property level.

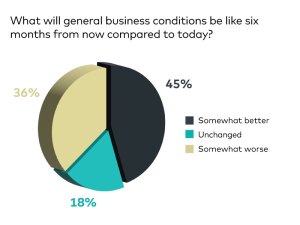

Regarding the state of the economy, the CPE 100 are taking a somewhat more upbeat view than they did at midyear. In the latest survey, more than 60 percent say that they expect business conditions to be the same or better in six months than they are now. That shows an uptick from the end of the second quarter,  when 47 percent predicted that the economy would be performing as well or better in six months.

when 47 percent predicted that the economy would be performing as well or better in six months.

The more positive outlook may stem at least partly from the unexpected staying power of the job market, which added 336,000 jobs in September, according to the latest figures from the Bureau of Labor Statistics. Other positive signs include gradually easing inflation, as well as widespread speculation that the Federal Reserve may pause the interest rate hikes that have hindered investment and the capital markets for much of the year.

from the Bureau of Labor Statistics. Other positive signs include gradually easing inflation, as well as widespread speculation that the Federal Reserve may pause the interest rate hikes that have hindered investment and the capital markets for much of the year.

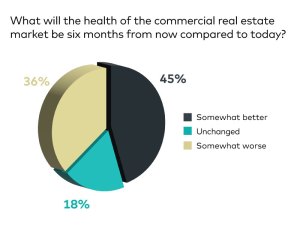

Modest optimism about the economy may also be influencing the CPE 100’s outlook for the commercial real estate sector. In the third-quarter survey, 64 percent said that the industry would be performing as well or better in six months.  As recently as the midyear survey, 53 percent expected the industry’s health to be worse six months out.

As recently as the midyear survey, 53 percent expected the industry’s health to be worse six months out.

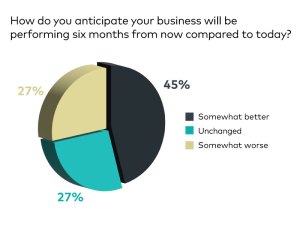

Meanwhile, the CPE 100 see a brighter future for their companies than they did at the beginning of the year. In the most recent survey, 73 percent of respondents said they believe that their firms will be doing as well or better in six months. That’s a 17 percent increase since the first quarter.

You must be logged in to post a comment.