After Rate Hike Pause, CPE 100 Are Staying the Course

Expectations of more increases may also be ramping up pessimism, our latest survey of industry leaders shows.

Few trends have had a greater impact on commercial real estate finance and investment recently than the 16-month series of interest rate hikes by the Federal Reserve. That is likely behind the tendency of most commercial real estate decision-makers’ wait-and-see approach in the wake of the Fed’s decision to pause rate hikes last month, according to the latest CPE 100 Sentiment Survey.

Few trends have had a greater impact on commercial real estate finance and investment recently than the 16-month series of interest rate hikes by the Federal Reserve. That is likely behind the tendency of most commercial real estate decision-makers’ wait-and-see approach in the wake of the Fed’s decision to pause rate hikes last month, according to the latest CPE 100 Sentiment Survey.

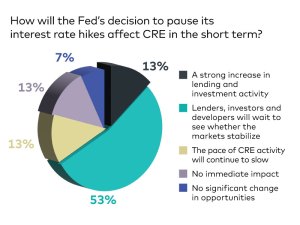

Fifty-three percent of respondents agreed that the short-term approach of investors, developers and lenders will be to wait and see whether the markets are stabilizing. Only 13 percent said that the pause in the increases that began 16 months ago will prompt a strong increase in lending and investment activity.

That tally was a noteworthy, if perhaps unsurprising, result of the quarterly survey of the CPE 100, an invited group of industry leaders representing a broad cross-section of commercial real estate business areas.

That tally was a noteworthy, if perhaps unsurprising, result of the quarterly survey of the CPE 100, an invited group of industry leaders representing a broad cross-section of commercial real estate business areas.

A growing consensus of Fed-watchers is that the central bank is poised to hike rates again this month. Federal Reserve Chair Jerome Powell will announce the decision on July 26.

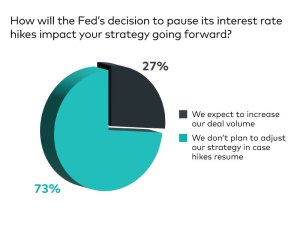

Moreover, executives are taking an equally cautious approach to their company’s strategy, given the Fed’s recent track record of raising rates. Only about one-quarter indicated that they expect an uptick in their deal volume as a result of the Fed’s decision to pause hikes.

Moreover, executives are taking an equally cautious approach to their company’s strategy, given the Fed’s recent track record of raising rates. Only about one-quarter indicated that they expect an uptick in their deal volume as a result of the Fed’s decision to pause hikes.

On the other end of the spectrum, 73 percent said that they don’t expect to modify their strategy in case the central bank starts raising rates again.

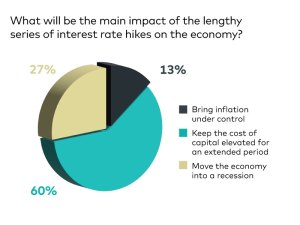

Regarding the rate hikes’ most salient effect, 60 percent of respondents told CPE that the principal outcome will be an extended stretch of higher capital costs. Another 27 percent believe that the rate hikes will push the economy into recession.

Regarding the rate hikes’ most salient effect, 60 percent of respondents told CPE that the principal outcome will be an extended stretch of higher capital costs. Another 27 percent believe that the rate hikes will push the economy into recession.

Only 13 percent agree that bringing inflation under control will be the most significant result.

As they hold off on major adjustments to their strategy, the CPE 100’s view of the market’s prospects this year have ticked down. The most striking change was in respondents’ expectations about the performance of their own businesses.

In the first-quarter survey, 61 percent of respondents said that they expected their companies to be performing better in six months. That share has dropped nearly in half since the first quarter.

In the first-quarter survey, 61 percent of respondents said that they expected their companies to be performing better in six months. That share has dropped nearly in half since the first quarter.

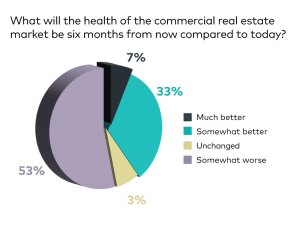

About 40 percent of respondents say that the industry’s health in six months will be somewhat better or much better, almost identical to the first quarter results. But 53 percent of respondents expect the industry to be performing somewhat worse in six months, up from 44 percent in the first quarter.

Regarding the health of the economy, the level of optimism remains virtually unchanged. The share of the CPE 100 who expect the economy to be at least somewhat better six months from now is still 40 percent. Yet the percentage of survey participants believing that economic conditions will worsen edged up to 47 percent during the second quarter from 39 percent in the first quarter.

Regarding the health of the economy, the level of optimism remains virtually unchanged. The share of the CPE 100 who expect the economy to be at least somewhat better six months from now is still 40 percent. Yet the percentage of survey participants believing that economic conditions will worsen edged up to 47 percent during the second quarter from 39 percent in the first quarter.

You must be logged in to post a comment.