Agency Lenders Raise Spreads Amid Market Volatility

The multifamily market remains heavily dependent on two GSEs, which could face restructuring after this year's presidential election.

By Paul Fiorilla, Associate Director of Research

Bond market volatility and a weakening competitive landscape have prompted Freddie Mac and Fannie Mae to widen loan spreads by 15-20 basis points in recent weeks. The increase in spreads is relatively small and has been offset by the decline in the 10-year Treasury rate, so borrower coupons remain extremely low, in the 4.5 percent range.

Still, even though the spread widening is not expected to have an immediate impact on multifamily lending, it does highlight potential issues that could reduce debt availability in coming months. For one thing, multifamily loan costs are dependent on the fixed-income market, which is likely to remain volatile this year. What’s more, other major lender types all have issues. CMBS is on the shelf at the moment, life companies have limited appetites and commercial banks are battling higher capital charges and a shifting regulatory environment.

“It’s definitely a rocky environment,” said one senior lending executive. “If banks or life companies cut back (later in the year), the agencies might not have enough capital to support the rest of the market and would go into rationing mode.”

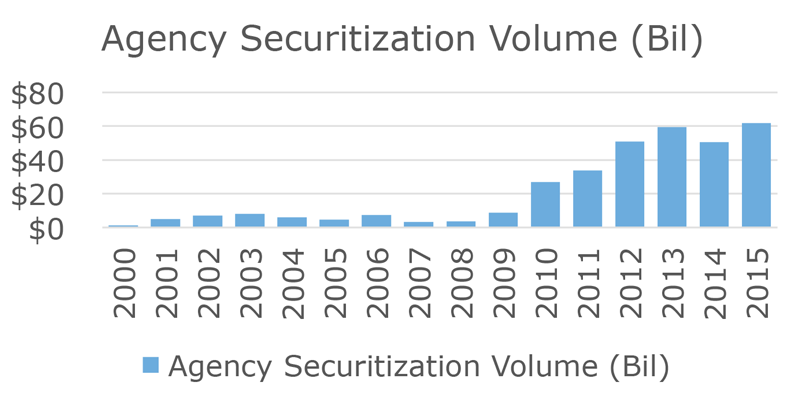

The multifamily market remains heavily dependent on the two government sponsored enterprises (GSEs), which are likely to be restructured after the next presidential election. The agencies have been originating upwards of 40 percent of multifamily debt in recent years. Fannie and Freddie each have $31 billion allocations for multifamily lending in 2016, although their regulator, the Federal Housing Finance Agency (FHFA), allows exceptions for properties that cater to low-income tenants and meet certain standards of sustainability. As a result, Fannie and Freddie are expected to each write $45 billion to $50 billion of loans this year. The GSEs securitized a combined $61.8 billion of loans in 2015, topping the 2013 record of $59.4 billion, according to Commercial Mortgage Alert.

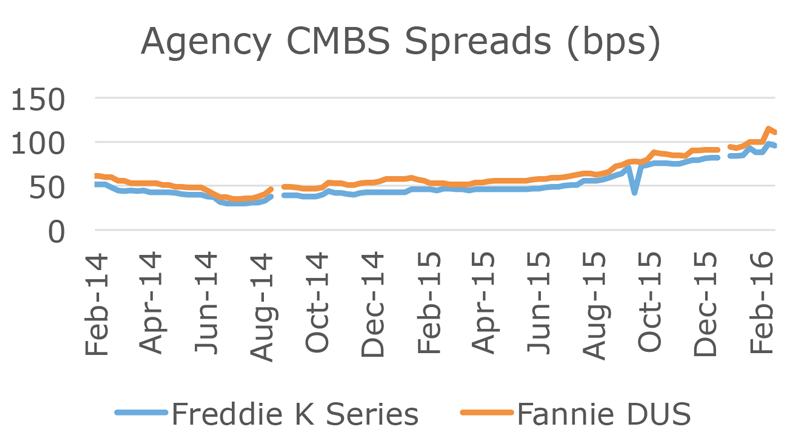

Freddie was the first to raise spreads, at the end of 2015, and has increased loan spreads by 20 basis points total since then. The increases in loan spreads largely track the increase in the spreads of Freddie’s K-Series securitizations. Spreads of AAA-rated K-Series bonds have steadily climbed in recent months, tracking increases in other fixed-income products. AAA-rated 10-year K-series bonds were priced to yield 95 basis points over Treasuries in late February, after being as low as the mid-40s in May 2015.

Spreads have also risen for Fannie’s Delegated Underwriting and Servicing (DUS) product. 10-year AAA-rated DUS bonds traded as high as 111 basis points over Treasuries in late February, up from the mid-50s during the spring of 2015. Loan spreads vary, obviously, but for a typical B-level property with 70 percent loan-to-value ratio are about 250 basis points over the 10-year Treasury.

Bonds issued by the GSEs have the implicit guarantee of the U.S. federal government, so they have historically been less volatile than other bond products such as mortgage-backed securities or corporate bonds. Lately, though, that has not been the case, which highlights how much bond investors are spooked by global economic concerns and the likelihood that the fixed-income markets will remain volatile this year.

Fannie has not increased official loan spreads as much as Freddie, but has effectively raised spreads by reducing the use of fee waivers, which can total 15 basis points or more. After originating $5.7 billion in January alone, Fannie also is believed to be trying to manage its allocation, trying to not to use it up too quickly in the first half year and leaving too little for the end of the year. The FHFA has the jurisdiction to increase the agencies’ allocations, but that is not likely unless other lenders’ activity dried up and there was a shortage of capital to finance multifamily loans.

Other lenders are active at the moment, but scenarios exist in which liquidity dries up. Life companies remain bullish on multifamily and are the lender of choice for low-leverage loans on high-quality assets. But life companies have limited allocations themselves and could lose some appetite for real estate if their equity portfolios continue to take a hit. Commercial banks remain active in permanent loans, but have reduced construction lending as a result of higher capital charges that went into effect last year. CMBS programs are largely on the sidelines because of increased CMBS spreads, and in any event have not been very competitive on pricing multifamily loans for a while. CMBS multifamily loans have been limited to secondary and tertiary markets and value-add assets.

The upshot is that it would be overstating things to raise an alarm, but there are potential pitfalls that could derail the multifamily lending markets in the second half and make debt less available and more expensive.

Paul Fiorilla is Associate Director of Research at Yardi Matrix.

You must be logged in to post a comment.