Salt Lake City Industrial: Perfect Storm for Value Creation

JLL's Todd Torok on how investors are seizing strong fundamentals rather—not just good timing,

The best industrial investments happen where market fundamentals meet real opportunity. The Intermountain West, anchored by Salt Lake City, represents exactly this convergence—a region where population growth, strategic location and tenant demand create investment scenarios that actually pencil. But what makes this market particularly compelling right now isn’t just strong fundamentals—it’s the rare equilibrium between buyers and sellers that’s creating a perfect storm for value creation.

Market fundamentals signal strength

The numbers tell a compelling story. According to JLL’s Q2 2025 Industrial Dynamics report, Salt Lake City’s industrial market maintained a healthy 7.1 percent vacancy rate through Q2 2025, with year-to-date net absorption reaching more than 2 million square feet—a figure that was offset by an equal amount of new deliveries. This equilibrium demonstrates a market that’s effectively absorbing new supply while maintaining occupancy levels.

LIKE THIS CONTENT? Subscribe to the CPE Capital Markets Newsletter

What drives this stability? The market’s 15 million square feet of active tenant requirements signals robust leasing momentum that should support continued transaction activity. Manufacturing led all industries with 29 percent of leasing activity, followed by food & beverage at 21 percent. This industrial diversification provides stability that many markets lack, reducing dependence on any single sector while capitalizing on Salt Lake City’s strategic location as a distribution hub serving the western U.S.

More significantly, average asking rents have climbed to $0.90 per square foot, reflecting sustained demand across the market and proving exceptional value compared to coastal alternatives. Beyond favorable metrics, the market also benefits from substantial in-migration, an educated workforce and business-friendly policies that continue attracting companies across multiple sectors.

The capital markets sweet spot

Right now, the market isn’t experiencing the bidding wars that characterized peak conditions, nor is it suffering from the capital drought that paralyzed transaction activity in other cycles. Instead, rational buyers are meeting realistic sellers—a recipe for sustainable transaction velocity and genuine value creation.

This balanced dynamic is creating measurable momentum in the market. Salt Lake City industrial BOV activity is up 81 percent year-over-year, indicating increased conviction from sellers contemplating realizing their returns over the next two to three quarters. This uptick in seller activity is particularly positive because it will allow risk to be priced more efficiently as more data points become available.

Additionally, most capable buyers in Salt Lake City are currently focused on strategic locations with smaller tenant profiles. This focus applies to existing legacy asset acquisitions, where the mark-to-market rent growth feature creates compelling investment scenarios. Similarly, 80 percent of new construction projects in the concept phase are targeting smaller format, multi-tenant designs where developers can pro forma rents exceeding $1.20 per square foot—levels that make these projects perform well financially and potentially push exit values into the mid-$200s per square foot range.

While Q2 2025 investment activity was somewhat muted compared to peak periods, the underlying fundamentals suggest increased transaction activity ahead. Buyers are underwriting to fundamentals rather than chasing deals, sellers are pricing to market reality rather than holding out for peak valuations and transactions are closing based on merit rather than market timing. This measured approach creates a foundation for sustainable value creation that extends beyond individual deal cycles.

The redevelopment opportunity

Perhaps the most compelling capital deployment opportunity involves large-scale redevelopment of legacy industrial assets. Two significant projects are currently being marketed—both involving the strategic demolition of functionally obsolete buildings in prime Class A locations.

These redevelopment opportunities address a key market dynamic: the need to transform legacy industrial properties into modern facilities that meet today’s operational specifications. Rather than viewing obsolete buildings as liabilities, these projects demonstrate how prime real estate in established business parks can be repositioned for contemporary users.

For capital comfortable with development execution, these projects offer value creation potential while addressing genuine market demand.

Debt markets support transaction velocity

One factor supporting Salt Lake City’s balanced transaction environment is the availability of competitive debt capital. Industrial assets in the market continue to attract favorable financing terms from both traditional lenders and alternative sources. The combination of stable fundamentals, diverse tenant base and strong demographic trends provides lenders with the confidence necessary to support leveraged transactions.

This financing availability is crucial for maintaining transaction velocity in a balanced market. When neither buyers nor sellers have overwhelming leverage, deal success often depends on execution capabilities—including the ability to secure attractive debt terms that support buyer return requirements while meeting seller pricing expectations.

The path forward

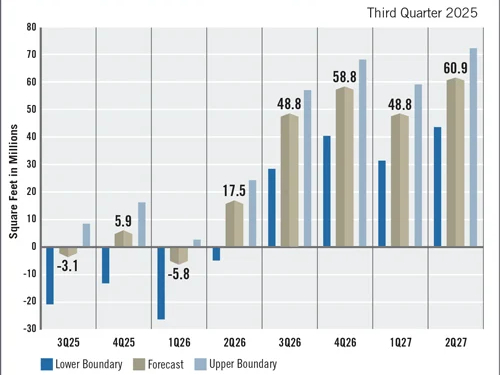

The fundamentals supporting Salt Lake City’s balanced market dynamic should persist into 2026. Continued population growth, business-friendly policies and the region’s strategic geographic position provide tailwinds for sustained industrial demand. While external factors such as trade policies and economic conditions will influence timing and velocity, the market’s diversified tenant base and disciplined supply approach position it well to maintain equilibrium even as broader conditions evolve.

For investors, this balanced environment offers something increasingly rare: the opportunity to deploy capital based on fundamental value rather than market timing. In a world where most markets swing between extremes, Salt Lake City’s steady equilibrium represents a sustainable competitive advantage.

Todd Torok is managing director at JLL Capital Markets, leading the industrial investment sales efforts in Salt Lake City and across the Intermountain West region, including Reno, Nevada and Boise, Idaho

You must be logged in to post a comment.