Are Cap Rates Starting to Compress?

Despite economic uncertainty, some asset types point to early signs of stabilization, according to CBRE’s latest report.

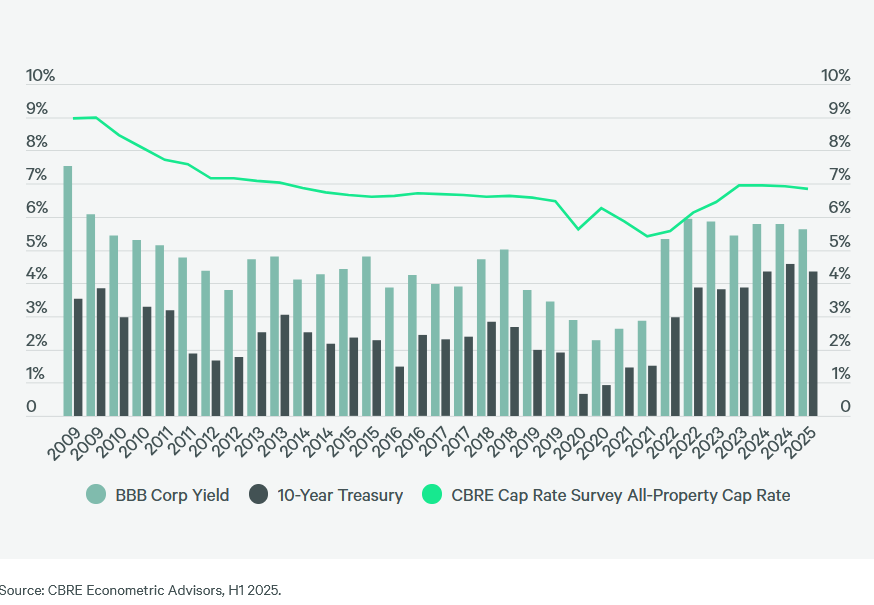

The uncertainty that real estate investors face regarding U.S. trade policy, the trajectory of interest rates and the nation’s long-term fiscal health is amply reflected in CBRE’s H1 2025 cap rate survey. The survey of more than 200 CBRE real estate professionals found that capitalization rates have declined slightly and that yields seem to be at—or even beyond—their cyclical peak.

In parallel with those trends, the outlook for total commercial real estate sales volume this year has decreased slightly.

The survey is based on 3,600 cap rate estimates across more than 50 metro areas, as of early June.

“Investor confidence is shifting, with the multifamily sector now emerging as the top choice for investors, surpassing the industrial sector. Retail holds firm in third place, followed by hotels, as the office segment navigates evolving preferences,” Tom Edwards, CBRE’s global president of valuation & advisory services, told Commercial Property Executive.

The report noted the volatility of 10-year Treasury yields in the first half, peaking at almost 4.8 percent in mid-January and then falling to around 4.3 percent by mid-March. Further gyrations followed the stock market’s reaction to more severe-than-expected tariffs and Moody’s downgrading the U.S. credit rating, ending with a 10-year yield of 4.2 percent at the end of June.

READ ALSO: CRE Pushes Toward Recovery

“Despite this volatility, the all-property cap rate estimate declined slightly, falling 9 basis points,” CBRE stated. “In a departure from the past few surveys, different property types largely moved in unison. This may be a sign we are past the peak of cap rates, despite the ongoing macroeconomic uncertainty, and entering a new period of property yield compression.”

Nearly one-quarter of the retail, industrial and hotel respondents believe that cap rates are past their peak and will begin to decrease over the second half of 2025.

Although yields on average held steady in the first half, CBRE reported, “There were several outlier office estimates, particularly among Class B and C properties, where cap rates expanded considerably.”

In addition, even though the average office cap rate estimate has not increased, the average spread between the survey respondents’ lower and upper estimates has been widening, “reflecting uncertainty for office pricing.”

Multifamily tops, office at the bottom

As to the anticipated effects on commercial real estate sales volume from the fallout of the Trump administration’s tariffs, more than half of the survey participants expect slightly lower sales volume, and one in six anticipate that volume will be significantly lower.

Asked to rank how they expect the five major commercial real estate sectors to perform, respondents (in contrast to the previous survey) were most optimistic for multifamily, which surpassed industrial. Retail was in third place, followed by hotel and finally office in the last place.

You must be logged in to post a comment.