Vornado to Pay $218M for Manhattan Tower

The firm will buy the office component of a 36-story asset.

Vornado Realty Trust has entered into an agreement to purchase the office component at 623 Fifth Ave. in Manhattan for $218 million. Cohen Brothers Realty currently owns the 36-story, 382,500-square-foot building, according to Yardi Research Data.

The office condominium sits above an 80,000-square-foot retail space occupied by Saks Fifth Avenue.

The buyer expects to close the deal in September and plans to completely reposition and redevelop the tower into a Class A office property. Completion is scheduled for 2027.

Cohen Brothers Realty acquired the asset in May 2002 from UBS, the same source shows. The property is subject to a $120 million loan originated by Allianz in 2014 and set to mature in 2030.

Over the last few years, the company has had multiple properties go into foreclosure, Commercial Observer reported. Last year, Forethought Life Insurance Co. filed a lawsuit against Cohen Brothers for allegedly defaulting on an $85 million loan at 3 E. 54th St.

READ ALSO: Worth the Risk: Value Investors Chase Office Deals

Completed in 1923, the property at 623 Fifth Ave. went through cosmetic renovations in 2016. The tower has floorplates averaging 14,486 square feet and 16 passenger elevators. The building’s vacancy is currently at 75 percent. Equinox Partners, HCLTech and Scopus Asset Management are some of the tenants at the high-rise, according to Yardi Research Data.

Located in the Plaza District, the building is adjacent to Rockefeller Center and 1 mile from the Empire State Building. The property is also close to some of Vornado’s other office assets in the area, including 640 Fifth Ave. and 595 Madison Ave.

The office sector is undergoing a shift, as businesses respond to evolving realities and changing workforce expectations. Tenants are no longer satisfied with buildings that simply meet functional needs—they’re seeking environments that deliver enriching experiences, foster meaningful interactions and offer a mix of amenities.

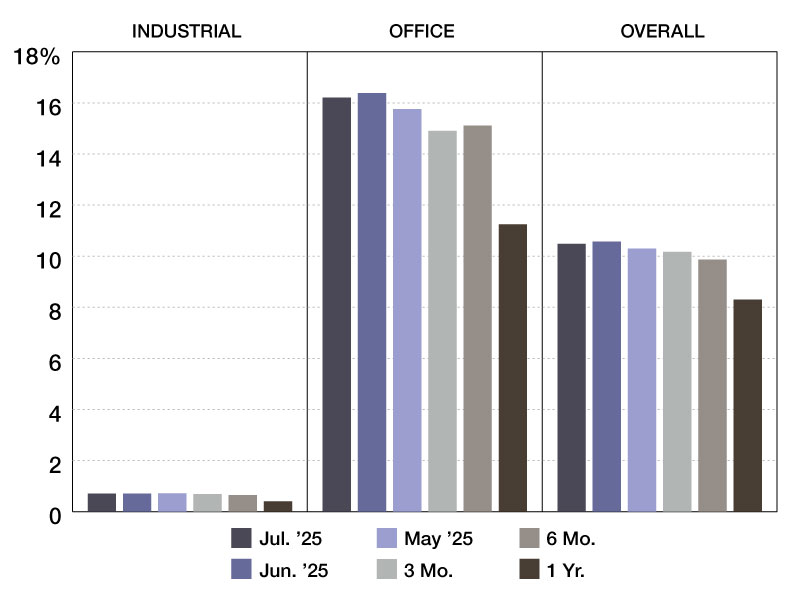

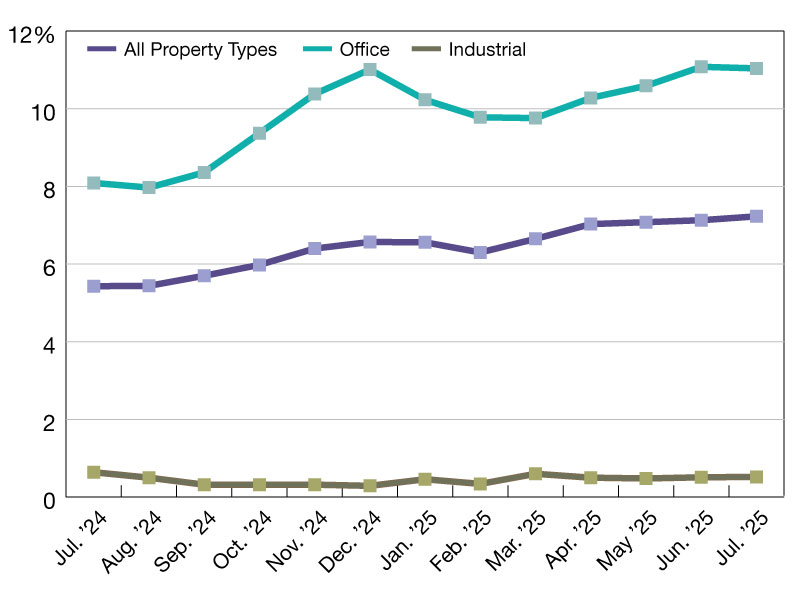

Manhattan office prices continue to lead nationally

Manhattan’s office investment volume year-to-date as of July clocked in at almost $3.1 billion, ranking third nationally, according to the latest Yardi Matrix office report. The market was surpassed by Washington, D.C. ($3.3 billion) and the Bay Area ($3.4 billion). However, the borough led the U.S. in terms of average price per square foot, clocking in at $422.

In May, Blackstone landed an $850 million loan to purchase a 49 percent stake in Fisher Brothers’ 1345 Avenue of the Americas in Midtown Manhattan. The 1.9 million-square-foot office tower rises 50 stories.

You must be logged in to post a comment.