Why CRE’s Transaction Volume Is So Low

This period of the cycle is unlike any seen before, writes Dekel Capital's Shlomi Ronen.

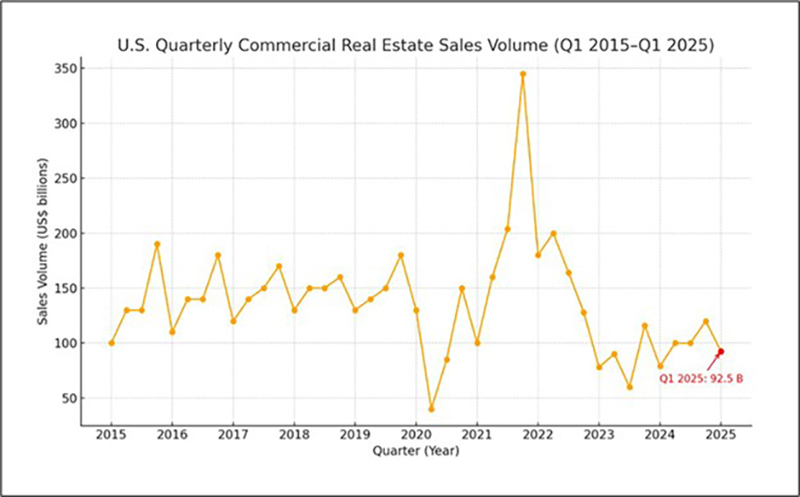

In previous cycles, commercial real estate transaction volume typically declined due to liquidity constraints or economic recessions. However, that’s not the case today—liquidity remains ample, and the economy is relatively stable. So what’s causing the current slowdown in CRE transactions?

I believe there are three primary factors:

- Unrealistic owner expectations. Many CRE owners still hold onto the belief that interest rates will return to 2022 levels, which is unlikely in the near term.

- Shifting risk pricing by equity investors. Investors are recalibrating how they assess and price risk, leading to more cautious investment behavior.

- “Extend and pretend” strategy. Investors and lenders are allowing owners to extend loan terms and delay recognizing losses on properties where current market values have wiped out most or all of the equity.

LIKE THIS CONTENT? Subscribe to the CPE Capital Markets Newsletter

The banking sector as a liquidity indicator

Banks, which hold about 40 percent of outstanding CRE debt, serve as a useful gauge of senior debt liquidity. Their public reporting gives us insight into lending trends.

In Q1 2025, the largest publicly traded U.S. banks—including Wells Fargo, U.S. Bancorp and M&T Bank—reduced their CRE loan exposure compared to Q1 2024. Notably, Wells Fargo, U.S. Bancorp and M&T Bank saw significant reductions in their CRE loan balances year-over-year, providing them with capacity for new loan origination. Overall, CRE delinquency rates remain moderate at approximately 1.49 percent.

Interest rate environment

Let’s start with short-term rates. The federal funds rate currently stands at 4.25 to 4.5 percent and the FOMC at its meeting on June 18 left it unchanged, with indications that a 0.25 to 0.5 percent decrease could be coming sometime in the second half of 2025.

The five-year and 10-year Treasuries, which drive long-term lending rates in CRE, have been hovering around 4 percent and 4.3 percent, respectively, for the past six months. Barring a major economic shift prompting the Fed to reintroduce quantitative easing—as it did during the Covid-19 crisis—Treasury yields are likely to face upward pressure. This is due to the government’s need to issue more debt to refinance existing obligations and cover deficits.

At current yields, CRE borrowers face interest rates ranging from 5.25 to 7.5 percent for 10-year term loans. While these rates are not historically high, they are significantly above the 3 percent rates seen during the pandemic.

Adjusting for risk

The market is returning to a more stratified view of risk. Riskier property types, locations and vintages are now trading at higher cap rates.

For example, in 2022, about 265 sales of 1970s to 1980s vintage multifamily properties (Class B/C) in the Phoenix MSA transacted at cap rates of 3.75 to 4.25 percent, with average per-unit prices in the mid-$200,000s. By 2025, cap rates for similar properties had risen to the mid-6 percent range.

By comparison, in 2022 Class A properties in the Greater Phoenix market traded at a cap rate range of 3.5 to 4.25 percent—very similar to that of Class B/C properties. In 2025, Class A properties have traded in the low-5 percent range. As this risk adjustment materializes across the CRE market, I expect to see continued value impairment.

The Great Modification

Debt funds played a central role in the 2022 CRE boom, offering high-leverage, non-recourse bridge loans with two- to three-year terms, typically priced 2 to 3 percent over SOFR. Borrowers were required to purchase interest rate caps, keeping all-in rates around 4 to 5 percent.

These loans were often financed through warehouse lines or CLO securitizations. As they matured into a market with higher cap rates and weaker leasing fundamentals, many sponsors saw their equity wiped out. Lenders then faced a choice: Modify the loans and hope for value recovery or foreclose.

According to the Mortgage Bankers Association, lenders extended $384 billion in loans from previous years into 2025.

Looking ahead to the second half of 2026, I expect recapitalizations and new developments to dominate CRE activity. Lenders are beginning to sell underperforming loans, which could drive acquisition activity until the market shifts again.

Shlomi Ronen is principal & founder at Dekel Capital.

You must be logged in to post a comment.