FalconEye Buys Metro Phoenix Mixed-Use Property

Plans call for a $100 million renovation.

FalconEye Ventures has acquired Scottsdale Quarter, a 755,000-square-foot mixed-use property blending Class A office, luxury retail and residential components in Scottsdale, Ariz. Washington Prime Group was the previous owner, according to Yardi research data.

Debt totaling $165 million previously encumbered the property, the same source shows. Wells Fargo issued the CMBS loan, which was due to mature this month, in 2015.

The new ownership earmarked $100 million in capital expenditure to improve the 2009-built property’s retail and office components, which encompass more than 300,000 square feet each. The enhancement program is set to kick off later this year.

READ ALSO: CPE Midyear Outlook: Is It Only About Uncertainty?

Plans call for the mixed-use property’s retail portion to shift toward an experiential environment, while the office segment will transform to cater to technology and creative industry tenants. Further work is slated to focus on tenant curation and infrastructure improvements.

Located at 15279 N. Scottsdale Road, the property is about 20 miles northeast of downtown Phoenix and less than 1 mile from Scottsdale Airport. More than 4.5 million visitors stop by the Quarter each year.

The tenant roster includes Apple, Restoration Hardware, lululemon, Jenni Kayne, Veronica Beard, Dominick’s Steakhouse, as well as True Food Kitchen. Vestar—an operator of open-air shopping centers—will take charge of operations at the property.

This isn’t FalconEye’s first mixed-use endeavor in Scottsdale, Ariz. The developer is planning a $1 billion, 32-acre project, set to deliver 250,000 square feet of commercial space and about 1,200 residential units as part of the redevelopment of an amusement park.

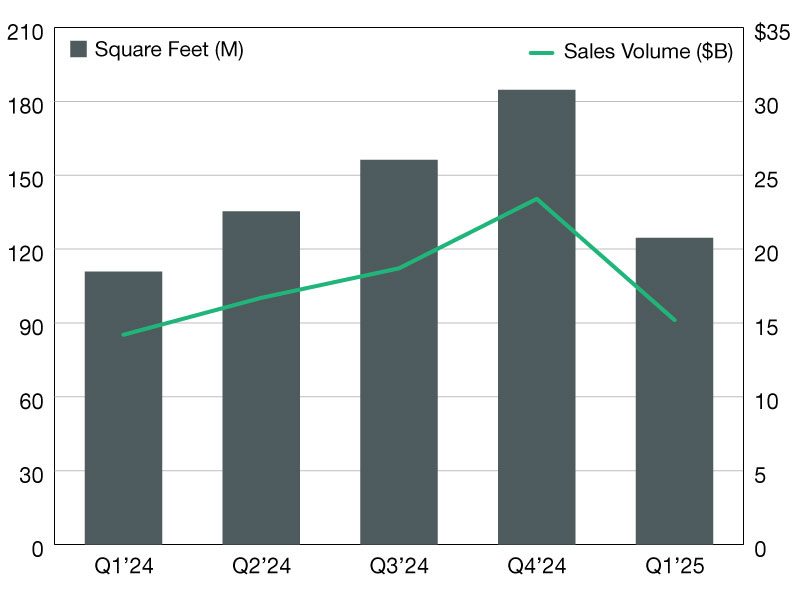

Investor interest in mixed-use assets heightens

Mixed-use transactions picked up the pace this year. PSP Investments purchased The Wharf in Washington, D.C., in April and then secured a $1 billion refinancing note this month. The debt is backed by 2.2 million square feet of space.

In May, Turtle Creek Village—a Dallas property comprising 230,000 square feet of office and 95,000 square feet of retail space—found itself under new ownership. CIM Group sold the asset to a local company.

You must be logged in to post a comment.