Bridge Logistics Secures $355M Portfolio Refi

The properties are spread across multiple states, including California, Florida, Texas and others.

Bridge Investment Group subsidiary Bridge Logistics Properties has received $354.6 million in financing from Invesco Commercial Real Estate Finance Trust Inc. to refinance a 2.5 million-square-foot portfolio of industrial assets.

The collection comprises 24 properties in six U.S. states: six in California, five each in Florida and Texas, four in New Jersey, and two each in New York and Washington.

INCREF is a perpetual life REIT focused on floating-rate private credit secured by real estate. Its strategy centers on originating income-generating loans secured by institutional-quality assets in the most liquid markets across the U.S. and Europe, Charlie Rose, president & lead portfolio manager of INCREF and global head of credit for Invesco Real Estate, told Commercial Property Executive.

READ ALSO: What Does Site Remediation for Industrial Use Entail?

INCREF’s portfolio now totals “61 like-kind loans representing over $3.6 billion in commitments,” Rose added. “[T]his sub-70 percent loan-to-value financing—secured by a diversified, well-leased infill industrial portfolio—complements our existing portfolio of moderate leverage loans to the industry’s top institutional sponsors.”

Founded in 2021, Bridge Logistics Properties is a vertically integrated logistics real estate investment manager. It’s led by industrial real estate veterans with prior tenures at Brookfield, Prologis, IDI Logistics, Duke Realty, Hines and KTR Partners based in four offices in New Jersey, Atlanta, Dallas and Los Angeles.

In January, Bridge Industrial formed a $789 million joint venture with CPP Investments that will focus on industrial assets in markets with limited warehouse space. Bridge took a 5 percent stake, while CPP Investments holds the other 95 percent.

Invesco’s first CLO

Just barely more than a month ago, INCREF closed its first commercial real estate collateralized loan obligation, valued at $1.2 billion and designated as INCREF 2025-FL1. The CLO is secured by a portfolio consisting of about 55 percent multifamily-associated loans and 45 percent industrial loans, primarily in southern tier states. Morgan Stanley structured the CLO, with bookrunning support from Barclays, Citigroup and Wells Fargo.

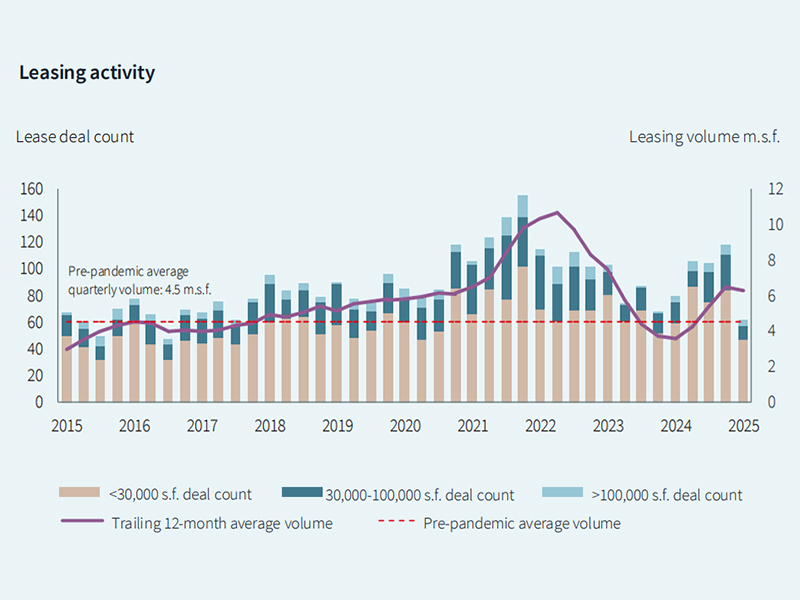

In a recent North American industrial outlook, Newmark foresees that given increased market volatility, U.S. market participants will need to maintain a balance between strategic patience and decisive action. “In the near term, the potential for softer leasing volume and extended investment timelines compounds existing slower-growth fundamentals, contributing to recessionary indicators,” the report found.

Nonetheless, Newmark continues, as trade flows continue to normalize, long-term opportunities exist in markets that have diverse industry exposure, substantial infrastructure for multi-modal logistics, and strong demographic and economic advantages.

You must be logged in to post a comment.