6 Key Trends Shaping the Life Science Sector

And what’s behind these shifts, according to JLL’s latest research.

Calling the life science sector’s start to this year “disquieting,” a just-released report from JLL examines the multiple uncertainties that are making investors and pharma companies cautious and leasing deals smaller on average.

One measure of this is that the U.S. lab market, which totals roughly 200 million square feet, would need about 20 million to 25 million in net absorption or supply reduction to reach equilibrium, according to JLL’s latest study.

“Barring an unforeseen and substantial growth spurt of demand,” JLL writes, “the likeliest outcome of this period of oversupply is that well-built and well-located buildings will gain market share, while buildings without those aspects will face increased odds of distress in the next 12-24 months.”

READ ALSO: Life Science Development’s Guarded Prognosis

The long game will be crucial here, the report predicts. Although “building owners cannot wait in perpetuity for markets to recover,” landlords with the requisite experience and scale—and submarkets that are well established—are currently out-leasing their competitors and should do well when the next recovery phase in the biopharma sector inevitably starts.

Looking past the big picture, JLL dives into six key trends.

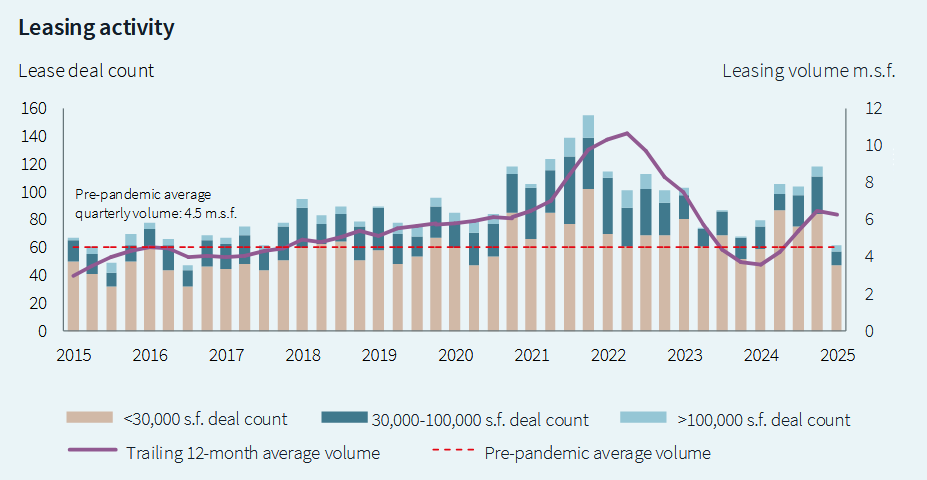

A drop in lab leasing volume

After growing throughout 2024, lab leasing decreased significantly in the first quarter.

This volume is notably slower so far this year versus 2024, and that caution is reflected in part by a larger percentage of smaller deals.

“The reductions in tenant demand in early 2025 across the U.S. suggest muted leasing volume growth for the rest of the year,” JLL predicts.

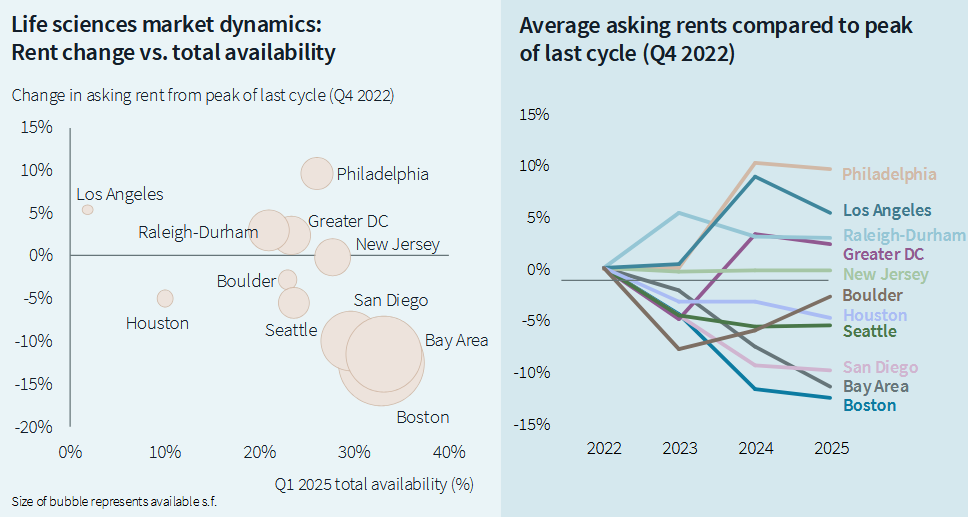

A mixed performance across regions

The downward pressure on rents is most apparent in markets with the most supply.

Traditional powerhouses metro Boston, the Bay Area and San Diego are seeing similar market conditions of “prolonged oversupply and weak demand,” JLL reported. “Availability rates have remained elevated, leading to significant downward pressure on rents.”

In contrast, some mid-sized markets, including metro Washington, D.C.; New Jersey and Raleigh-Durham, N.C., are in a more stable position, with “decent availability levels and relatively moderate rent changes.”

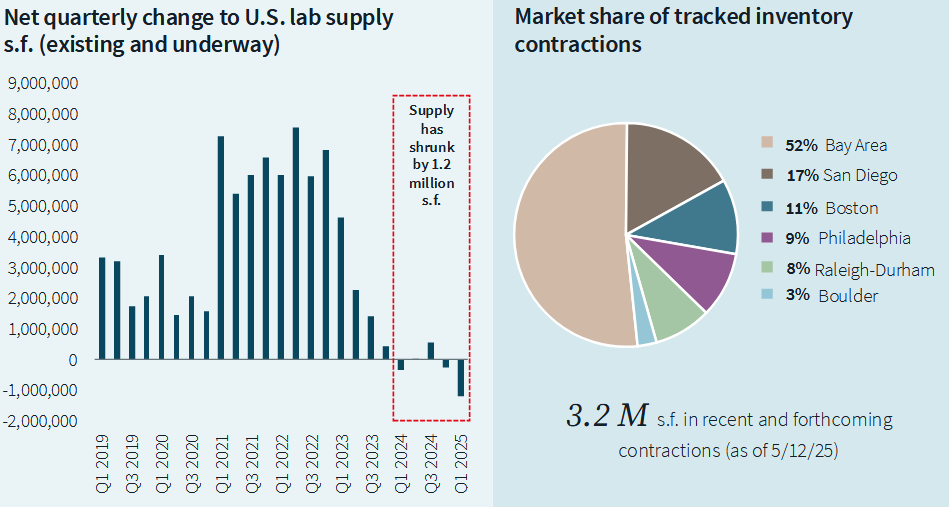

A shrinking inventory

The lab market is already shrinking, “with much more to go.” The shrinking inventory is evidenced by JLL having identified a reduction in lab space over the past 12 months of about 1.2 million square feet across roughly a dozen buildings nationwide, as owners of buildings with elevated vacancy levels seek other uses.

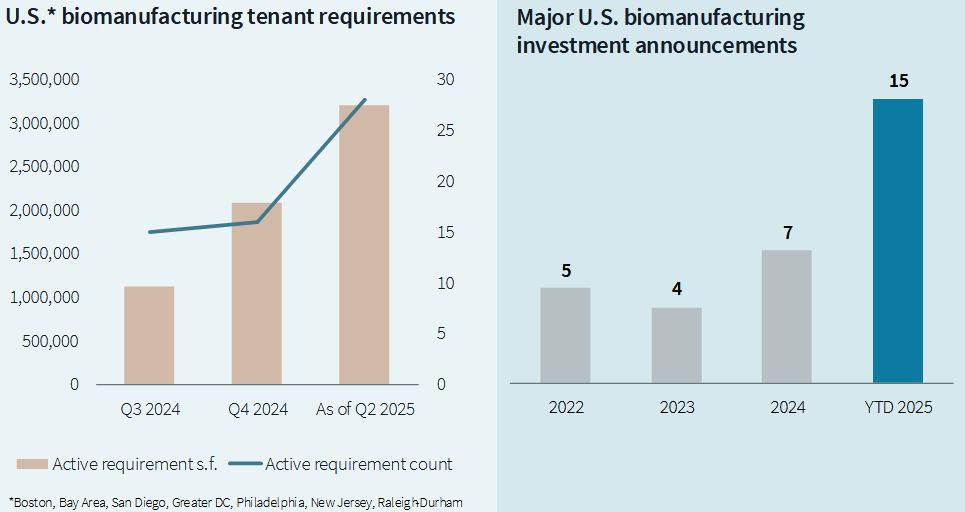

A shift to reshore biomanufacturing

Federal policy shifts since the pandemic have begun to reshore biomanufacturing.

The report states that “15 major pharmaceutical companies year-to-date have announced more $270 billion in U.S. biomanufacturing and R&D investments planned over the next five to 10 years, driven by the threat of additional pharmaceutical tariffs and other cost pressures.”

Although some of those investments will be on pharma companies’ own campuses, JLL found a spike in interest in built biomanufacturing space in key U.S. markets.

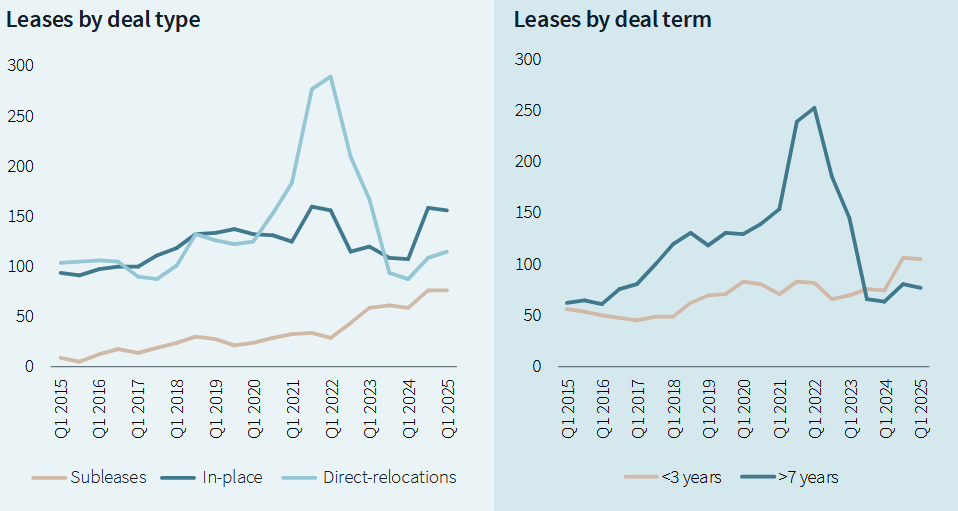

A change in deal composition

The make-up of lab deals across the country has changed dramatically.

Nationwide, deals for lab space have changed “dramatically,” according to JLL. Direct relocations are down sharply, and renewals—especially for shorter terms (less than seven years)—are more popular, as are subleases.

A focus on the best buildings, best locations

More than ever, tenants want to be in the best buildings or the best submarkets.

The two most in-demand segments of the lab market are newer, purpose-built properties in the largest markets (metro Boston, the Bay Area and San Diego) and, for companies relocating across the U.S., long-established submarkets.

It might sound too basic, the report noted, but “building quality and location matter more than ever.”

You must be logged in to post a comment.