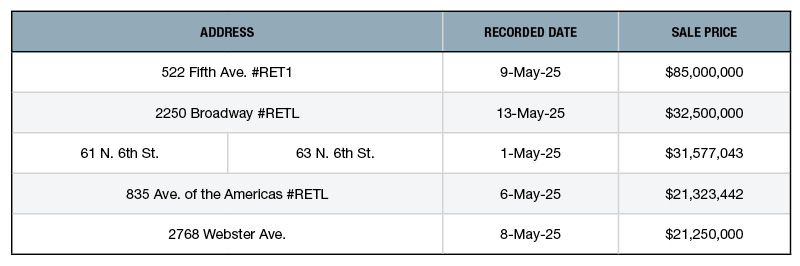

Top 5 NYC Retail Building Sales—May 2025

The metro’s top deals for the sector rounded up by PropertyShark.

Sale Price: $85 million

Amazon purchased the 24,786-square-foot retail portion of 522 Fifth Ave. from RFR Realty. RFR Realty owns the office part of the 595,430-square-foot, 23-story building since 2020 and picked up the retail space from Deka Immobilien for $85 million in May. On the same day, RFR sold the retail portion to Amazon, for an undisclosed price, through a condominium deed.

The retail giant, through a separate transaction, purchased two office floors at the same building in a $350 million deal, according to TheRealDeal. Other sources mention a total sale price of roughly $456 million, while property records show only the amount previously stated, according to Commercial Observer.

Sale Price: $32.5 million

TPG Angelo Gordon sold the 34,353-square-foot retail portion at 2250 Broadway to grocery chain WestSide Market NYC. The buyer secured a $18.6 million acquisition financing package through a loan consolidation and a gap note from Metropolitan Commercial Bank.

The building at 2250 Broadway is totaling 166,952 square feet and came online in 1986. It rises 22 stories and includes 123 condominium units. The retail space is currently occupied. The buyer has seven locations in the borough, with two of them located on the Upper West Side.

Sale Price: $31.6 million

City Urban Realty picked up a 7,500-square-foot retail property from a private seller. Northeast Bank provided a $16 million senior loan and a $3.3 million gap mortgage on behalf of the buyer, with the second loan set to mature in 2027.

The one-story retail building came online in 2007 and was vacant at the time of the sale. It includes 15,000 square feet of unused air rights. The asset is within Brooklyn’s Williamsburg area, where City Urban Realty sold a three-building collection in April.

Sale Price: $21.3 million

An entity affiliated with Blackstone purchased the 20,962-square-foot retail portion of the Kimpton Eventi Hotel, that holds the 835 6th Ave. address, on the same lot. The seller JD Carlisle sold the commercial unit as well as the hotel part of the 210,311-square-foot building. Blackstone also secured a $125 million loan from Wells Fargo Bank for the entire building.

The 2010-built property is a Class A+, 53-story hotel built in 2010. Situated in Manhattan’s Chelsea area, close to the Empire State Building, the property provides easy access to Midtown and the Upper West and East sides.

Sale Price: $21.3 million

Maddd Equities picked up the 7,500-square-foot building from North End Wine & Liquor Store. The owner also secured a $27 million loan from LibreMax Capital through a loan backed up by a second adjacent property at 2740 Webster Ave.

The buyer is working together with Stagg Group for the development of a 800,000-square-foot mixed-use project on the two lots, according to Commercial Observer. The project will include more than 500 dormitories for Fordham University and 485 affordable housing units.

The retail property at 2768 Webster Ave. dates back to 1920, was last upgraded in 2017 and includes 169,781 square feet of unused air rights.

—Posted on June 27, 2025

You must be logged in to post a comment.