Will Economic Headwinds Blow Away CMBS Growth?

New issues are expected to reach $110 billion in 2025. But challenges are mounting.

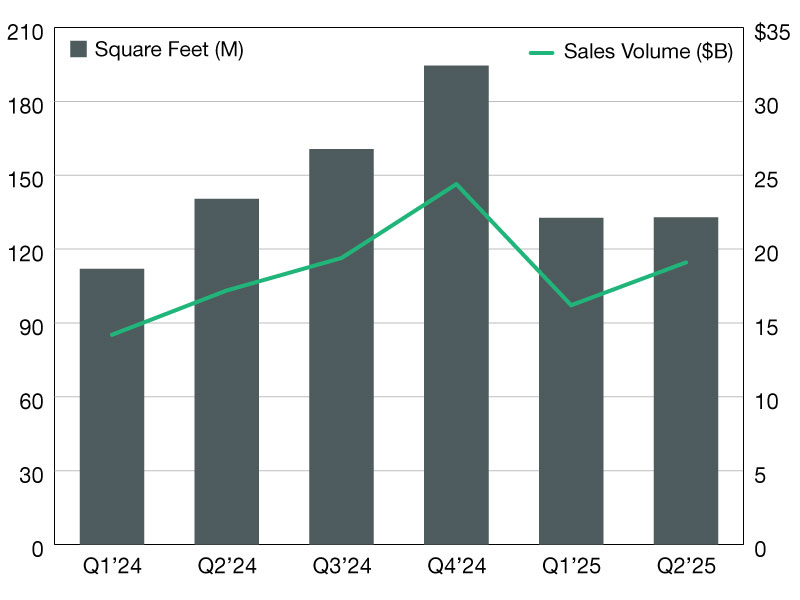

Last year was a banner year for CMBS. Despite growing delinquency, issuance in 2024 rose 180 percent over the previous year to $108.2 billion versus just $40 billion in 2023, S&P Global reported.

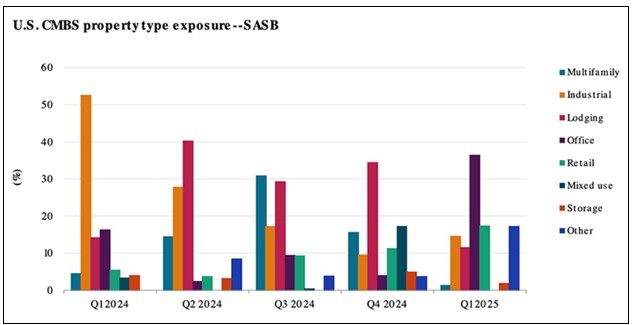

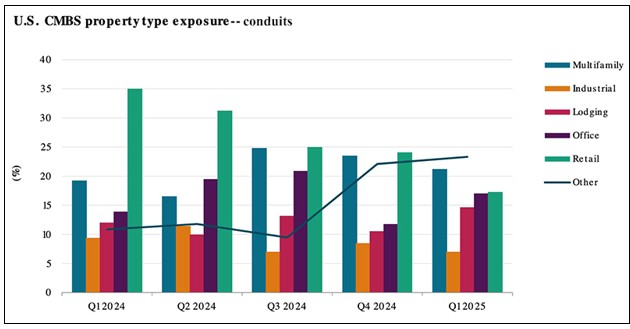

And this trend has continued into 2025. Combined SASB and conduit private label issuance volumes more than doubled year-over-year in the first quarter of 2025 to $37 billion compared with $18 billion in the first quarter of 2024. In fact, if all goes as planned, SASB and conduit private label issuance volume is expected to reach $110 billion this year.

This increase in CMBS issuance drove a surge in bond investment, according to Jay Maddox, principal, Capital Markets for Avison Young.

READ ALSO: Loan Servicing Insights for a Market in Flux

“CMBS issuers stepped in to fill the liquidity void created by the steep decline in CRE loan originations by banks as they cut way back on lending,” he said, noting that the leading CMBS issuers are JP Morgan Chase, Wells Fargo and Bank of America.

In cases where slightly higher leverage, more flexible amortization or an interest-only component is needed, CMBS remains extremely competitive, said Barry Gersten, managing director & director of capital markets, for Northmarq.

Mixed-use and multifamily are the leading property types favored by CMBS lenders, but CMBS lenders also are getting outsized spreads on high-quality office buildings because other lenders are shunning this asset category, he added.

Gersten also noted that CMBS lenders will favor higher-quality office assets, particularly multi-tenant buildings in strong markets with experienced, well-capitalized sponsors.

Noting that credit spreads tightened in May, fueling increased demand for CMBS loans, Gersten predicted that CMBS will experience favorable conditions and strong investor appetite over the next few months before the typical mid-to-late summer lull in activity.

And then what?

However, the CMBS market is facing a number of challenges that cast a shadow on projections for the rest of the year. The biggest challenge involves uncertainty surrounding the U.S. economy in the near term along with the long-term impact on Treasuries caused by the growing national debt, said Shlomi Ronen, managing principal at Dekel Capital. “The national debt is causing upward pressure on Treasury yields, thereby increasing borrowing costs,” he explained.

Meanwhile, a $957-billion wall of commercial real estate debt will mature this year, according to the Mortgage Bankers Association. This includes $150.9 billion in private-label CMBS loans with approximately $63.6 billion needing to be paid off or refinanced, noted the S&P report.

CMBS delinquencies rose in May 2025 to 7.08 percent, up slightly from the four-year high in April of 7.03, compared to 5.3 percent last April, according to a Trepp report. Not surprisingly, delinquencies were led by office, which increased to 10.59 percent. Office was followed by multifamily, which decreased from 6.57 in April to 6.11 percent in May. Avison Young’s Asset Resolution Team expects this trend to continue and perhaps worsen for the balance of this year and next, noted Maddox.

But special servicers are taking a measured approach to avoid a massive increase in foreclosures or deeds-in-lieu, Maddox continued, noting that workouts are possible but challenging and require new cash investment.

Copyright 2025 by Standard & Poor’s Financial Services LLC. All rights reserved.

“One thing we’re seeing is that many maturing defaulted loans have an equity cushion providing the opportunity to negotiate forbearance, recapitalize or sell without the CMBS loan incurring a loss,” he continued. “In many cases, there is equity worth protecting, meaning that, despite the impaired value of the property, it is still worth more than the loan.”

But with current uncertainty and anxiety over rising inflation, interest rates are expected to remain high relative to the near zero rates of three or four years ago. “Higher rates translate to increased financing challenges for borrowers who have maturing loans,” said Maddox. “Unless lenders are willing to extend, those borrowers are faced with having to transact at today’s stricter underwriting criteria and depressed valuations.”

Tariffs add fuel to the fire

CMBS asset performance, however, will deteriorate due to tariff-related disruptions, including inflation, elevated interest rates and decelerating global growth, according to a report authored by Melissa Che, senior director, Structured Finance, CMBS, at Fitch Ratings. She noted that policy shifts are introducing considerable uncertainty within commercial real estate, and that will likely lead to lower deal volume and a pause in major capital investments and new developments, and negatively impact tenant decision-making due to rising costs.

Industrial real estate, particularly in West Coast port markets, will be affected the most by reduced trade, given the region’s outsized exposure to China trade and existing oversupply in key submarkets like the Inland Empire, Che said. While the tariff on goods from China was recently lowered from 145 percent to 31.8 percent, it remains much higher than other countries and will result in lower import volumes. This will have the greatest impact on smaller, less well-capitalized tenants, resulting in increased industrial vacancy, lower cash flows and higher cap rates for port-centric properties, and may prompt an exit of businesses to less expensive markets, she noted.

Che also expects retail demand to soften as prices rise, causing retailers reliant on Chinese supply chains to scale back store size or accelerate store closing plans. This will make it more difficult for power centers and malls to fill vacancies and put downward pressure on rents, she noted. As a result, Fitch has revised its retail CMBS asset performance outlook from neutral to deteriorating.

Weak consumer confidence and lower inbound international travel, along with pressure on labor supply due to immigrant restrictions, are already having a negative impact on the hospitality industry, increasing hotel vacancy and labor costs.

Multifamily, on the other hand, is well-positioned for growth due to low affordability, moderating supply in key urban markets and high demand, Che said, noting that increased costs due to tariffs on materials and labor shortages will limit new construction and drive-up occupancy and rents. For those reasons, Fitch moved its multifamily rating from deteriorating to neutral.

Why investors favor CMBS debt

Uncertainty around the direction of the U.S. economy has led to a general flight to safety in the capital markets, Ronen said. Credit products, CMBS included, have been the beneficiary of it.

“The CMBS market has proven to be resilient since the Great Recession, and it will be a critical funding source in the coming years, as borrowers seek to maximize their leverage to pay off maturing floating rate debt,” Ronen added, noting that CMBS has relatively low default rates due to the concentrated nature of defaults by property type.

Gersten noted that CMBS has become a funding alternative for refinancing maturing loans. “Often the challenge lies in ‘right-sizing’ the debt for assets that may have been overleveraged, which can require either additional equity or the addition of a mezzanine component to fill the capital shortfall,” he said.

Loan defaults do slow down payoffs and result in losses that impact originations going forward, but Maddox contended that maturity defaults do not affect CMBS lending activity since lenders securitize and sell CMBS debt, thereby eliminating legacy-portfolio risk considerations. “Underwriting parameters for new originations reflect the current market outlook for spreads and loan sizing, not the ‘sins of the past,’” he contended.

Large SASB deals are still being funded in the CMBS market. “Debt funds have been especially aggressive on bridge loans, and a select few provide construction loans, filling the void left by banks that have curtailed lending,” Maddox said.

Is recession CMBS’ monkey wrench?

Economists are split over whether or not the U.S. is headed for recession. In the case of recession, there would likely be fewer loan originations and less CMBS issuance as well as increased levels of delinquency and distress.

“We may see some refinancing of low-coupon mortgages with only a few years’ remaining term as the defeasance costs are low and this may help to support loan volume,” said Maddox, noting lower issuance volume would not necessarily deter CMBS investors.

And, while CMBS investors would likely demand more conservative leverage and higher spreads, a recession should not affect borrower creditworthiness, according to Ronen.

You must be logged in to post a comment.