Realty Income to Acquire $1.5B Convenience Store Portfolio

The REIT is buying more than 400 single-tenant assets from EG Group under a sale-leaseback deal.

Realty Income Corp. has agreed to acquire a portfolio of as many as 415 single-tenant convenience store properties in the U.S. under a sale-leaseback with EG Group, an independent convenience retailer based in the U.K. The deal is valued at approximately $1.5 billion and is expected to close in the second quarter, subject to customary closing conditions. The estimated cap rate is approximately 6.9 percent, with the portfolio having a 20-year weighted average initial lease term.

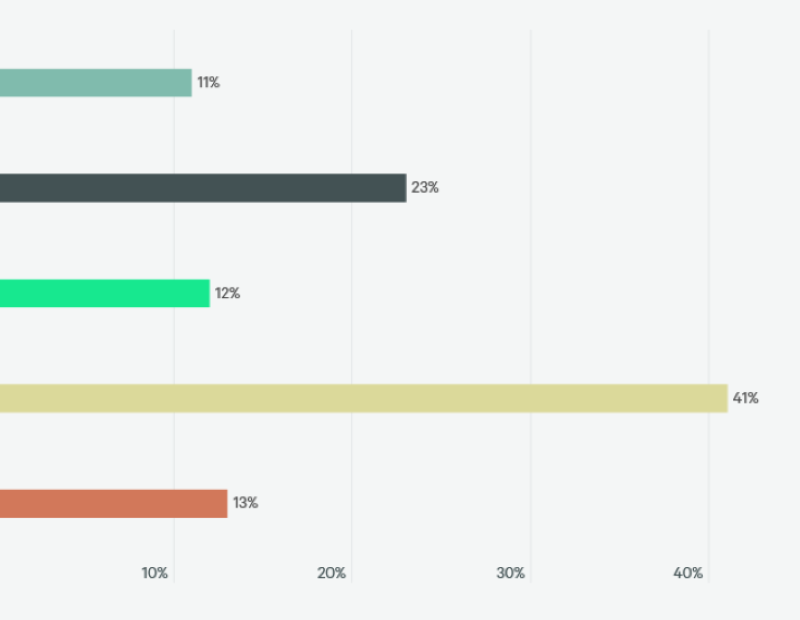

About 80 percent of the portfolio’s annualized contractual rent is expected to be generated from properties in the Northeast, including some 116 properties in Massachusetts, 87 in New York and 74 in Florida, the three most-represented states in the portfolio.

More than 80 percent of the portfolio’s annualized contractual rent is anticipated to be generated by properties operated under the Cumberland Farms brand, but Tom Thumb, Fastrac and Sprint locations are also included in the portfolio. The average property size is 3,700 square feet.

READ ALSO: What Will Retail Look Like in 2023?

The assets included in the deal represent approximately 15 percent of EC Group’s total freehold property in 10 markets. Eastdil Secured, Barclays, Latham & Watkins, Skadden, Arps, Slate and Meagher & Flom, Rothschild & Co., and EY advised EC in this transaction. The retailer intends to use net proceeds resulting from the deal to repay debt, which is in line with the management’s commitment to reduce total net leverage through debt reduction and free cash flow generation, as announced by the group late last year.

Upon the deal’s completion, the convenience store sector and the EG Group are expected to represent roughly 11.3 percent and 2.9 percent, respectively, of Realty Income’s total portfolio annualized contractual rent.

Two hefty companies

In a prepared statement, Sumit Roy, Realty Income’s president & CEO, noted that the convenience store industry has long been a well-performing staple in the REIT’s real estate portfolio. Realty Income has more than 12,200 real estate properties, primarily owned under long-term net-lease agreements. Most recently, Realty Income purchased 185 retail and industrial non-core, net lease properties from CIM Real Estate Finance Trust Inc. for $894 million.

Though headquartered in Blackburn, U.K., EG Group reportedly is one of the largest operators of convenience stores in the U.S. Since its founding in 2001, the company has acquired c-stores from Kroger and TravelCenters of America (MinitMart), among others.

You must be logged in to post a comment.