Boston Office Asset Sells for $450M

Tishman Speyer's property in the Seaport District changed hands for more than $1,200 per square foot, a record-breaking price for the metro.

By Scott Baltic

Tishman Speyer has sold the Pier 4 trophy office building in Boston’s Seaport District to CommonWealth Partners for $450 million. The pricing of $1,208 per square foot for the 372,372-square-foot property reportedly is the highest-ever achieved for a Boston office asset.

The 13-story Pier 4 building located at 200 Pier 4 Blvd. came online in May. Designed by Elkus Manfredi Architects of Boston, it has earned LEED Gold certification. The anchor tenant is Boston Consulting Group, which has its global headquarters there. The building is also the global headquarters of Cengage Learning and Man Numeric.

In addition to ground-floor retail, the building features a roof terrace with living walls, a fitness center, bicycle storage and three levels of parking.

Tishman Speyer is currently also developing the rest of the Pier 4 mixed-use project: a nine-story, 106-unit residential condominium project; a one-acre public park; and new section of the Harbor Walk and sea steps, all next to the Institute of Contemporary Art.

In a prepared statement, Tishman Speyer Managing Director Jessica Hughes, who heads the firm’s Boston regional office, noted that once the Pier 4 Residences and park are completed next year, public access to the waterfront at Pier 4 will be restored.

CommonWealth Partners did not reply to Commercial Property Executive’s request for additional information.

Though Tishman Speyer owns other properties in Boston, the Pier 4 project was its first development there. The property was also a first for two Chinese insurance companies. China Life Insurance Group Co. and Ping An Insurance Co., in their first equity investment in the U.S. commercial real estate market, funded the majority of the project, or an estimated $167 million each of the approximately $500 million total.

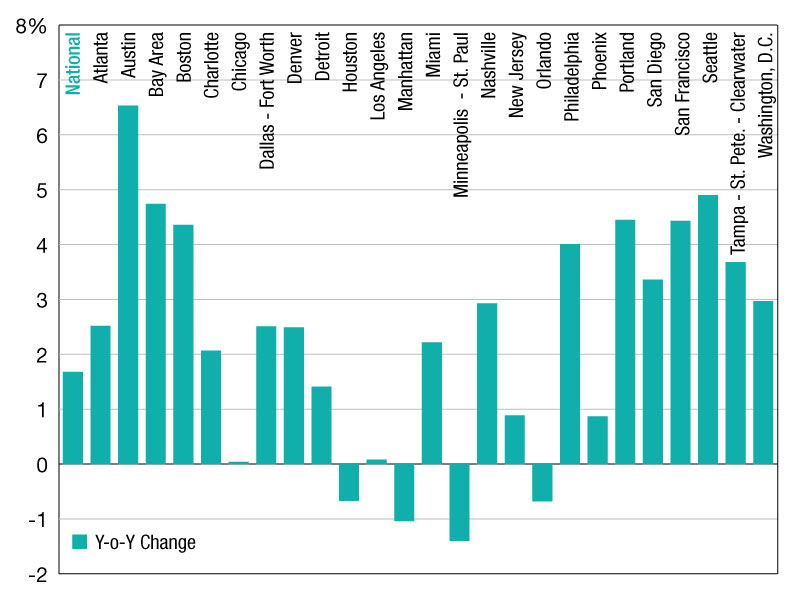

A tight market gets tighter

The metro Boston office market continues to tighten, especially in core areas, according to a second-quarter report from Marcus & Millichap. Amazon, MassMutual and other companies have announced expansions that will create thousands of new office-using jobs in the Seaport District.

The majority of the metro’s office space underway is in the CBD and the Cambridge area. Though deliveries continue to rise, most of the completions are preleased, minimizing the effect on vacancy.

According to Marcus & Millichap, the average office vacancy will reach its lowest level in at least 12 years. The downtown and Cambridge areas boast the lowest vacancy rates metro-wide.

“Robust office-using hiring, low vacancy and above-average rent growth keep investors interested in Boston’s office market,” according to the report. Most institutional buyer focus is on assets in the Financial District and Seaport, where first-year returns are in the low- to mid-4 percent band.

Image courtesy of Tishman Speyer

You must be logged in to post a comment.