2022 Special Servicing Rates

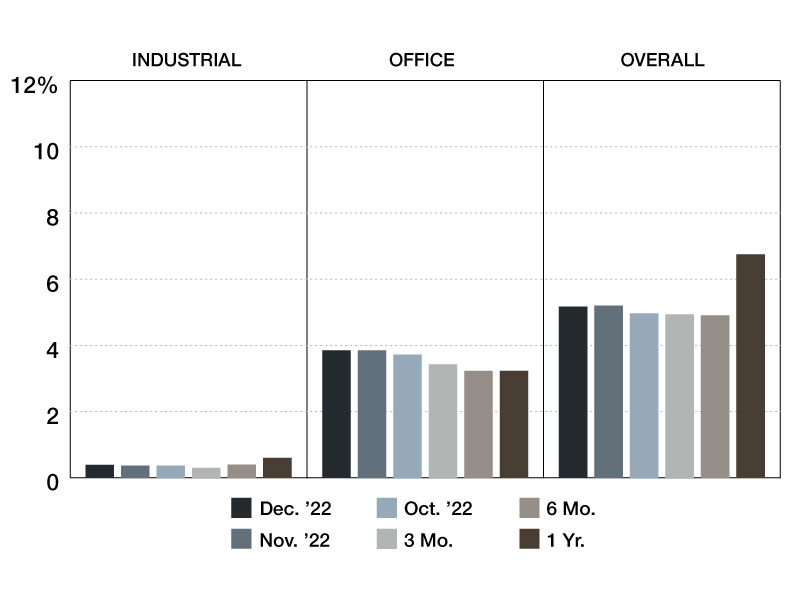

The Trepp CMBS Special Servicing Rate dropped three basis points in December to 5.17 percent.

The Trepp CMBS Special Servicing Rate dropped three basis points in December to 5.17 percent – representing the first decline in the past five months. Six months ago, the rate was 4.91 percent, and 12 months ago, the rate was 6.75 percent.

The December rate declined after four consecutive increases from August to November. In December, three of the five major CRE property types declined, the office sector special servicing rate was

unchanged, and the industrial sector special servicing rate rose by two basis points.

The percentage of loans on the servicer watchlist fell 48 basis points to 19.64 percent.

The largest basis point decline occurred in the lodging sector, down 32 basis points from the month prior. New special servicing transfers were dominated by office loans, although it appears that the new list of transfers have been offset by a host of office loans coming out of special servicing. In total, approximately 14 office loans (split across 19 loan pieces) were transferred, with a combined outstanding loan balance of $939 million. January’s special servicer data will indicate if this month’s special servicing rate drop was a momentary reprieve or the start of another sustained decline.

—Posted on Jan. 30, 2023

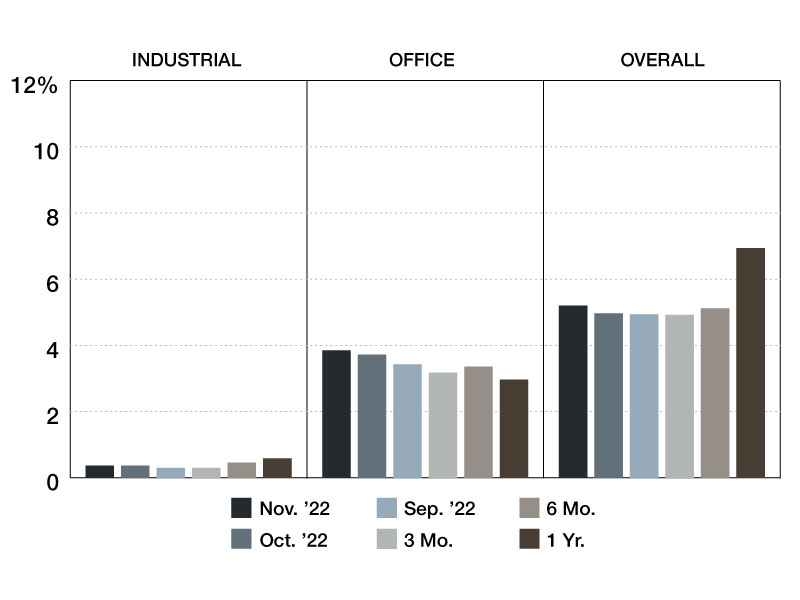

The Trepp CMBS Special Servicing Rate rose 23 basis points in November to 5.20 percent – a stark jump from the incremental increases of the months prior. Six months ago, the rate was 5.12 percent, and 12 months ago, the rate was 6.95 percent.

The November rate represents the largest month-to-month increase since September 2020. In November, three of the five major CRE property types experienced a rise in their respective special servicing rates, while the retail sector special servicing rate inched down, and the industrial special servicing rate remained unchanged.

The percentage of loans on the servicer watchlist fell 32 basis points to 20.12 percent.

November’s 23 basis point increase was largely due to a host of lodging, multifamily, and office transfers. In a month where the multifamily delinquency rate rose nearly 100 basis points, the multifamily special servicing rate also rose by 69 basis points, more than any other major CRE property type. Imminent maturity defaults are also proving to be a prime reason for special servicing transfers of late. Three of the five Iargest special servicing transfers in November were due to imminent maturity default, as the current interest rate environment continues to make refinancing difficult.

—Posted on Dec. 30, 2022

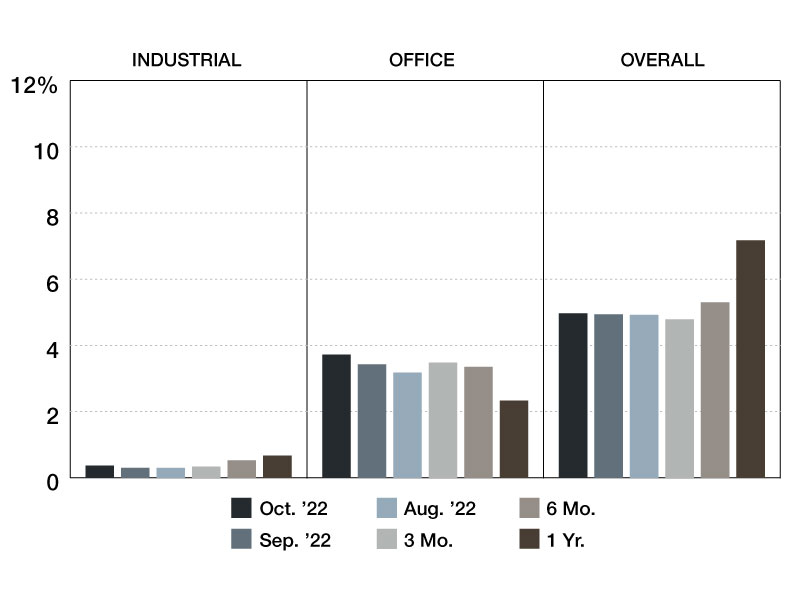

The Trepp CMBS Special Servicing Rate rose three basis points in October to 4.97 percent – slightly above the September print. Six months ago, the rate was 5.30 percent, and 12 months ago, the rate was 7.17 percent.

This is the first time since June of 2020 that the CMBS Delinquency and Special Servicing Rates rose in tandem. In October, three of the five major CRE property types experienced a rise in their respective special servicing rates, most notably the office and retail sectors, which saw a rise of 28 and 25 basis points.

The percentage of loans on the servicer watchlist fell 73 basis points to 20.44 percent.

As mentioned in last month’s report, the office sector has a large concentration of loans with near-term maturities and tenants with expiring leases, which is adding a heightened amount of distress to the office loan market. However, the retail sector also faces its own set of challenges. Some companies are opting to forgo traditional brick-and-mortar space and increase their online presence, warehouses, and distribution capabilities, while others have experienced subdued quarterly earnings and are shedding space to cut costs. For these reasons, Trepp is keeping a close eye on retail and office.

—Posted on Nov. 30, 2022

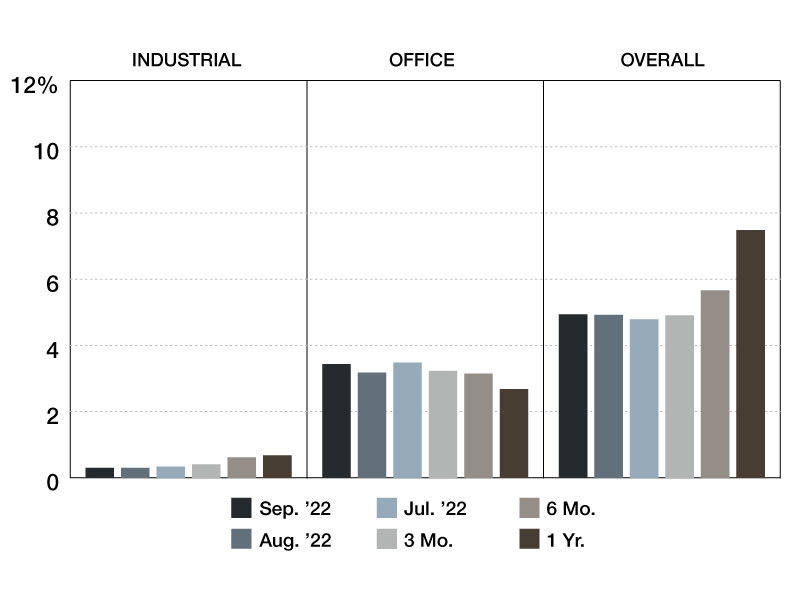

The Trepp CMBS Special Servicing Rate rose two basis points in September to 4.94 percent – slightly above the August print. Six months ago, the rate was 5.66 percent, and 12 months ago, the rate was 7.48 percent.

This is the first time the rate has increased in consecutive months since August and September of 2020. September data revealed declines in the rate for four of the five major commercial real estate (CRE) property types. However, it was the office sector that saw a 26-basis point increase, and the volume of retail loans in special servicing remained high.

The special servicing rate for loans categorized as ‘Other’ (not one of the five major property types) rose by four basis points from the August print.

September CMBS data reflects market suspicions that August 2022 was an inflection point, at least as it pertains to specially serviced loans. The office sector has a large concentration of loans with near-term maturities and tenants with expiring leases. Lockdown periods during the pandemic displayed the ease at which companies can implement a work-from-home (WFH) policy, and if many of the major tenants in the office sector shed their leases and opt to implement a full or hybrid WFH model, this could have a major impact on the CRE market. Now, the looming maturities and lease terminations are starting to be reflected in the special servicing numbers.

—Posted on Oct. 24, 2022

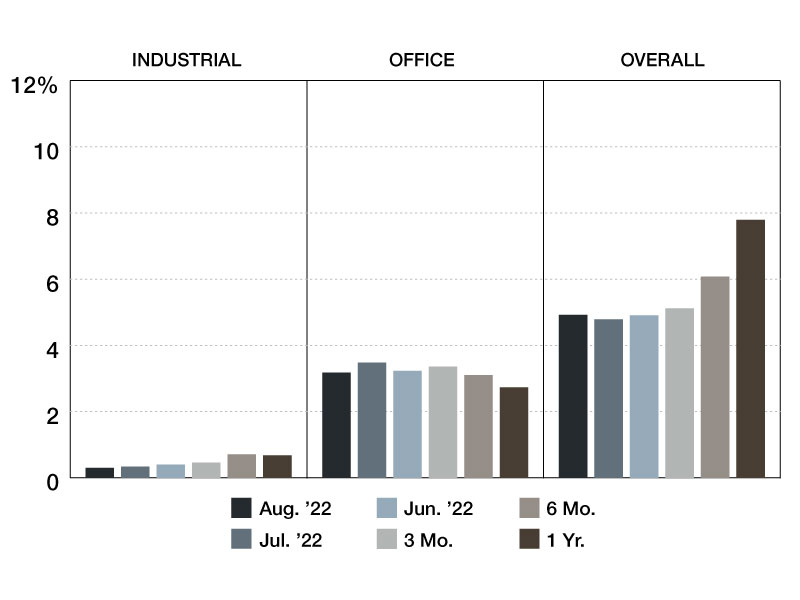

The Trepp CMBS Special Servicing Rate rose 13 basis points in August to 4.92 percent—slightly above the July print. Six months ago, the rate was 6.08 percent, and 12 months ago, the rate was 7.79 percent.

This is the first time the rate has increased since 03’2020. In August 2022, the distress was concentrated in the retail and multifamily sectors, which saw 117 and 67 basis point jumps, to 11.03 percent and 1.90 percent, respectively.

The percentage of loans on the servicer watchlist rose 26 basis points to 21.34 percent.

August CMBS data has the makings of an inflection point. After struggling during COVID, the current economic environment may have hampered what retail borrowers hoped would be a full recovery. Companies like Bed Bath & Beyond and Cinemark have announced store closings and Chapter 11 filings which may indicate a I larger trend in the CRE market. This month’s large retail transfers were heavily tied to regional and superregional malls that were transferred due to imminent monetary default. This may indicate the lack of belief that the market has in some of the non-A Class malls and the retail sector as a whole going forward.

—Posted on Sep. 28, 2022

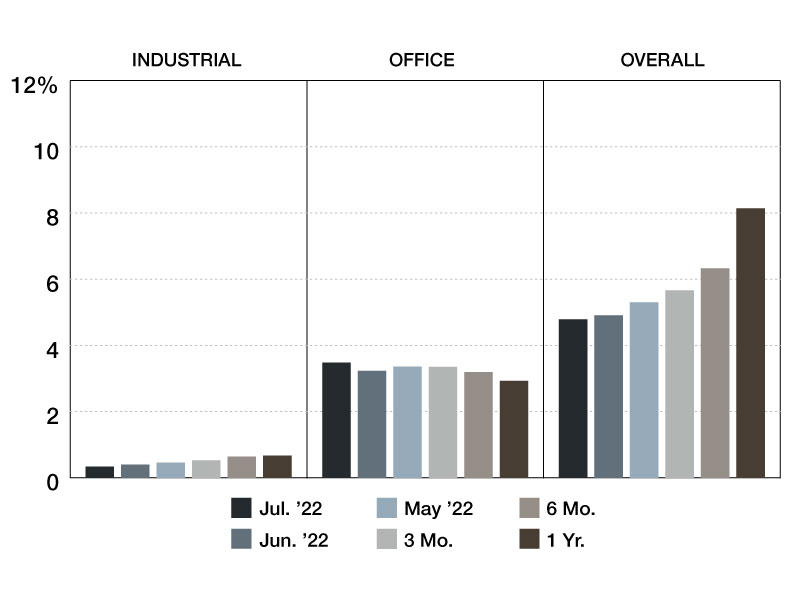

The Trepp CMBS Special Servicing Rate fell 12 basis points in July to 4.8 percent. Six months ago, the rate was 6.3 percent and 12 months ago, the rate was 8.1 percent. A property type that saw the largest improvement in July was the retail sector, which reported special servicing rates of 9.9 percent (60-basis point drop).

The percentage of loans on the servicer watchlist fell 128 basis points to 21.1 percent, its lowest reported rate in 2022. July CMBS data continued to promote the narrative that despite turmoil in the wider economic sectors, the commercial real estate market is isolated. Issuance has fallen off, specifically in what was a thriving CRE CLO market, but distress has continued to recede despite mounting economic concerns. When the pandemic first happened, it was easy to explain the low distress as a by-product of COVID loan extensions and forbearance, but the markets continued ability to weather distress speaks to the safety of the market post Great Financial Crisis regulations and changes to deal structures.

However, market participants are still cautious as there is ample room for refinance risk, and the future of the office market continues to loom somewhere in the distant background. New Transfers Approximately $372.8 million in CMBS debt was transferred to a special servicer in July. New retail transfers made up 40 percent of the newly transferred and was followed closely by mixed-use transfers which made up 23.7 percent. The largest loans to transfer this month were the $66.63 Arbor Walk and Palms Crossing and the $65.08 Southland Center Mall.

The Arbor Walk and Palms Crossing is made up of two power centers totaling 792,000 square feet in Texas. The Shops at Arbor is 464,700 square feet and located in Austin. Roughly 178,000 square feet of space is leased to a Home Depot and four out-parcels who own their own stores but are subject to ground leases with the borrower. Palms Crossing is a power/lifestyle center consisting of seven anchor buildings and four inline buildings with tenant spaces ranging from 1,036 square feet to 10,500 square feet. The loan was transferred due to imminent default related to the loan’s upcoming maturity. The Southland Center Mall is a 905,000-square-foot mall in Taylor, Mich. Its currently largest anchor tenant is JCPenney and first quarter of 2022 occupancy was reported as 91 percent. The loan was also transferred for imminent monetary default at the borrower’s request after they indicated to the master servicer, they may be unable to payoff prior to maturity. It was set to mature on Aug. 10.

For overall property types CMBS 1.0 and 2.0+, the industrial rate went down six basis points to 0.3 percent, office went up 24 basis points to 3.5 percent and retail went down 60 basis points to 9.9 percent. For CMBS 2.0+, industrial went down six basis points to 0.1 percent, office up 31 basis points to 3.1 percent and retail down 50 basis points to 9.0 percent. For CMBS 1.0, industrial went up 35 basis points to 77.6 percent, office down 325 basis points to 38.9 percent and retail down 75 basis points to 70.7 percent.

—Posted on Aug. 25, 2022

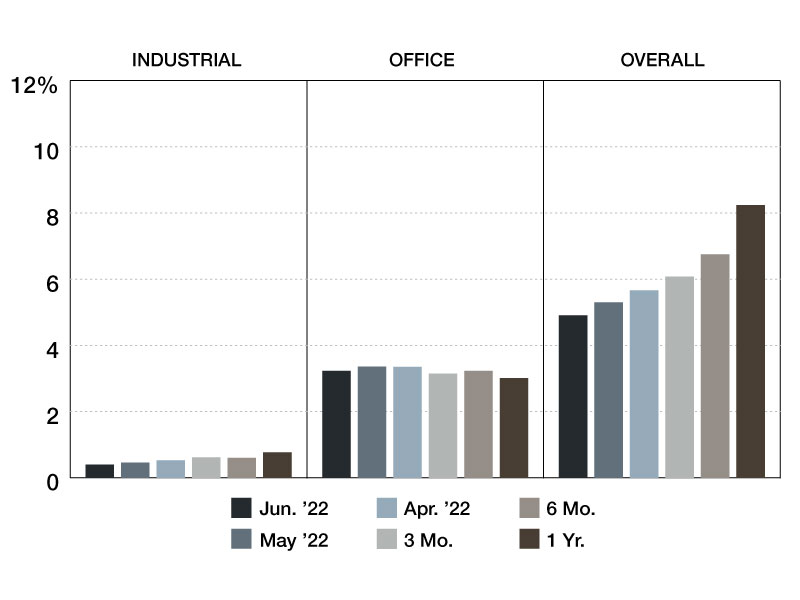

The Trepp CMBS Special Servicing rate fell 21 basis points in June to 4.9 percent. Six months ago, the rate was 6.8 percent and 12 months ago, the rate was 8.2 percent.

The percentage of loans on the servicer watchlist inched up one basis point to 22.4 percent, breaking what had been a streat of eight consecutive months of declines.

Despite the loan cures representing a positive sign for CMBS and the greater commercial real estate market, elsewhere the Trepp CMBS delinquency rate rose six basis points. It is too early to tell whether a new trend is emerging, but special servicing rate increases in the coming months would not be surprising considering the current interest rate and economic environment.

Approximately $341.1 million in CMBS debt was transferred to a special servicer in June. Two thirds of the newly transferred balance was made up of retail and office loans. A noteworth transfer included the $60.4 million Trenton Office Portfolio.

The overall US CMBS 2.0+ special servicing rate is 4.5 percent. One year ago that was 8.0 percent and six months ago it was 6.3 percent. For property types, the industrial rate for CMBS 1.0 and 2.0+ went down six basis points to 0.40 percent, while office went down 13 basis points to 3.2 percent.

—Posted on Jul. 27, 2022

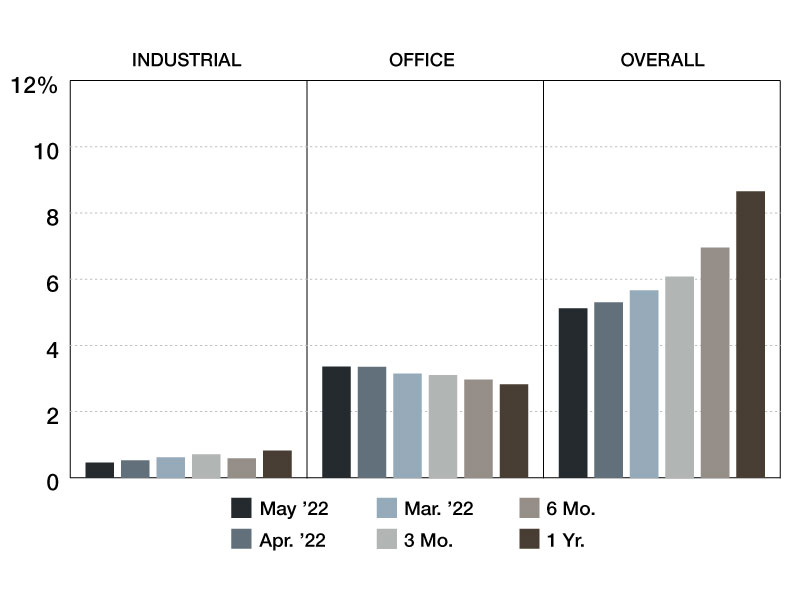

The Trepp CMBS Special Servicing Rate fell 18 basis points in May 2022 to 5.1 percent. Six months ago, the rate was 7.0 percent and 12 months ago, the rate was 8.7 percent.

The percentage of loans on the servicer watchlist fell to 22.4 percent. This is the eighth consecutive month of declines in the rate.

Distress rates continue to decline despite the recent volatility in the stock market, painting the picture of a CMBS market that has yet to take any collateral damage. Loans continue to cure, and the market is showing a sign of resiliency–cementing itself as as different financial environment than the one we saw during the Great Financial Crisis. Additionally, spreads have widened but issuers move ahead with quoting loans and deals continue to come to market.

Approximately $772.5 million in CMBS debt was transferred to a special servicer in May. The overall US CMBS 2.0+ special servicing rate is 4.8 percent. One year ago that was 7.9 percent and six months ago it was 6.8 percent. The overall CMBS 1.0 special servicing rate is 40.4 percent. One year ago that was 47.2 percent and six months ago it was 41.2 percent.

For overall property type analysis CMBS 1.0 and 2.0+, industrial went down seven basis points to 0.5 percent, while office went up one basis point to 3.4 percent. For 2.0+, industrial went down one basis point to 0.2 percent and office went up eight basis points to 2.9 percent. For 1.0, industrial went down 225 basis points to 76.0 percent, while office went down 280 basis points to 44.3 percent.

—Posted on Jun. 22, 2022

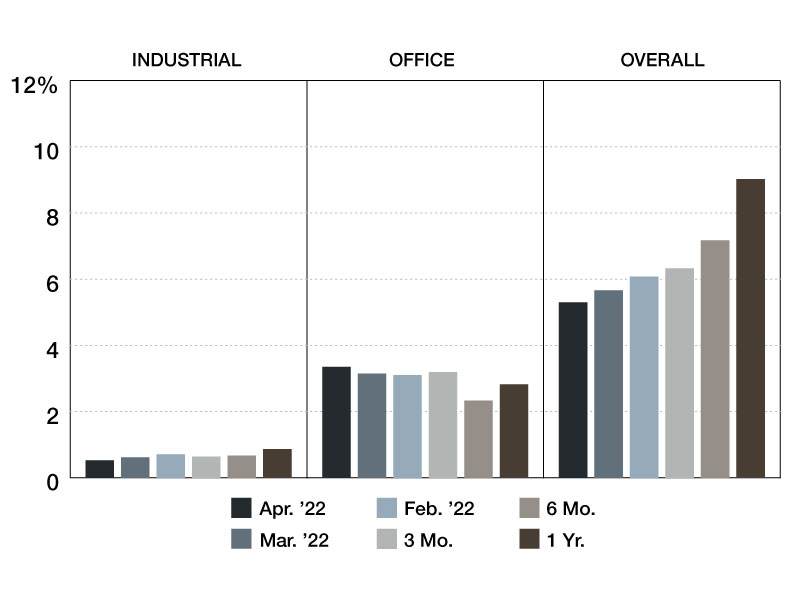

The Trepp CMBS special servicing rate fell 36 basis points in April to 5.3 percent. Six months ago, the rate was 7.2 percent, and 12-months ago the rate was 9.0 percent.

The office sector, specifically, is worth keeping an eye on. The office special servicing rate has increased 25 basis points since February 2022. Looking even further back, the office special servicing rate fell as low as 2.3 percent in October 2021, but despite the beginnings of flexible returns to the office, the rate has been above 3.0 percent since December 2021, and at 3.4 percent is posting its highest rate of the past two years.

The percentage of loans on the servicer watchlist fell 37 basis points to 23.5 percent. This is the seventh consecutive month of declines in the rate. Approximately $1.09 billion in CMBS debt was transferred to a special servicer.

The overall CMBS 2.0+ rate is 4.9 percent, where one year ago it was 8.3 percent and six months ago it was 6.7 percent. The overall CMBS 1.0 rate is 32.3 percent. One year ago that was 47.3 percent and six months ago it was 41.9 percent.

The industrial special servicing rate went down nine basis points to 0.5 percent for CMBS 1.0 and 2.0+, while office went up 20 basis points to 3.4 percent. For CMBS 2.0+, industrial went down five basis points to 0.2 percent and office increased 23 basis points to 2.8 percent. For CMBS 1.0, industrial went down 3,565 basis points to 21.1 percent and office went up 544 basis points to 51.9 percent.

—Posted on May 23, 2022

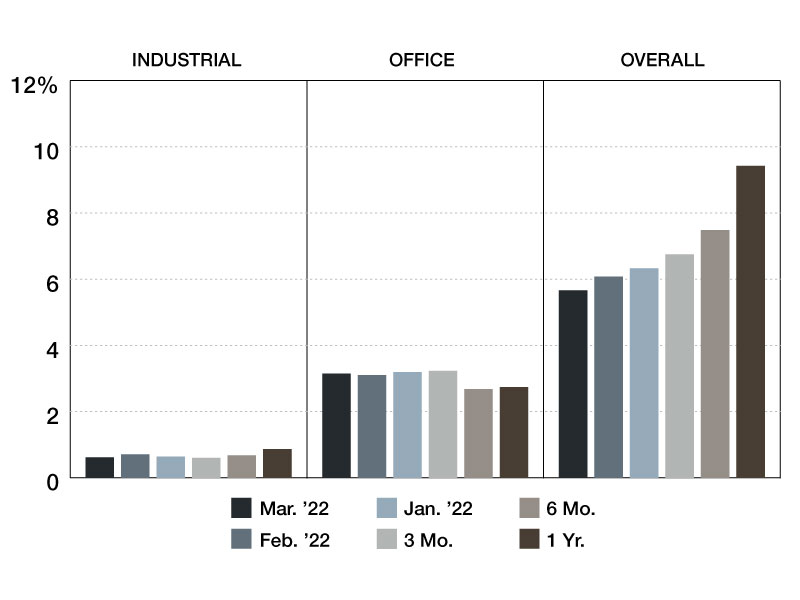

The Trepp CMBS Special Servicing Rate fell 42 basis points in March to 5.7 percent. Six months ago, the Trepp special servicing rate was 7.5 percent, and 12-months ago the rate was 9.4 percent. The percentage of the loans on the servicer watchlist fell 37 basis points to 25.5 percent. This is the sixth consecutive month of declines in the rate.

Approximately $668.3 million in CMBS debt was transferred to a special servicer in March. The overall US CMBS 2.0+ special servicing rate is 5.4 percent. One year ago, the US CMBS 2.0+ special servicing rate was 8.7 percent, while six months ago, the US CMBS 2.0+ special servicing rate was 7.0 percent. The overall US CMBS 1.0 special servicing rate is 41.5 percent. One year ago, the US CMBS 1.0 special servicing rate was 47.4 percent, while six months ago the rate was 41.7 percent.

For overall property types CMBS 1.0 and 2.0+, the industrial rate went down 9 basis points to 0.62 percent, while office went up 5 basis points to 3.2 percent. For CMBS 2.0+, industrial went down 4 basis points to 0.3 percent, while office increased 5 basis points to 2.6 percent. For CMBS 1.0, industrial webt up 28 basis points to 56.7 percent, while office was up 11 basis points to 46.4 percent.

—Posted on Apr. 27, 2022

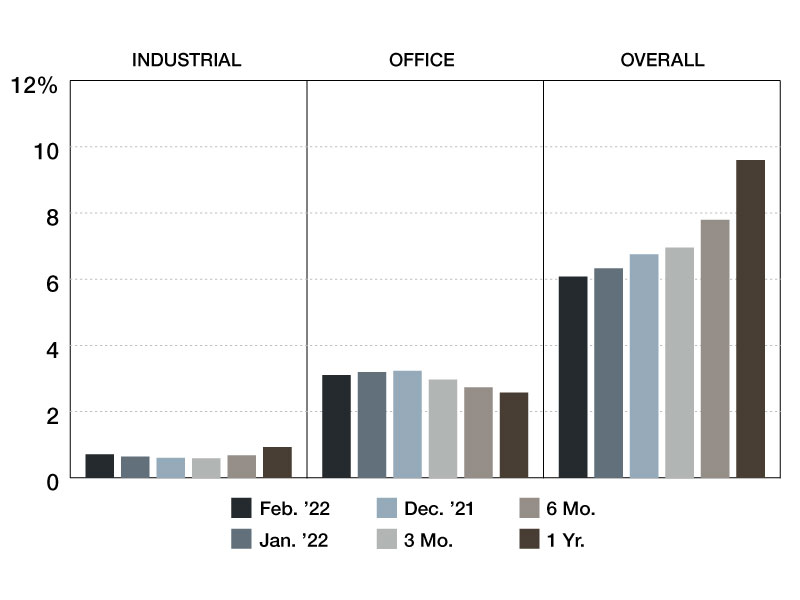

The Trepp CMBS Special Servicing Rate fell 25 basis points in February to 6.1 percent. Six months ago, the Special Servicing rate was 7.8 percent, and 12 months ago the rate was 9.6 percent. The percentage of loans on the servicer watchlist fell 21 basis points to 25.9 percent. This is the fifth consecutive month of declines. Approximately $270.5 million in CMBS debt was transferred to a special servicer in February. The new transfers were heavily made up of loans backed by office properties, which equated to $175.9 million of the newly transferred balance.

In a 2019 edition of TreppWire we noted that namesake tenant Wells Fargo was planning to relinquish 100,000 square feet at the Wells Fargo property in the portfolio. A new anchor tenant was announced, and another tenant renewed, but servicer commentary for this month notes that the loan was transferred due to imminent monetary default as a result of the COVID-19 pandemic. Other noteworthy transfers include the $46.7 million Princeton South Corporate Center office loan and the $36.6 million 55 Green St. office loan.

The overall US CMBS special servicing rate is 6.1 percent in February. One year ago, the US CMBS special servicing rate was 9.6 percent. Six months ago, the US CMBS special servicing rate was 7.8 percent. The overall US CMBS 2.0+ special servicing rate is 5.6 percent. One year ago, the US CMBS 2.0+ special servicing rate was 8.9 percent. Six months ago, the US CMBS 2.0+ special servicing rate was 7.3 percent. The overall US CMBS 1.0 special servicing rate is 43.4 percent. One year ago, the US CMBS 1.0 special servicing rate was 47.4 percent. Six months ago, the US CMBS 1.0 special servicing rate was 42.1 percent.

For CMBS 1.0 and 2.0+, the industrial special servicing rate went up 7 basis points to 0.7 percent, while office went down 10 basis points to 3.1 percent. For CMBS 2.0+, the industrial special servicing rate went up 3 basis points to 0.3 percent, while office went down 8 basis points to 2.6 percent. For CMBS 1.0, the industrial special servicing rate went up 390 basis points to 56.4 percent, while office went down 54 basis points to 46.3 percent.

—Posted on Mar. 25, 2022

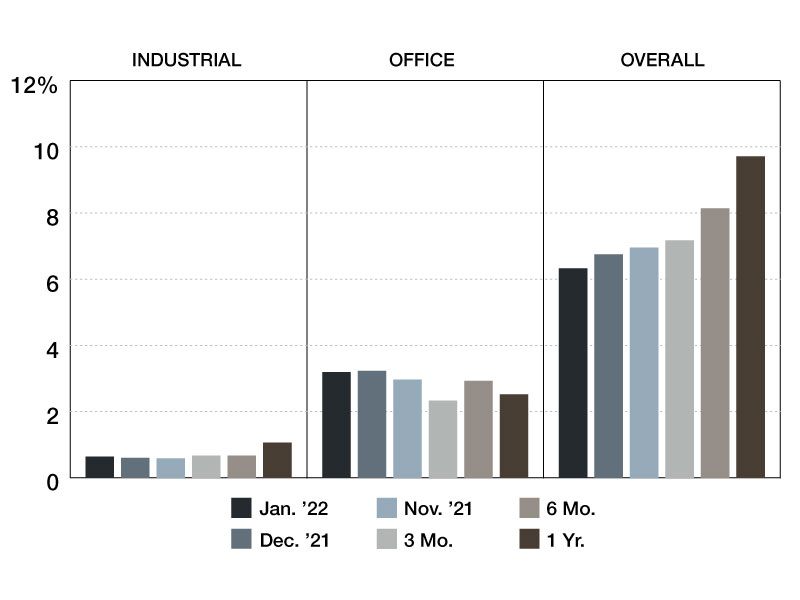

The Trepp CMBS Special Servicing Rate fell 42 basis points in January to 6.3 percent. One year ago, the US special servicing rate was 9.7 percent. The percentage of loans on the servicer watchlist fell for the fourth consecutive month with 26.1 percent of loans reported as on the servicer watchlist, a drop of 38 basis points from the December reading.

Approximately $289.9 million in CMBS debt was transferred to special servicing in January. The office, multifamily, and mixed-use sectors made up 85.4 percent of the of the month’s newly transferred balance. The largest of these transfers was the $59.6 million Writer Square mixed-use loan. The 186,200 square foot property was built in Denver in 1980 and renovated in 2016. The loan had been monitored since its DSCR dropped from 1.30x at year-end 2019 to 0.87x at year-end 2020, and then 0.72x per a June 2021 report. Servicer watchlist notes indicate that the property has been negatively impacted by the pandemic, leading to the lower reported DSCR and a slight dip in occupancy (reported as 76% in June 2021 in comparison to its normal range of ~ 85%). Another noteworthy transfer included the $59.3 million TEK Park (MSBAM 2016-C31) office loan.

Six months ago, the US CMBS special servicing rate was 8.1 percent. The overall US CMBS 2.0+ special servicing rate is 5.9 percent. One year ago, the US CMBS 2.0+ special servicing rate was 8.9 percent. • Six months ago, the US CMBS 2.0+ special servicing rate was 7.5 percent. The overall US CMBS 1.0 special servicing rate is 43.5 percent. One year ago, the US CMBS 1.0 special servicing rate was 49.9 percent. Six months ago, the US CMBS 1.0 special servicing rate was 45.9 percent. For CMBS 1.0 and 2.0+, the industrial rate went up 4 basis points to 0.6 percent, while office went down 4 basis points to 3.2 percent. For 2.0+, industrial went up 4 basis points to 0.3 percent, while went down 4 basis points to 2.6 percent. For 1.0, industrial went up 129 basis points to 52.5 percent and office went up 699 basis points to 46.8 percent.

—Posted on Feb. 28, 2022

You must be logged in to post a comment.