2021 Special Servicing Rate

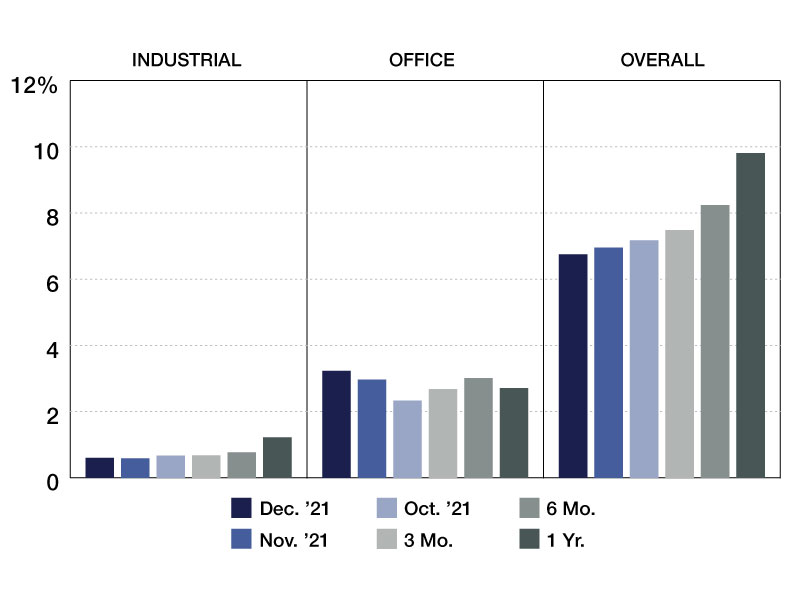

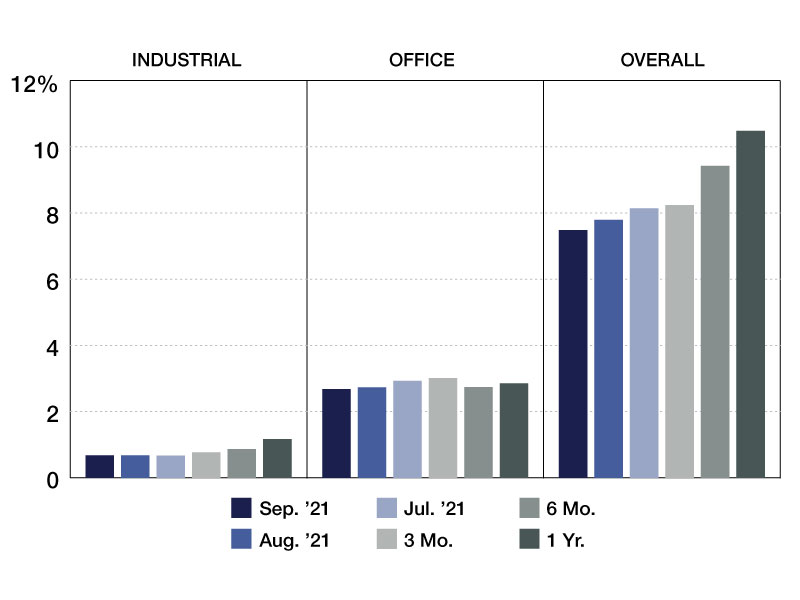

The Trepp CMBS Special Servicing Rate fell 20 basis points in December .

The Trepp CMBS Special Servicing Rate fell 20 basis points in December to 6.8 percent despite an uptick in the number of office loans sent to the special servicer. The office special servicing rate tipped upwards to 3.2 percent—a 26 basis point rise. Behind the notable transfers were the $133 million 181 W. Madison St. loan and the $100 million 135 S. LaSalle loan in Chicago. The percentage of loans on the servicer watchlist fell for the third consecutive month, 26.5 percent of which were reported as on the servicer watchlist, a drop of 103 basis points from the November reading.

Approximately $830 million in CMBS debt was transferred to special servicing in December. The transfers were heavily focused in the office and retail sectors, which made up 92 percent of the newly transferred balance. Part of the office transfer balance can be attributed to the updated reporting of 245 Park Ave., which Trepp anticipated and noted in our November special servicing report. New Chicago office transfers include the $133 million 181 W. Madison loan which makes up the SASB deal, JPMCC 2020-LOOP.

Servicer commentary notes that the 946,000 square-foot property was transferred to special servicing as the borrower filed for a petition of bankruptcy in the state of Delaware. The Northern Trust Company makes up 30.0 percent of the NRA. The office building is also securitized across three other deals, amounting to approximately $107 million more that currently have yet to be transferred. The second Chicago office transfer belonged to the $100 million 135 S. LaSalle loan, which makes up 15.1 percent of CGCMT 2015-GC31.The 1.3-million-square-foot property was initially placed on the watchlist due to Bank of America’s (62% of the GLA) confirmed lease expiration in July 2021. Once Bank of America’s rent was excluded, Cash Flow Adjustments resulted in a Q1 2020 stressed DSCR of 0.30x.

The industrial special servicing rate went up one basis point to 0.6 percent, while office increased 26 basis points to 3.2 percent.

—Posted on Jan. 26, 2022

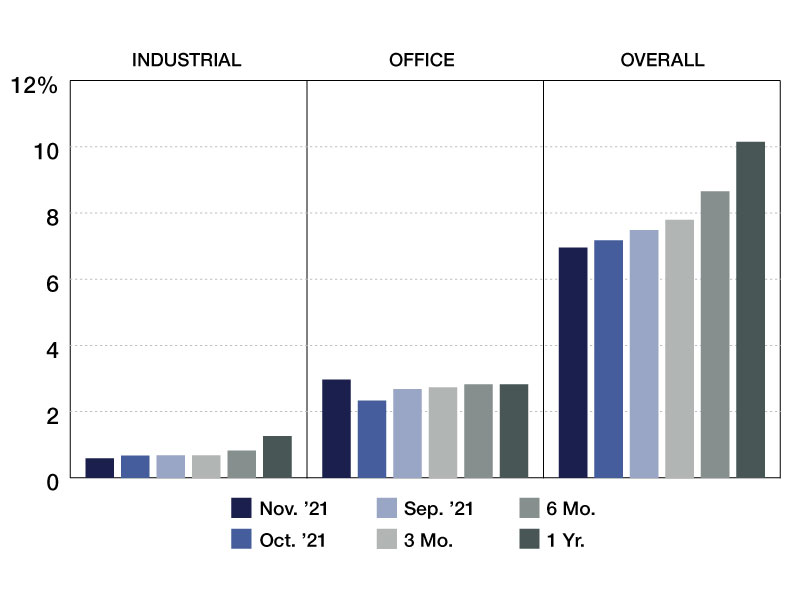

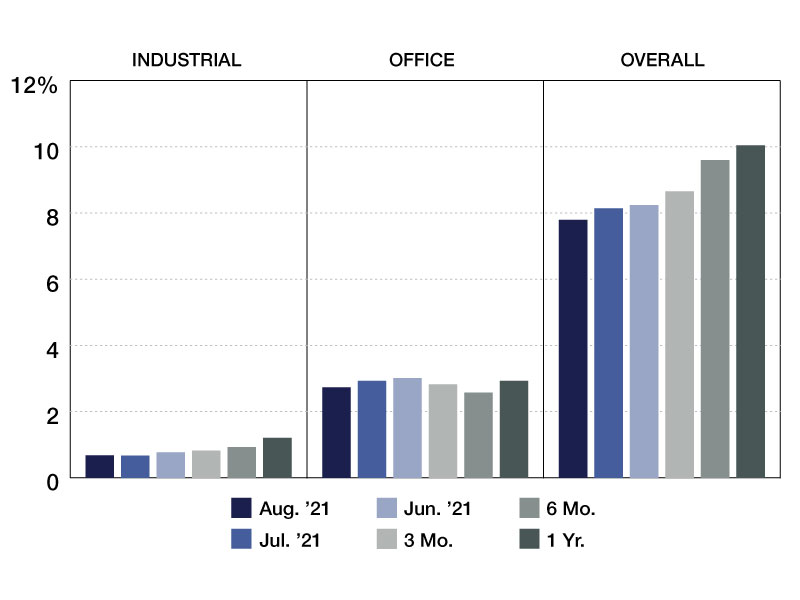

The Trepp CMBS Special Servicing Rate fell 22 basis points in November to 7.0 percent. In November 2020, the rate was as high as 10.2 percent, but the market has continued to adapt to a COVID-impacted economy. The office sector came in at 3.0 percent in November – 64 basis points higher than the month prior. The industrial sector dipped 7 basis points to 0.60 percent. The percentage of loans on the servicer watchlist fell for the second consecutive month. Roughly 27.5 percent of loans were reported to be on the servicer watchlist in November, down from 28.2 percent in October. The major property types all saw slight drops in their rate.

Approximately $1.9 billion in CMBS debt was transferred to special servicing in November. The transfers were largely made up of office and retail properties, and despite being overshadowed by the number of cures that took place in the market, this is the highest newly transferred balance in 2021. That number, however, is mostly inflated by the transfer of the 245 Park Ave. loan. The property at 245 Park Ave. is a 1.7-million-square-foot office building located near Grand Central Terminal in Manhattan.

In November, it was reported that the PWM Property Management arm of the HNA Group had filed for bankruptcy, creating uncertainty around its two CMBS assets, one of which is 245 Park Ave. November remittance determined that the loan “was in grace period” as well as sent to the special servicer. Other noteworthy transfers include the $258 million 175 W. Jackson office property.

—Posted on Dec. 21, 2021

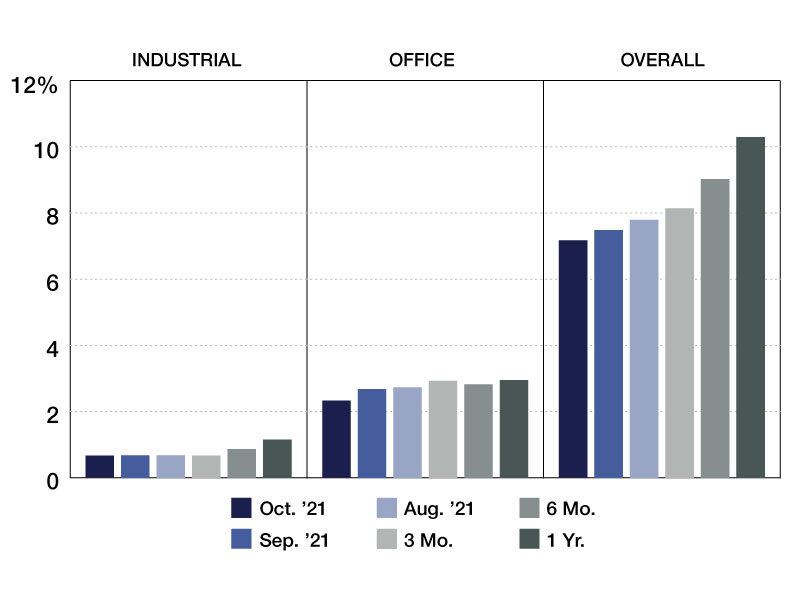

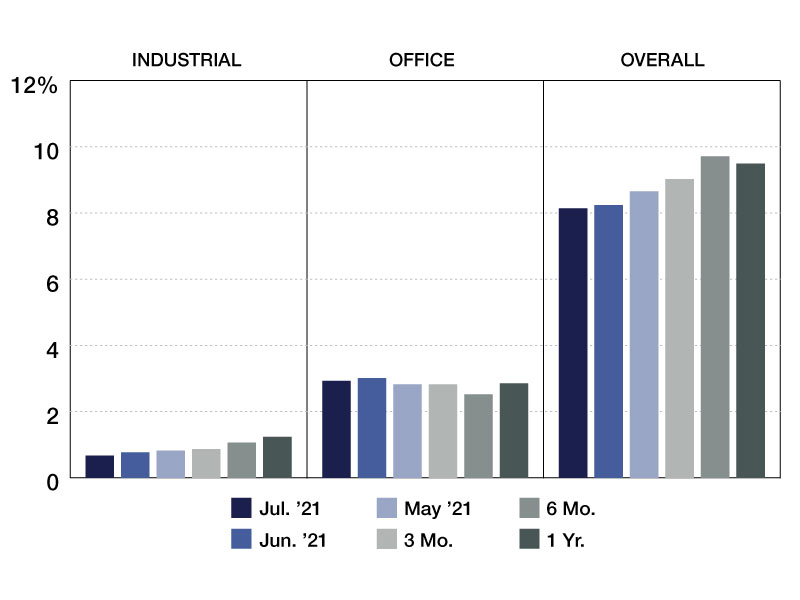

The Trepp CMBS Special Servicing Rate fell 31 basis points in October, coming in at 7.2 percent. This is the 13th consecutive month that the special servicing rate has declined.

The office sector dropped 35 basis points from 2.7 to 2.3 percent in October. The percentage of loans on the servicer watchlist fell for the first time in nine months. Roughly 28.2 percent of loans were reported to be on the servicer watchlist in October, down 109 basis points from its reading of 29.3 percent in September. Approximately $244.9 million in CMBS debt across 13 notes were transferred to special servicing in October. This is the lowest balance of newly transferred loans in 2021.

One year ago, the US CMBS special servicing rate was 10.3 percent, while six months ago it was 9.0 percent. For the CMBS 2.0+ numbers, the overall rate is 6.7 percent. One year ago it was 9.4 percent and six months ago it was 8.3 percent. For the CMBS 1.0 numbers, the overall rate was 41.9 percent. One year ago it was 51.4 percent, while six months ago was 47.3 percent.

For property types in CMBS 1.0 and 2.0+, the industrial rate was at 0.7 percent down 1 basis point, while office went down 34 basis points to 2.3 percent. The CMBS 2.0+ rate for industrial didn’t change and office decreased by 33 basis points to 1.7 percent. For CMBS 1.0, industrial jumped 280 basis points to 50.7 percent, while office increased 131 basis points to 41.4 percent.

—Posted on Nov. 19, 2021

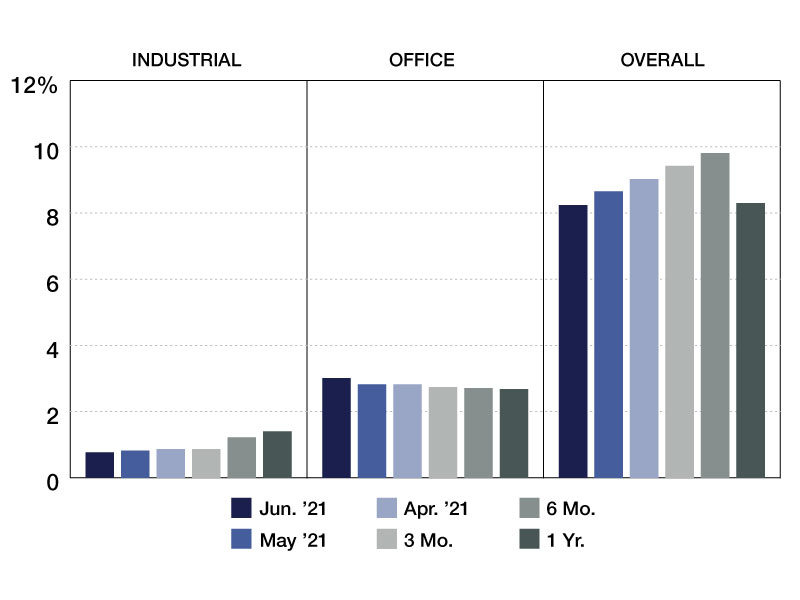

The Trepp CMBS Special Servicing Rate fell 30 basis points in September, coming in at 7.5 percent. This month’s drop marks one year of consistent declines in the special servicing rate, following the initial rise due to the economic impact of COVID-19. In the past 12 months, the special servicing rate has fallen 300 basis points, from 10.5 percent in September 2020.

The office sector dropped five basis points to 2.7 percent in September. The percentage of loans on the servicer watchlist rose for the ninth consecutive month–increasing 32 basis points to 29.3 percent. Approximately $355.6 million in CMBS debt across 15 notes were transferred to special servicing. This month, office properties backed by CMBS made up 58.7 percent of the newly transferred balance.

One year ago, the US CMBS special servicing rate was 10.5 percent, while six months ago it was 9.4 percent. For the CMBS 2.0+ numbers, the overall rate is 7.0 percent. One year ago it was 9.6 percent and six months ago it was 8.7 percent. For the CMBS 1.0 numbers, the overall rate was 41.7 percent. One year ago it was 48.1 percent, while six months ago was 47.4 percent.

For property types in CMBS 1.0 and 2.0+, the industrial rate was at 0.68 percent and did not change basis points, while office went down five basis points to 2.7 percent. The CMBS 2.0+ rate for industrial also didn’t change and office increased by five basis points to 2.0 percent. For CMBS 1.0, industrial jumped 43 basis points to 47.9 percent, while office dropped 132 basis points to 40.1 percent.

—Posted on Oct. 26, 2021

The Trepp CMBS Special Servicing Rate fell 35 basis points in August coming in at 7.8 percent. This is the 11th consecutive month the rate has declined. According to August remittance data, four of the five major property types saw decreases in their special servicing reading.

The percentage of loans on the servicer watchlist rose for the eighth consecutive month, rising 145 basis points to 29 percent in August.

One year ago, the US CMBS special servicing rate was 10 percent, while six months ago it was 9.6 percent. For the CMBS 2.0+ numbers, the overall rate is 7.3 percent. One year ago it was 9.1 percent and six months ago it was 8.9 percent. For the CMBS 1.0 numbers, the overall rate was 42.1 percent. One year ago it was 46.8 percent, while six months ago was 47.4 percent.

For property types in CMBS 1.0 and 2.0+, the industrial rate increased 1 basis point to 0.7 percent, while office went down 20 basis points to 2.7 percent. The CMBS 2.0+ rate for industrial went up 5 basis points to 0.3 percent and office decreased by 5 basis points to 2 percent. For CMBS 1.0, industrial jumped 35 basis points to 47.5 percent, while office dropped 463 basis points to 41.4 percent.

—Posted on Sep. 28, 2021

The Trepp CMBS Special Servicing Rate dropped for the 10th consecutive month in July, coming in at 8.1 percent–a 10 basis points decline from the month prior. While the drop indicates continued signs of recovery, this is the smallest drop since January when the rate fell nine basis points.

The percentage of loans on servicer watchlist rose for the seventh consecutive month–inching up eight basis points to 27.6 percent in July. The industrial watchlist rate fell 31 basis points to 10.9 percent.

One year ago, the U.S. CMBS special servicing rate was 9.5 percent, while six months ago it was 9.7 percent. For the CMBS 2.0+ numbers, the overall rate is 7.5 percent. One year ago it was 8.5 percent and six months ago it was 8.9 percent. For the CMBS 1.0 numbers, the overall rate was 45.9 percent. One year ago it was 46.8 percent, while six months ago was 49.9 percent.

For property types in CMBS 1.0 and 2.0+, the industrial rate went down 10 basis points to 0.7 percent, while office went down seven basis points to 2.9 percent. CMBS 2.0+ was down one basis point to 0.2 percent, while office was down six basis points to 2.0 percent. For CMBS 1.0, industrial went down 43 basis points to 47.2 percent, while office was up 27 basis points to 46.1 percent.

—Posted on Aug. 27, 2021

The Trepp CMBS Special Servicing Rate maintained its strong downward movement in June, helped by the US economy continuing to make progress towards a full reopening. The overall reading dropped by 41 basis points to 8.2 percent last month, making it the ninth consecutive monthly decrease.

With firms reevaluating their need for office space and finalizing plans to bring employees back to work, there appears to be a notable pickup in special servicing transfers for office and mixed-use loans, especially those in major gateway cities.

The percentage of loans on servicer watchlist climbed to 27.4 percent in June, a rise of 97 basis points from May’s tally. The watchlist rate has now increased for sixth consecutive months as loans removed from special servicing were later added to servicer watchlist for continued surveillance. Office (+1.8 percent to 16.7 percent) was among one of the property types that represented the largest monthly decline, while the industrial watchlist rate fell 3.2 percent to 11.2 percent.

Roughly $1.28 billion in CMBS debt across 36 notes were transferred to special servicing in June. CMBS loans backed by Manhattan office and mixed-use properties comprised nearly 50 percent of last month’s transfer balance.

The $220 million 850 Third Ave. loan (whole loan balance)–which is backed by a 600,000-square-foot office in the Midtown East part of NYC–was the largest loan sent to special servicing last month. The property backs the single-asset NCMS 2017-850T deal. The floating-rate loan is slated to mature next month but has embedded extension options that could push the maturity out to 2023. Year-end 2020 financials on the loan showed occupancy at 57 percent after top tenant Discovery Communications vacated the collateral after its lease expired in May 2020.

—Posted on Jul. 23, 2021

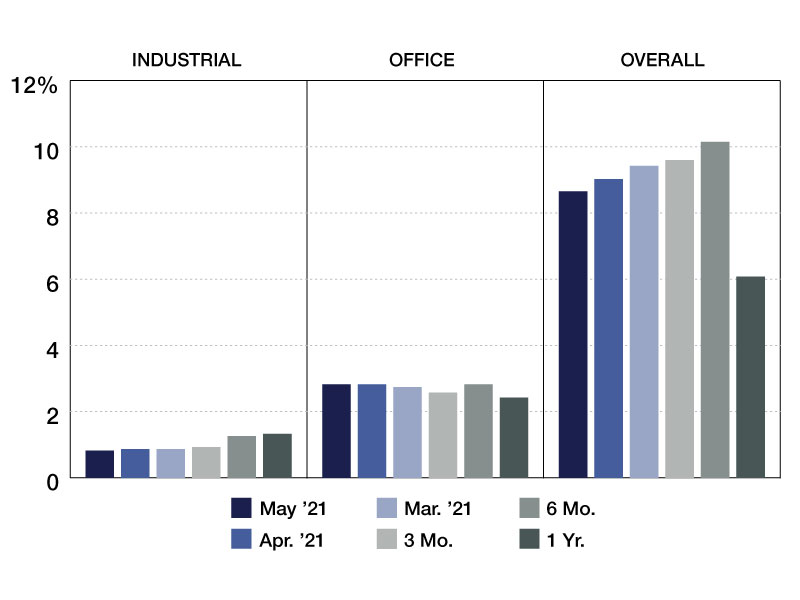

Helped by an improving economic outlook from easing lockdown restrictions across the U.S., the Trepp CMBS Special Servicing Rate continued to trend lower last month. The overall reading fell 38 basis points to 8.7 percent in May, making it the eighth consecutive decrease in the monthly percentage since September 2020.

The CMBS industry continues to make headway in its recovery from COVID-related distress that had impacted the commercial real estate markets last year, which has led to sizable declines in the special servicing rates for many segments. With the U.S. making progress towards “normalcy,” that should result in the continued improvement in the performance of CMBS loans.

By property type, industrial special servicing rates went down five basis points month-over-month to 0.8 percent, while office was unchanged at 2.8 percent.

The watchlist rate once again climbed in May, boosted in part by loans that were transferred out of special servicing and added to servicer watchlist for further surveillance. The percentage of loans on servicer watchlist rose for the fifth consecutive month to 25.6 percent, up 97 basis points from April. For example, industrial increased from 5.1 percent to 14.4 percent.

May remittance data indicates that about $1.1 billion in CMBS loans were removed from special servicing last month.

—Posted on Jun. 29, 2021

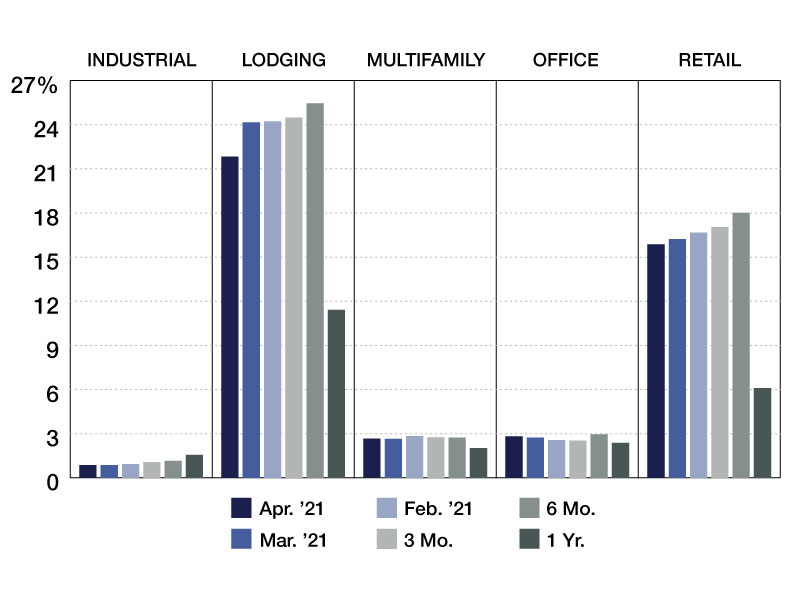

The Trepp CMBS Special Servicing Rate declined by 40 basis points in April–the largest improvement in the monthly reading during the coronavirus market crisis–to 9.0 percent. This is the seventh monthly decrease in that reading since September 2020, when the rate reached a post-GFC peak of 10.5 percent.

With federal plans underway to make vaccinations more widely available in the US and states taking steps to ease lockdown restrictions even further, loan “cures” and special servicing removals should continue at a measurable pace in the coming months.

By property type, the percentage of loans with the special servicer was relatively unchanged month over month except for that of lodging and retail, which registered a 233 and 37 basis point reduction in April. Roughly 21.8 percent of lodging loans and 15.9 percent of retail loans were reported to be in special servicing last month.

—Posted on May 25, 2021

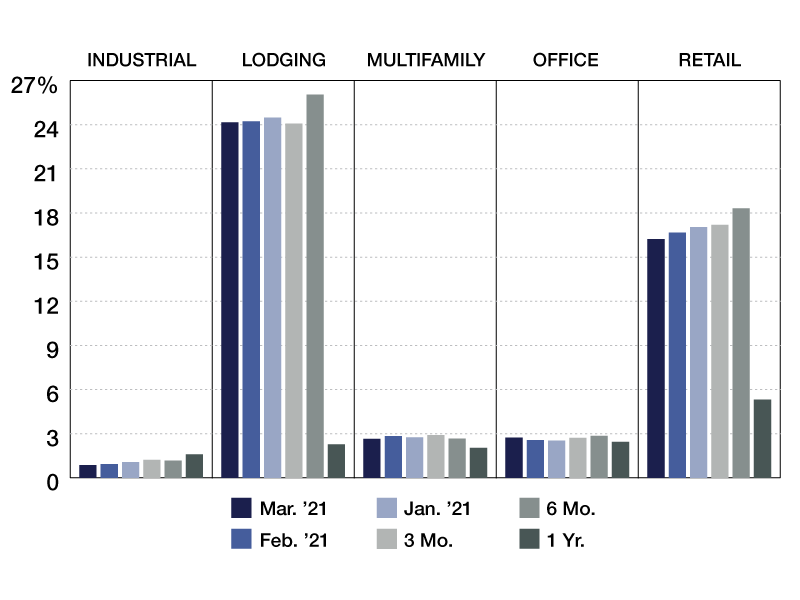

The Trepp CMBS Special Servicing Rate fell by 18 basis points month over month to 9.4 percent in March, making it the sixth consecutive decline in the reading since September. As the balance of loans exiting special servicing has exceeded the volume of new loans being transferred in, this has led to the consistent downward trend in overall rates.

The percentage of loans in special servicing moved modestly lower across all property type categories last month. The exception was office, which climbed 17 basis points, due to the transfer of the $300 million loan behind One California Plaza, a 1-million-square-foot office complex in downtown Los Angeles. Retail posted the largest improvement in the monthly reading (-0.4 percent), thanks in part to a $635.7 million reduction in the retail special servicing balance in March compared to February.

Overall, 35 CMBS notes totaling $1.13 billion were newly sent to the special servicer in March, down from $1.19 billion across 51 notes in February. Lodging and retail represented 35 percent and 34 percent of the special servicing transfer balance, respectively. Office accounted for another 26 percent. The $135 million loan backed by the Aruba Marriott Resort in Palm Beach, Fla.; the $127.9 million loan behind Deerbrook Mall in Humble, Texas; and the $111.1 million loan backed by 600 Broadway in Manhattan were among the largest loans that were moved to the special servicing bucket last month.

—Posted on Apr. 26, 2021

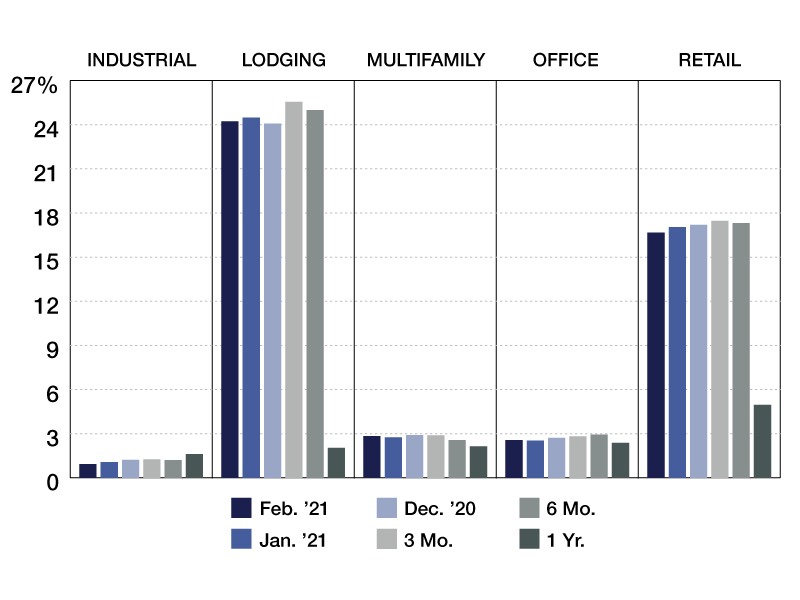

In February, Trepp CMBS Special Servicing rate saw a reduction of 12 basis points, coming in at 9.6 percent, in comparison to 9.7 percent in January. This marks the fifth consecutive monthly decline in special servicing rates. This reduction can be mainly attributed to a significant reduction in CMBS special servicing rate for retail and lodging sector.

Retail special servicing rates which have been on a downhill path since September last year came in at 16.7 percent, a 38-basis point reduction last month. Lodging special servicing rates, which increased by 42 basis points in January, saw a reduction of 26 basis points last month. Office and multifamily special servicing rates saw an increase of five and eight basis points respectively.

The special servicing rate for CMBS 2.0+ notes saw a reduction of five basis points, clocking in at 8.9 percent in February. In terms of the outstanding balance of loans that are currently in special servicing, the total reduced by roughly $164 million to $47.13 billion in February.

—Posted on Mar. 23, 2021

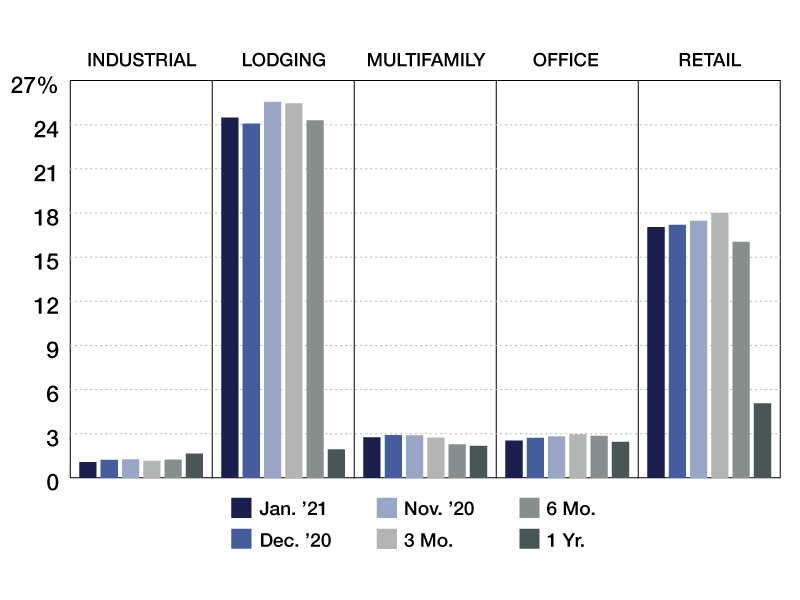

In January, the Trepp CMBS Special Servicing rate saw a reduction of nine basis points, coming in at 9.7 percent, in comparison to 9.8 percent in December. This marks the fourth consecutive monthly decline in the overall special servicing rate. The drop in January can be mainly attributed to a significant reduction in the CMBS special servicing rate of every property type, besides lodging. The lodging special servicing rate saw an increase of 42 basis points last month. This comes after a reduction in the lodging special servicing rate in December.

The office special servicing rate had the largest reduction of all property types at 19 basis points, followed by industrial at 16 basis points. Considering that office loans comprise the largest balance of all property types in the CMBS universe, the reduction in the office rate has a significant impact on the overall rate. The special servicing rate for CMBS 2.0+ notes saw a reduction of five basis points, clocking in at 8.9 percent in January. In terms of the outstanding balance of loans that are currently in special servicing, the total reduced by roughly $189 million to $47.29 billion in January.

In the legacy CMBS universe, the overall special servicing rate saw a significant reduction of 66 basis points, coming in at 49.9 percent in January. The total outstanding balance of these loans fell to $5.21 billion from $5.47 billion in December. The number of loans newly transferred to special servicing saw a drop in January. A total of 44 loans were sent to special servicers compared to 40 the month before. Together, these loans hold an outstanding balance of $837.4 million. About 55 percent of the new specially serviced loan balance was attributed to lodging CMBS loans followed by retail CMBS loans which accounted for about 36 percent.

—Posted on Feb. 26, 2021

You must be logged in to post a comment.