2019 CMBS Delinquency Rates

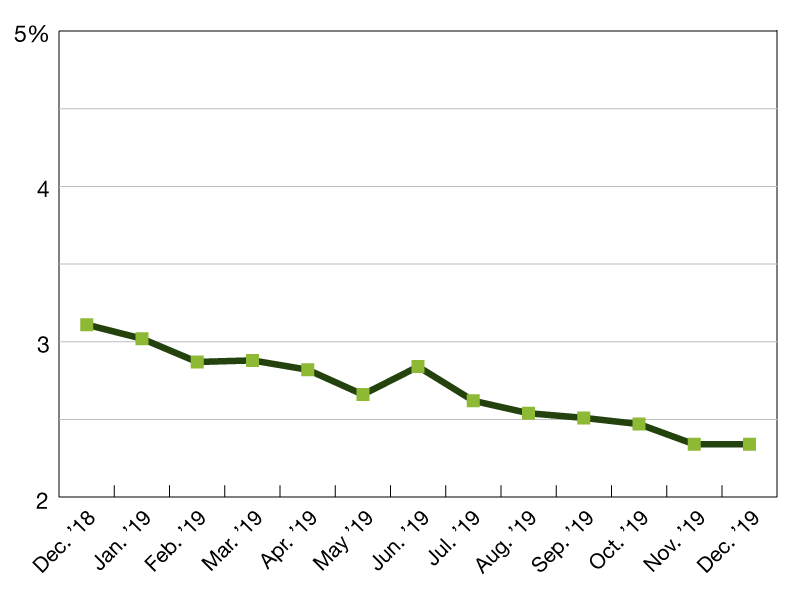

The Trepp overall CMBS Delinquency Rate remained unchanged in December, ending a five-month stretch of reductions.

The Trepp overall CMBS Delinquency Rate remained unchanged in December, ending a five-month stretch of reductions in the delinquency rate. The December reading is 2.3 percent, the same we recorded in November for which the rate was a post-financial-crisis low. The delinquency rate is down 77 basis points year-over-year. The delinquency rate started to fall after June 2017 when CMBS delinquencies totaled 5.8 percent. Since then, the rate has fallen in 25 of the last 30 months. The all-time high of 10.3 percent was registered in July 2012.

Manus Clancy is Senior Managing Director of Applied Data & Research.

—Posted on Jan. 16, 2020

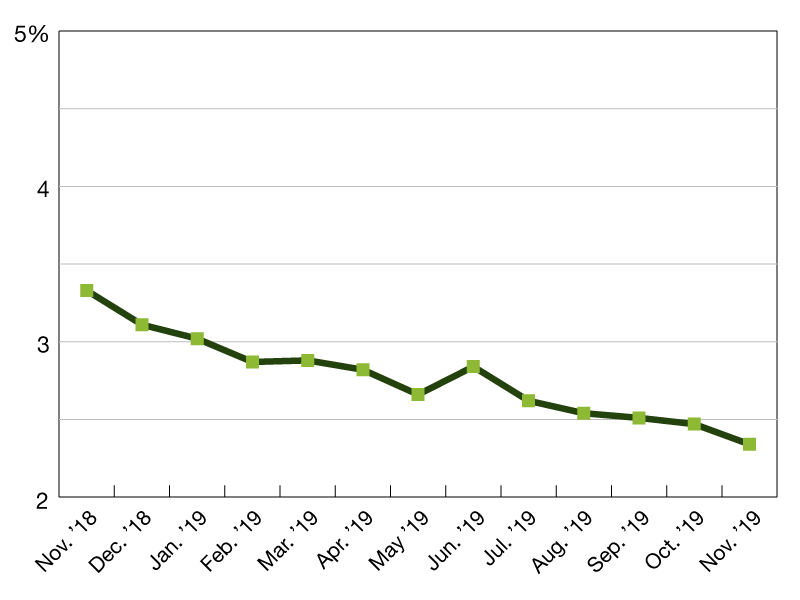

The Trepp CMBS Delinquency Rate fell sharply in November, as the index hit another post-crisis low. The November reading is 2.3 percent, a month-over-month drop of 13 basis points. The delinquency rate is down 99 basis points year-over-year. The delinquency rate started to fall after June 2017 when CMBS delinquencies totaled 5.8 percent. Since then, the rate has fallen in 25 of the last 29 months. Year-to-date, the rate is lower by 77 basis points. The all-time high of 10.3 percent was registered in July 2012.

Manus Clancy is Senior Managing Director of Applied Data & Research.

—Posted on Dec. 16, 2019

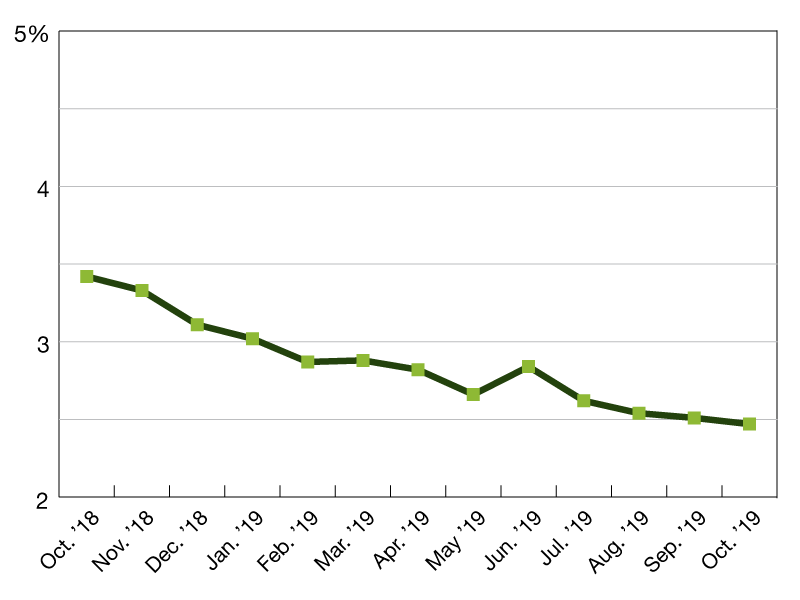

The Trepp CMBS Delinquency Rate fell modestly in October, as the index hit another post-crisis low. The October reading is 2.5 percent, a month-over-month drop of four basis points. The delinquency rate is down 95 basis points year over year. The delinquency rate started to fall after June 2017 when CMBS delinquencies totaled 5.8 percent. Since then, the rate has fallen in 24 of the last 28 months. Year-to-date, the rate is lower by 64 basis points. The all-time high of 10.3 percent was registered in July 2012.

Manus Clancy is Senior Managing Director of Applied Data & Research.

—Posted on Nov. 18, 2019

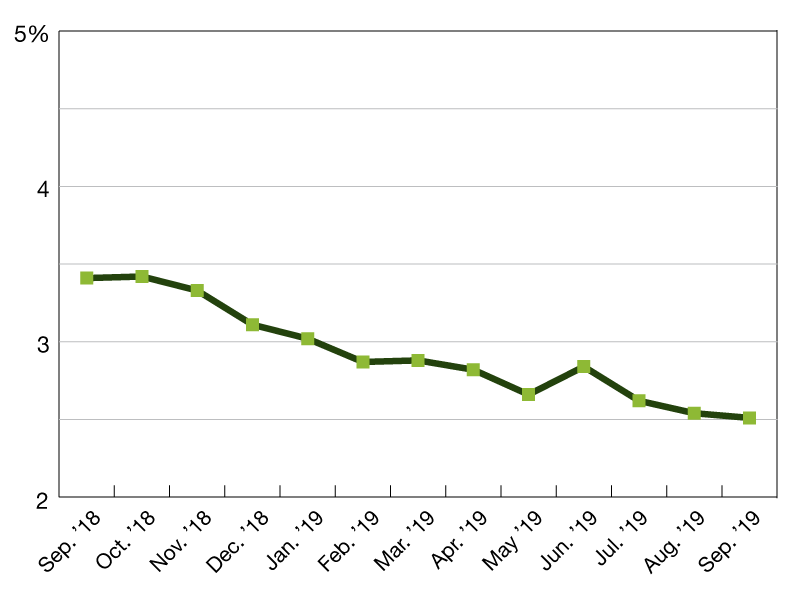

The Trepp CMBS Delinquency Rate fell slightly in September, once again setting another new post-crisis low in the process. The September reading is 2.5 percent, a month-over-month drop of three basis points. The delinquency rate is down 90 basis points year over year. The delinquency rate started to fall after June 2017 when CMBS delinquencies totaled 5.8 percent. Since then, the rate has fallen in 23 of the last 27 months. Year-to-date, the rate is lower by 60 basis points. The all-time high of 10.3 percent was registered in July 2012.

The percentage of loans that are seriously delinquent (60+ days delinquent, in foreclosure, REO, or nonperforming balloons) is now 2.4 percent, down two basis points for the month. If defeased loans were taken out of the equation, the overall 30-day delinquency rate would be 2.7 percent, down three basis points from August. One year ago, the U.S. CMBS delinquency rate was 3.4 percent, while six months ago, the US CMBS delinquency rate was 2.9 percent.

Manus Clancy is Senior Managing Director of Applied Data & Research.

—Posted on Oct. 23, 2019

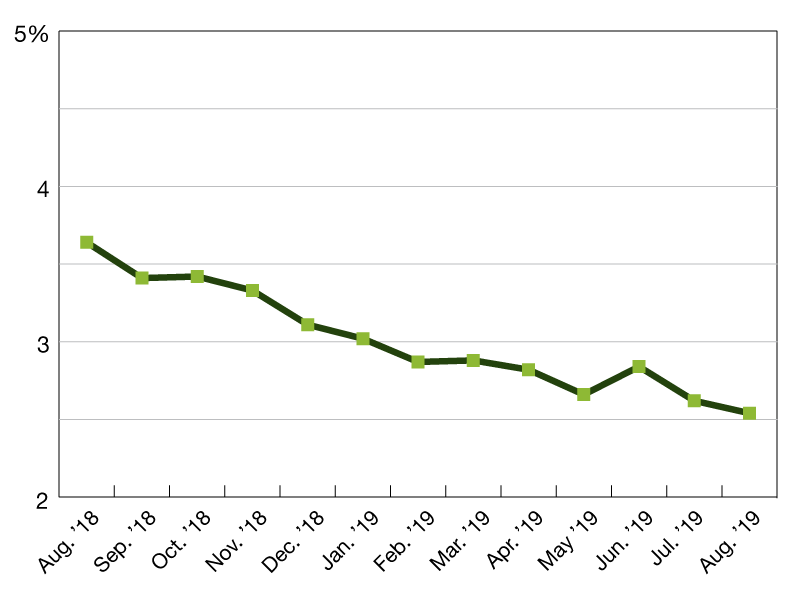

The Trepp CMBS Delinquency Rate fell again in August, setting another new post-crisis low in the process. The August reading is 2.5 percent, a month-over-month drop of eight basis points. The delinquency rate is down 110 basis points year-over-year. The delinquency rate started to fall after June 2017 when CMBS delinquencies totaled 5.8 percent. Since then, the rate has fallen in 22 of the last 26 months. Year-to-date, the rate is lower by 57 basis points. The all-time high of 10.3 percent was registered in July 2012.

Manus Clancy is Senior Managing Director of Applied Data & Research.

—Posted on Sep. 24, 2019

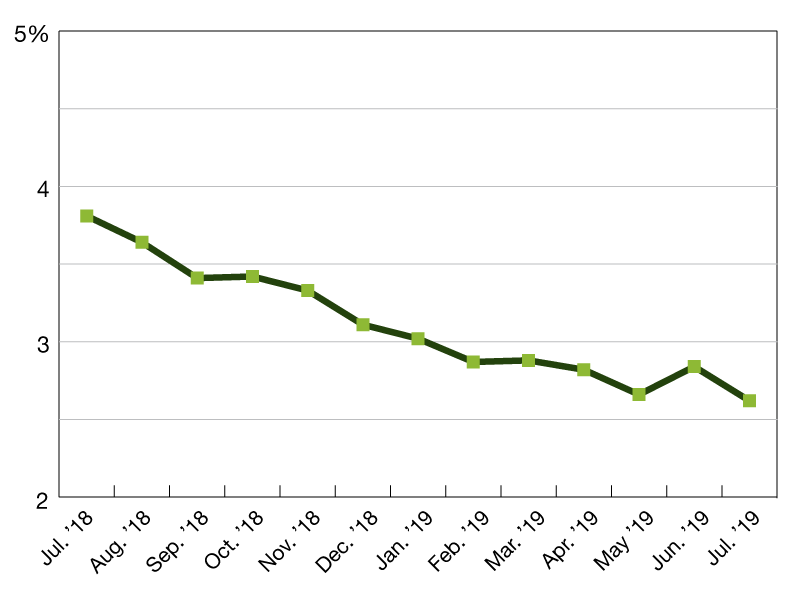

The Trepp CMBS Delinquency rate posted a sizable decline in July, setting a new post-crisis low along the way. All five major property types posted improvements in their delinquency readings over the past month. The July reading was 2.6 percent, a month-over-month drop of 22 basis points. The delinquency rate is down 119 basis points year-over-year. The delinquency rate started to fall after June 2017 when CMBS delinquencies totaled 5.8 percent. Since then, the rate has fallen in 21 of the last 25 months. From a year-to-date standpoint, the rate is lower by 49 basis points. As we’ve noted frequently over the last two years, the downward trend is the result of troubled legacy loans being resolved away. The all-time high of 10.3 percent was registered in July 2012.

Manus Clancy is Senior Managing Director of Applied Data & Research.

—Posted Aug. 22, 2019

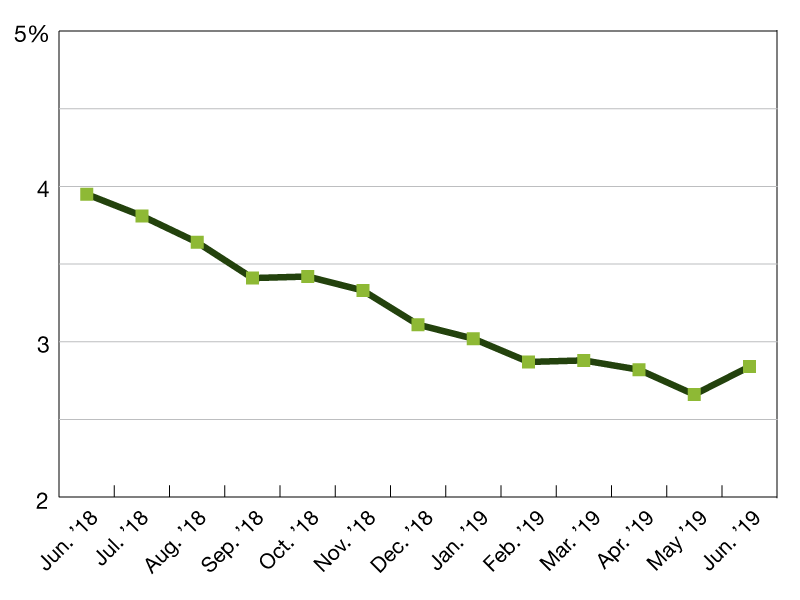

The Trepp CMBS Delinquency Rate saw a rare increase in June, although the number comes with a footnote. The June reading increased 18 basis points to 2.8 percent. The spike represents only the fourth monthly increase over the last two years.

The footnote comes from the single-borrower CLNS 2017-IKPR deal. The Innkeepers portfolio loan behind the $754 million loan showed up as a non-performing loan that was past its maturity according to servicer data.

The Trepp CMBS Delinquency Rate is down 111 basis points year over year (using the 2.8 percent rate). The delinquency rate started to fall after June 2017 when CMBS delinquencies amounted to 5.8 percent. Since then, the rate has fallen in 20 of the last 24 months.

Year-to-date, the rate is lower by 27 basis points. The all-time high of 10.3 percent was registered in July 2012.

Manus Clancy is Senior Managing Director of Applied Data & Research.

—Posted on July 23, 2019

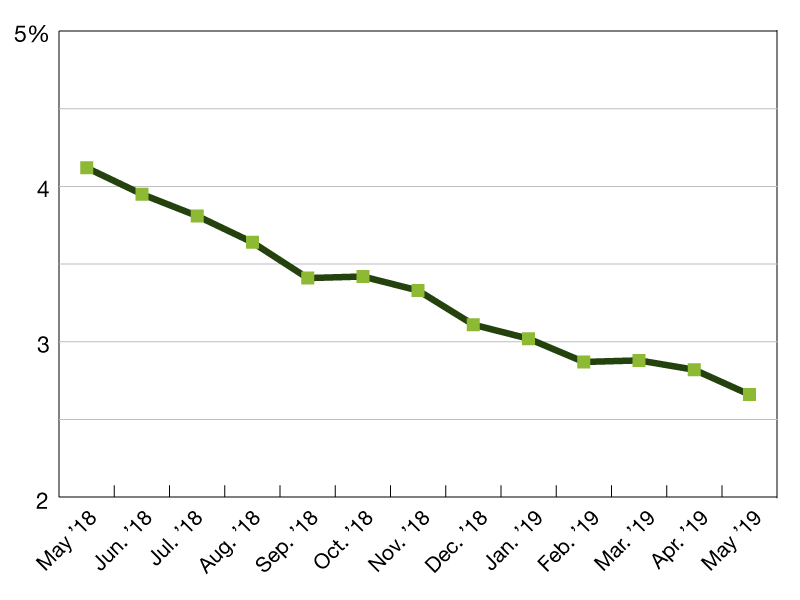

The Trepp CMBS Delinquency Rate fell sharply in May, as more troubled loans have been squeezed out of the system and new CMBS issuance remains steady.

The May reading declined 16 basis points to 2.7 percent, hitting another post-financial crisis low in the process. The delinquency rate is down 146 basis points year over year. Year-to-date, the rate is lower by 45 basis points.

Retail delinquencies fell 33 basis points in May, the largest drop of all property types. Lodging remains the best performing type thanks to a 13-bp drop to 1.4 percent last month. The CMBS 1.0 delinquency rate was 44.4 percent in May, a decrease of 209 basis points.

Manus Clancy is Senior Managing Director of Applied Data & Research.

—Posted on June 20, 2019

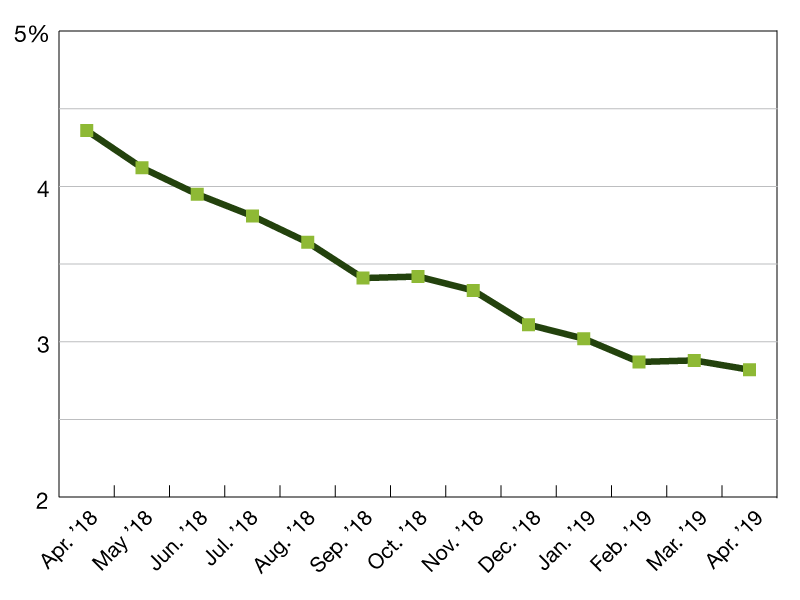

The Trepp CMBS Delinquency rate resumed its decline in April after a rare (and tiny) uptick in March. The April reading declined six basis points to 2.8 percent, hitting a new post-financial crisis low in the process. The reading is down 154 basis points year over year. Year to date, the rate is down 29 basis points.

The retail delinquency rate declined 28 basis points to 4.6 percent, the greatest improvement of all major property sectors in April. Retail remains the worst performing major property type. The CMBS 2.0+ delinquency rate climbed five basis points to 0.70% in April, while the CMBS 1.0 delinquency rate was 46.5 percent, a decrease of one basis point.

Manus Clancy is Senior Managing Director of Applied Data & Research.

—Posted on May 20, 2019

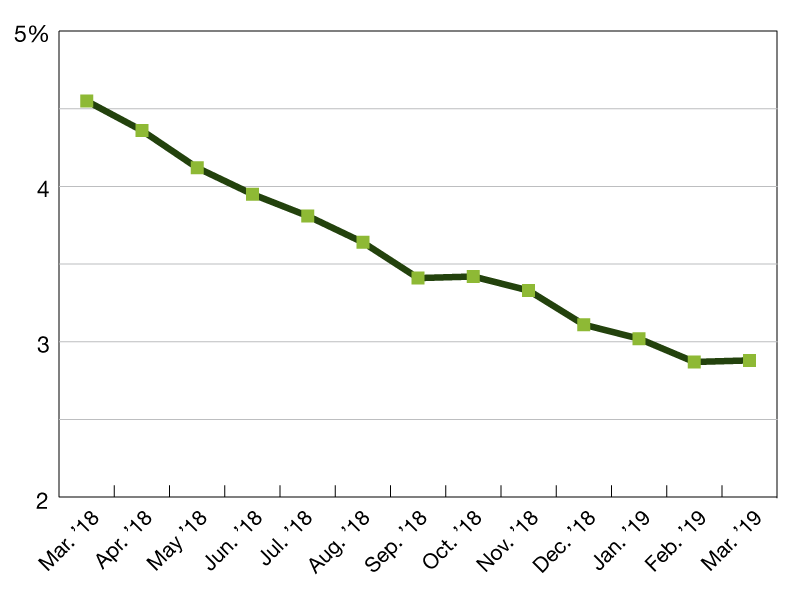

The Trepp CMBS Delinquency rate posted a rare increase in March. The March reading inched up one basis point to 2.9 percent, which marks the first uptick in five months and the second in the last 12 months. The rate is down 167 basis points year over year. Delinquencies started to abate after June 2017, when the reading was 5.8 percent. Since then, the rate has fallen in 18 of the last 21 months, showing how rare an increase has become. The all-time high of 10.3 percent was registered in July 2012. February’s reading of 2.9 percent is the lowest rate since the financial crisis. Delinquencies for loans in CMBS 2.0+ inched two basis points higher to 0.7 percent last month. That reading has risen by 10 basis points year over year. The CMBS 1.0 delinquency reading surged 164 basis points higher in March and now registers at 46.5 percent. After posting February’s greatest rate drop by property type, the retail sector featured March’s greatest increase as its reading jumped 13 basis points to 4.9 percent. The largest rate drop among major property sectors belonged to the apartment segment, as multifamily delinquencies slid 30 basis points to 2.0 percent last month.

Manus Clancy is Senior Managing Director of Applied Data & Research.

—Posted on Apr. 19, 2019

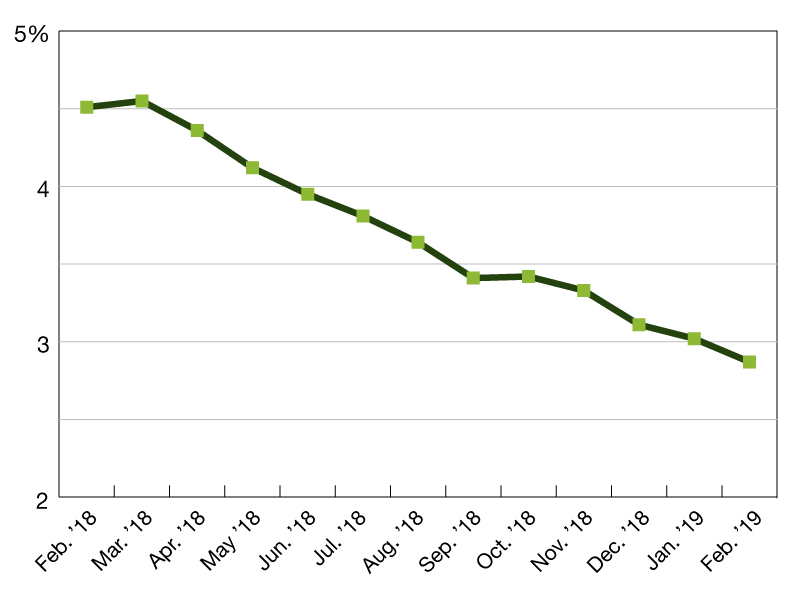

The Trepp CMBS Delinquency rate broke through the 3 percent threshold in February as the reading continues its steady decline. The February reading fell 15 basis points to 2.9 percent while hitting yet another post-crisis low.

The delinquency rate is 164 basis points lower year-over-year. The reading started to fall after the June 2017 report when CMBS delinquencies registered 5.8 percent. Since then, the rate has fallen in 18 of the last 20 months.

February’s greatest month-over-month improvement by major property type belonged to the office segment. The office reading shed 34 basis points last month and now clocks in at 3.1 percent.

Retail still has the worst performing rate among property types, but its reading fell once again in February. With its most recent decline of 15 basis points, the retail rate now sits at 4.8 percent and has improved in each of the last five months.

Although the overall CMBS 2.0+ rate dipped five basis points to 0.6 percent last month, the seriously delinquent reading for 2.0+ increased eight basis points to 0.6 percent. Delinquencies among CMBS 1.0 continue to slide as its overall rate dipped another 45 basis points to 44.8 percent.

Manus Clancy is Senior Managing Director of Applied Data & Research.

—Posted on Mar. 26, 2019

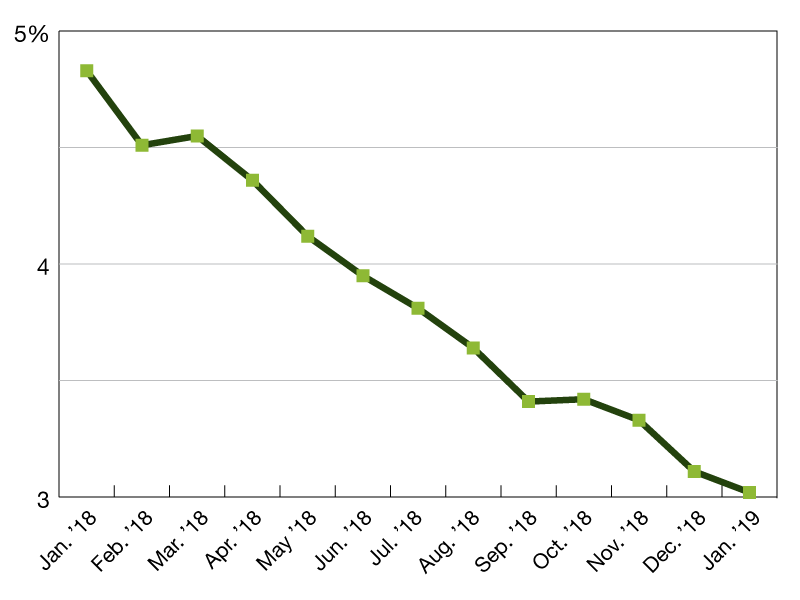

The Trepp CMBS Delinquency Rate opened 2019 on a positive note as the reading dropped again in January. The rate fell nine basis points from 3.1 percent to 3.0 percent in January, which represents a new post-recession low. The reading is down 181 basis points year-over-year. The delinquency rate started to improve consistently after June 2017. The CMBS 2.0+ delinquency rate rose 6 basis points to 0.7 percent in January. The percentage of 2.0+ loans that are seriously delinquent is now 0.5 percent, which is down 4 basis points month-over-month. For the second consecutive month, the industrial sector was the major property type which featured the greatest month-over-month improvement in its delinquency rate. The industrial reading dipped 34 basis points to 2.1 percent in January.

Manus Clancy is Senior Managing Director of Applied Data & Research.

—Posted on Feb. 13, 2019

You must be logged in to post a comment.