Yardi Matrix: Steady in St. Louis

The metro is enjoying a spell of solid employment and rent growth, which has pushed investor activity to cycle highs.

By Alex Girda

St. Louis rent evolution, click to enlarge

St. Louis is enjoying a spell of solid employment and rent growth, which has pushed investor activity to cycle highs. Both transaction volume and per-unit prices increased in 2016, as the high acquisition yields of assets and low barriers to entry facilitated interest from investors priced out of larger core and secondary markets.

Driven by growth in hospitality, trade, transportation and construction, St. Louis is also focusing on increasing its number of technology- and information-related jobs. The Cortex Innovation community is a project meant to improve the metro’s standing with tech companies, continuing the push for the addition of science, technology, engineering and math (STEM) jobs in the area. The expansion of Southwest Airlines at Lambert Airport bodes well for mobility to and from the city.

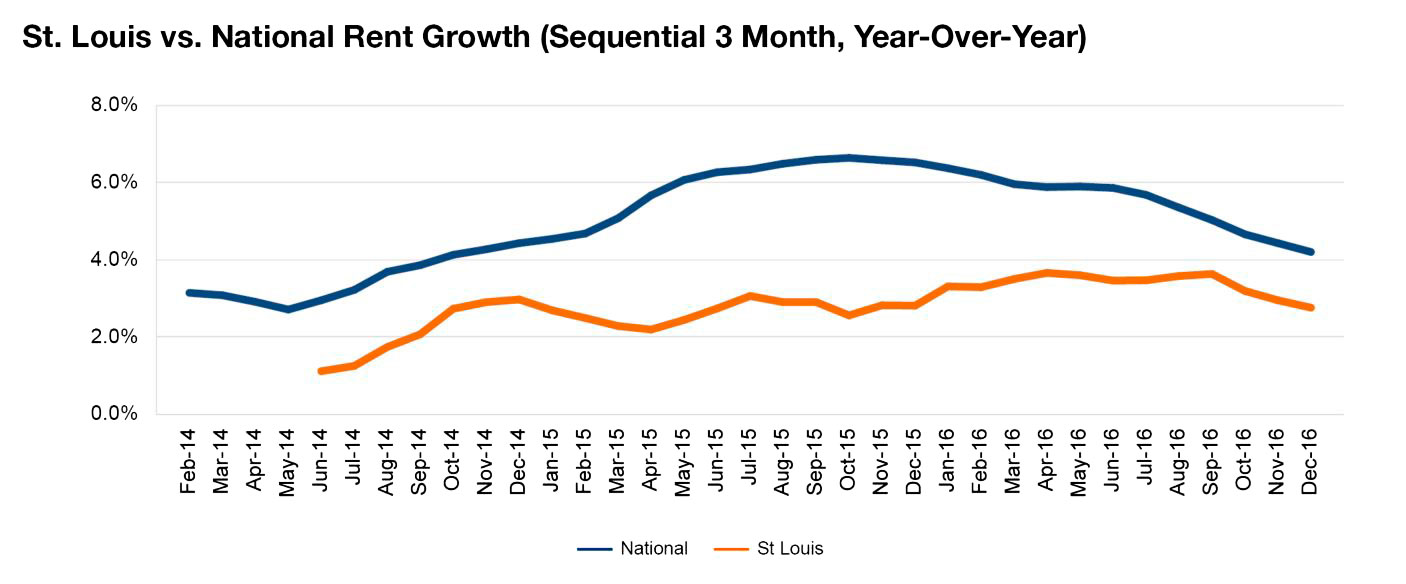

More than 3,000 apartment units are under construction, the bulk of which will be added to the market’s core. High rents and proximity to Washington University have helped the University City/Maplewood submarket lead the metro for both rent growth (21.7 percent) and actual rent ($1,724) in 2016. The submarket also boasts the most intense development activity, with more than 800 units underway. As occupancy is trending below 95 percent and multifamily stock continues to expand, we expect moderate rent growth to continue, producing a 3.1 percent gain for 2017.

Read the full Yardi Matrix report.

You must be logged in to post a comment.