Yardi Matrix: Steady Growth in St. Louis

Multifamily Summer Report 2016: An influx of professional jobs and the area’s relative affordability are attracting residents and lifting demand for apartments.

Employment and population gains have given a boost to the multifamily market in traditionally slow-growth St. Louis. An influx of professional jobs and the area’s relative affordability are attracting residents and lifting demand for apartments.

The region’s universities and medical institutions produce a skilled workforce that attracts medical and technology firms. As a result, high-paying science, technology, engineering and math (STEM) jobs are expected to grow over the next five years. The Cortex innovation district, a master-planned community in Midtown, serves as a hub for life sciences and biotech research, creating a strong multiplier effect for the St. Louis economy. Plans for the district call for 4.5 million square feet of mixed-use space, 13,000 jobs and more than $2 billion in capital investment. So far, more than 1 million square feet of office, lab and retail space have already been built at a cost exceeding $500 million.

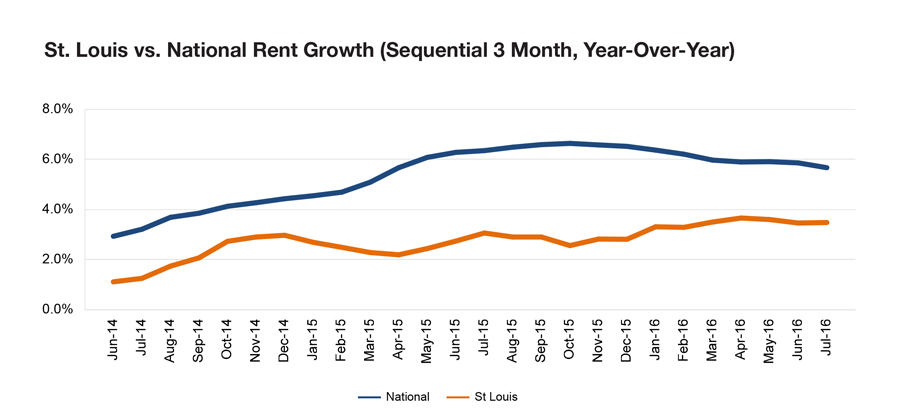

Submarkets that command the highest rents are those offering young professionals easy access to downtown jobs and amenities. Investment activity is gaining momentum, having reached a new post-recession high of $315 million in 2015. Upcoming deliveries are also significant, currently amounting to more than 9,700 units. Absorption is set to keep up with new product, hindered only by the affordability of single-family housing. Increasing demand and limited inventory are expected to push rents up by 3.2 percent in 2016.

You must be logged in to post a comment.