Yardi Matrix: Stabilized Portland

Though multifamily demand remains elevated, increasing development and affordability issues have brought gains to a more sustainable level.

Portland rent evolution, click to enlarge

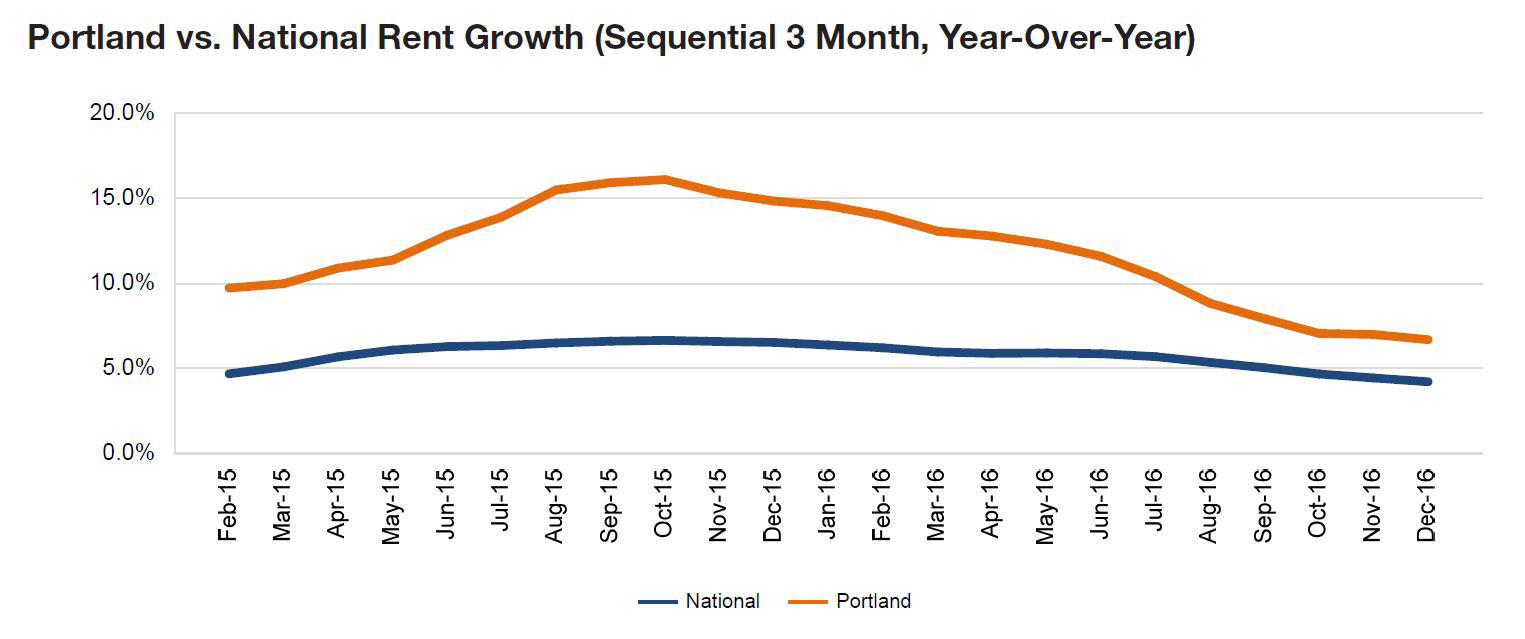

The “Silicon Forest“ still appeals to young professionals and continues to add jobs, especially in the booming business, education, health-care and tech sectors. But after more than a year of double-digit rent increases, growth is finally starting to slow down. Though multifamily demand remains elevated, fueled by a healthy job market and a constant influx of Millennials, increasing development and affordability issues have brought gains to a more sustainable level.

Portland’s healthy economy continues to attract investment as well as development, and a new wave of office construction is overtaking the central business district (CBD) and Northeast submarkets. Major companies such as Beaverton-based Nike and Under Armour are expanding, adding jobs and further boosting multifamily demand. The supply delivered in recent months has not been able to temper demand, and more than 24,000 units are still in the pipeline. The opening of the new Portland-Milwaukie MAX Orange line and the approval of the city’s West Quadrant development plan are likely to spur waterfront development and draw investor interest.

With so much growth, Portland will continue to see strong demand and steady job growth. But we expect rent growth, which measured 6.25 percent in December, to stay in the 6 percent range, still strong yet not at the frothy levels of the past two years.

Read the full Yardi Matrix Report.

You must be logged in to post a comment.