Yardi Matrix Predicts Strong 2016 for Multifamily

Yardi Matrix's Winter 2016 Outlook reports predicts another strong, yet less-volatile, year for the apartment market.

By Mallory Bulman, Associate Editor

By Mallory Bulman, Associate Editor

As the New Year comes into full swing, many real estate professionals are looking ahead to what the market has in store for the future. While the apartment market has enjoyed considerable rent growth over the past few years, the peak 6 percent growth rate just isn’t sustainable long-term. However, Yardi Matrix, Yardi’s multifamily data provider, predicts that 2016 will be strong year for rent growth despite the forecasted deceleration in its newest report, “The 2016 Winter Outlook.”

Economically, things are looking up, with 2016 poised to herald U.S. GDP growth of approximately 2.5 percent and the addition of 2.5 million jobs. Fundamentals should continue to be strong in terms of demand, and in terms of rent growth. “We’re starting to see development pick up to the point where it possibly could be a concern in some markets, but I think on a national level, we’re not in the trouble zone yet,” said Paul Fiorilla, editorial director of Yardi Matrix. The report also predicts the steady flow of capital into the U.S. multifamily market showing few signs of slowing, meaning a variety of lending sources will likely continue to offer debt at moderate prices.

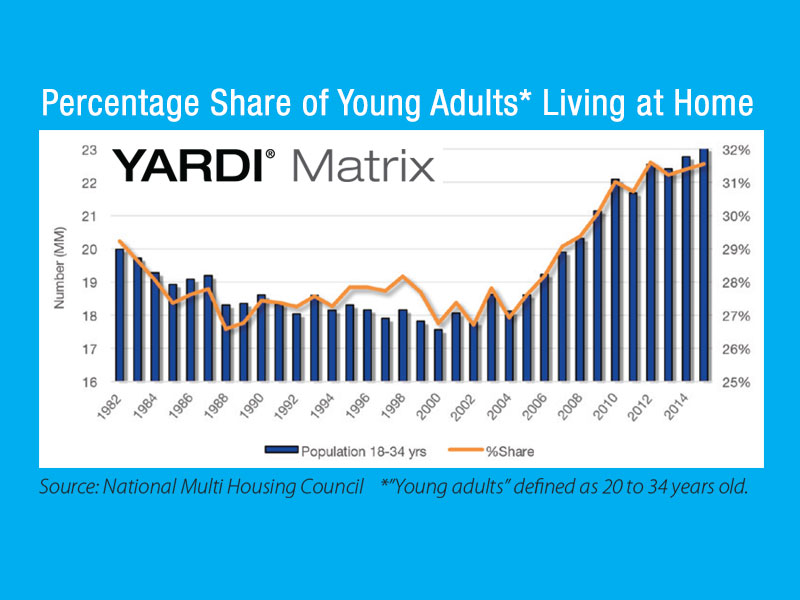

The social trends of 2015, including the influx of Millennial and Baby Boomer renters, will only continue as better job prospects lead to more household formations. Baby Boomers are joining their Millennial children in the exodus from traditional family homes, and are increasingly likely to rent, whether for convenience or financial freedom. “The demographics are favorable in terms of the Millennial prime renter age group that’s continuing to grow, and the increasing number of Baby Boomers, some of whom are trading down from houses into apartments,” Fiorilla said.

With the increased demand always comes the need for increased supply, and Matrix predicts a 2.9 percent increase in existing housing stock in their 111 tracked markets. While the figure may seem large in the context of previous years, more supply is needed to keep up with overwhelming demand stemming from new households, high occupancy rates and lack of affordability. Fiorilla is confident that capital supply won’t be an issue, reporting, “There’s so much capital being funneled into real estate that the prices are at all-time highs in the multifamily sector. There is concern that there is too much capital in the market, and that prices have hit their top. While I don’t think that capital is going to disappear because of the trends we’re seeing, the reason that the capital is coming to the US is because the U.S. is a global safe haven, and I don’t see that changing.”

Click here to view the report.

You must be logged in to post a comment.