Yardi Matrix: Phoenix on Fire

Arizona is among the top handful of U.S. states for economic and population growth, creating strong demand for multifamily.

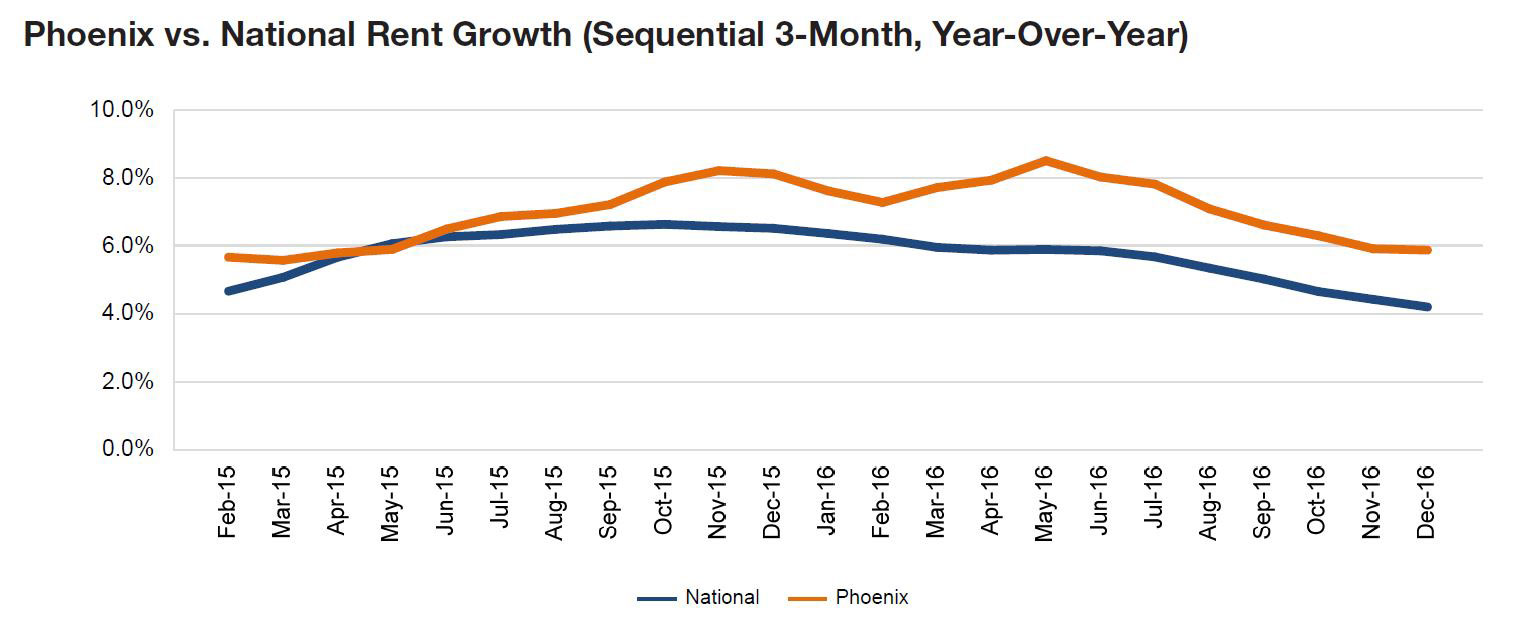

Phoenix rent evolution, click to enlarge

Phoenix tends to ride hot and cold, and currently it’s in hot mode. Arizona is among the top handful of U.S. states for economic and population growth, creating strong demand for multifamily. Units that were built before the last downturn are filled, and the next wave of development has started.

Employment gains are diversified, with education and health services, mining, logging and construction, and professional and business services leading the activity. Arizona’s four largest health systems announced in December 2015 the opening of 8,500 new positions, planned to be filled in 2016. Additionally, a new State Farm campus in Tempe next to a Home Depot service center was completed last fall, and it continues to hire.

Rents rose 5.9 percent year-over-year through November, well above the national average, and occupancy for stabilized properties climbed to 95.2 percent. Homeownership remains less costly than renting in Phoenix, and the affordability issue is slowly creeping in. Future supply is robust, with more than 10,500 units currently underway and over 23,000 in planning stages. Improving property fundamentals and relatively high yields are intensifying demand for multifamily assets, while transaction volume climbed 25 percent year-over-year through November, peaking at $4.6 billion.

Read the full Yardi Matrix Report.

You must be logged in to post a comment.