Yardi Matrix: Nashville’s Strong Performance

Nashville remains a target for multifamily investors for its 18-hour city appeal, strong apartment demand, burgeoning local economy and high quality of life.

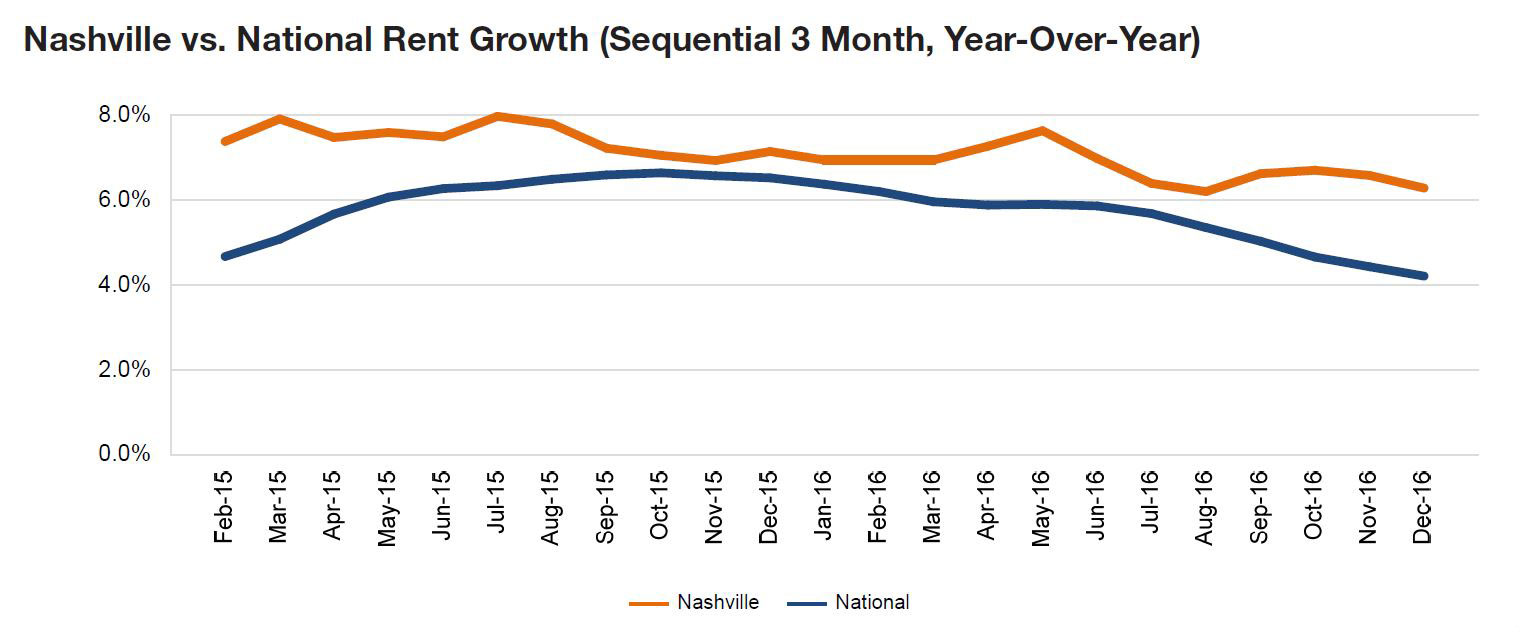

Nashville rent evolution, click to enlarge

Nashville’s multifamily market is positive on most levels. The metro’s booming economy is producing job opportunities at a rate double the national average. That serves to attract an educated young workforce, which helps to drive the demand for housing.

Employment is flourishing, with 25,300 jobs added in the 12 months ending in September. Traditionally known for its entertainment industry, the city is slowly pivoting from relying solely on this sector. The health care industry leads in job gains and is expected to reach $5 trillion in spending by 2022. With 16 publicly traded health care companies headquartered in Nashville, having a combined $73 billion in global revenue, the sector is currently at its peak. Public-private collaborations, such as Partnership 2020, are working toward growing the regional economy, preparing young workers for emerging fields and improving global connectivity, as well as regional transit.

Investor appetite slowed down in 2016, as this year’s transaction volume of $834 million fell behind last year’s record-breaking $1.2 billion volume. Even so, Nashville remains a target for multifamily investors for its 18-hour city appeal, strong apartment demand, burgeoning local economy and high quality of life. 2016 has been a record-setting year for population gains, rent growth, per-unit price, median home price and development pipeline.

Read the full Yardi Matrix Report.

You must be logged in to post a comment.