Yardi Matrix: Jacksonville’s Multifamily Renaissance

The multifamily market in Jacksonville is improving, sustained by the metro’s hiring boom and increasing population.

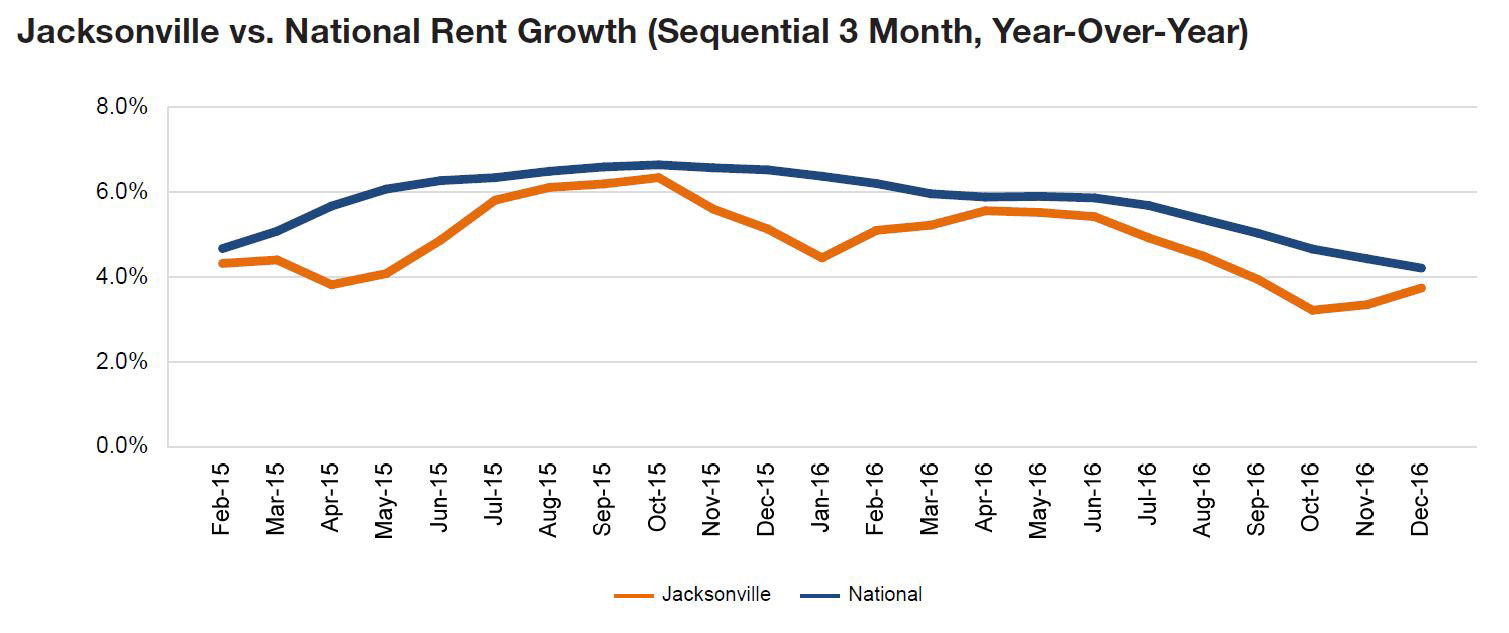

Jacksonville rent evolution, click to enlarge

The multifamily market in Jacksonville is improving, sustained by the metro’s hiring boom and increasing population. Although Jacksonville is a secondary tourist location in Florida, its share of the market is growing. The leisure and hospitality industry is leading the way, as visitors are coming to the state in record numbers. Employment gains have also been significant for the local medical community, the office-using sectors, construction and transportation.

Jacksonville currently ranks as one of the most affordable metros in Florida for apartment renters. And even though rent gains have persisted over the last three years, incomes have grown even faster, helping to maintain the city’s relative affordability as a key draw for incoming residents.

Multifamily fundamentals have been healthy, and we expect that to continue. Transaction volume exceeded $700 million, and investors reached a cycle-high price per unit last year. Construction activity, however, posted modest numbers, as only about 1,200 units came online in 2016, although we expect an increase to 1,800 units in 2017. The pipeline includes developments targeting areas near St. Johns Town Center, downtown and the Jacksonville International Airport. We expect absorption to remain robust, despite rents growing a modest 3.7 percent in 2017, down from 5.1 percent in 2016.

Read the full Yardi Matrix Report.

You must be logged in to post a comment.