Yardi Matrix: Indianapolis Rebounds

Multifamily Summer Report 2016: Demand is picking up, with a record number of units on tap to come online by the end of the year.

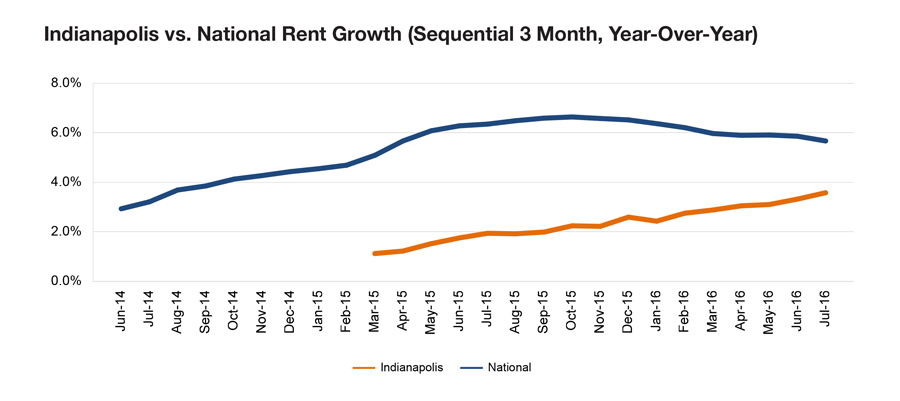

Benefiting from metro Indianapolis’ strong employment gains, rising wages and relatively low cost of living, the local multifamily market is picking up the pace. Though the metro’s job and rent growth trail the nation, sectors such as hospitality, health care, trade and transportation are adding jobs and fueling demand for apartments.

Indianapolis is a major transportation and distribution center for the Midwest, adding more than 10,000 jobs in this sector alone over the past year. Home to the nation’s second-largest FedEx Express hub, it offers a central location that appeals to developers and investors alike. The metro is within a relatively short driving distance of much of the U.S. population, making it essential to companies such as Amazon, Walmart, Newegg or Ozburn-Hessey Logistics, which are expanding their presence in the region. Leisure and hospitality is another economic driver, with projects such as the $650 million American Place casino and retail complex proposed by Full House Resorts currently in the works. Numerous hotels have also sprung up close to the downtown area in the past year.

Multifamily demand is picking up, with a record number of units on tap to come online by the end of the year. However, the market’s rent growth rate ranks among the nation’s weakest, and our forecast calls for it to remain modest in 2016.

You must be logged in to post a comment.