Houston’s Shaky Economy

According to Yardi Matrix, very low rent growth and an occupancy rate that lags the national average will result in slow absorption of the 18,700 apartments added in 2016.

By Adelina Osan

Houston’s multifamily market is still reeling from the oil price collapse in 2015, which resulted in thousands of job cuts and slowing investment activity. Even though in-migration continues due to the metro’s growing economic diversity, its high quality of life and favorable cost of living, the rent growth outlook will remain clouded as the ample new supply gets absorbed.

The metro’s economy received a boost from hosting the Super Bowl, which generated seasonal jobs in hospitality and tourism. Through increases in consumer spending in hotels, retail and other entertainment venues, the Super Bowl’s economic impact has been estimated at $350 million. Home to Texas Medical Center, one of the largest medical centers in the world, Houston benefits from a skilled workforce, and the use of innovative technologies in health care attracts a large talent pool to the metro. The trade, transportation and utilities segment also posted positive results, as Houston develops a well-rounded workforce.

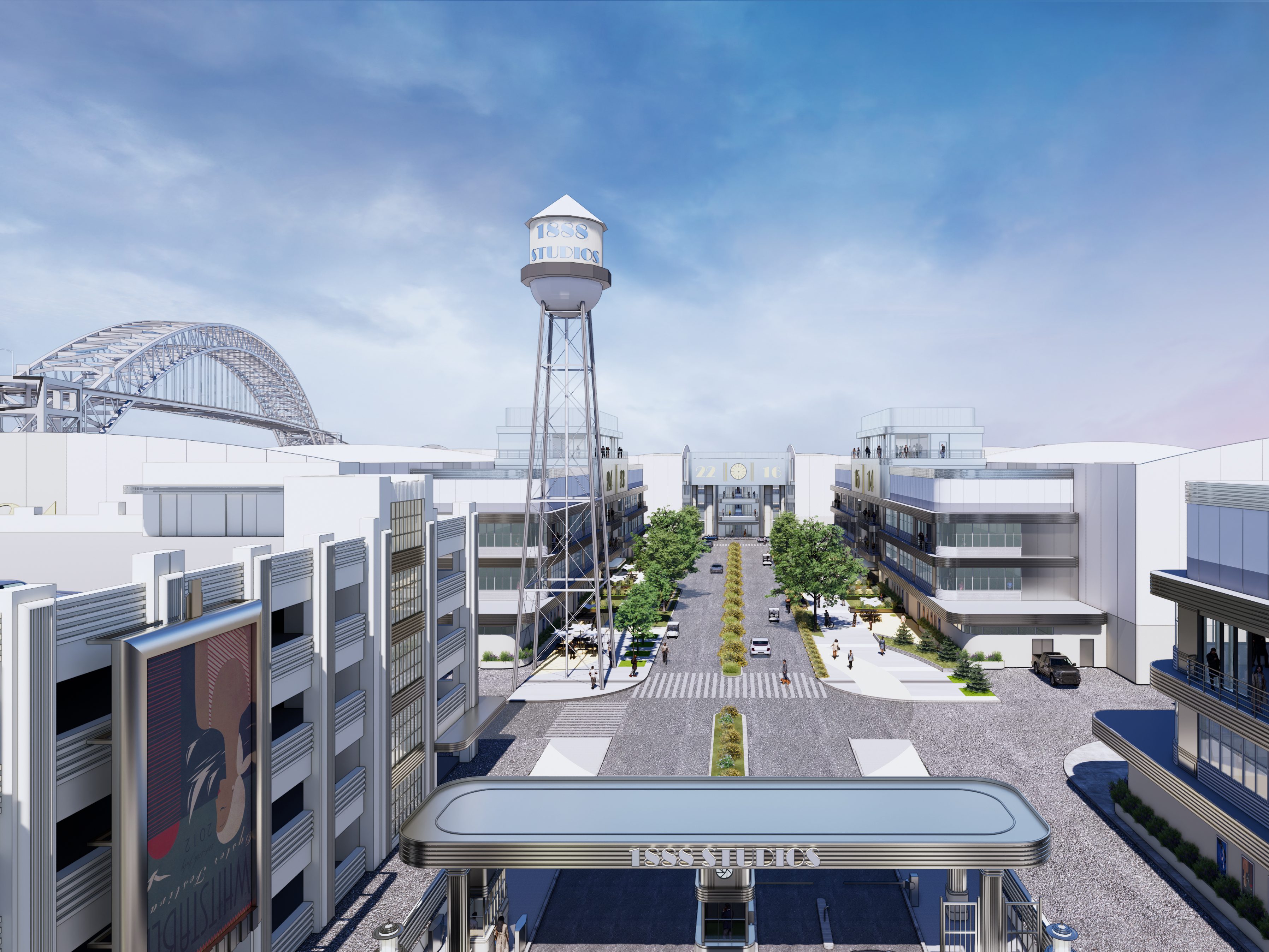

The outlook for multifamily is not favorable, since the development pipeline includes 58,000 units and the local economy remains unstable. With very low rent growth and an occupancy rate that lags the national average, absorption of the 18,700 apartments added in 2016 will be slow. Transactions remain widespread across the metro, while upcoming development is focused on the West End/Downtown submarket—with 4,800 units under construction.

Read the full Yardi Matrix report.

You must be logged in to post a comment.