Yardi Matrix: Employment Rebounds in June

The reversal of the downward trend seen in April and May indicates that the job market remains strong, which is good news for the multifamily industry.

By Chris Nebenzahl, Senior Market Analyst, Yardi Matrix

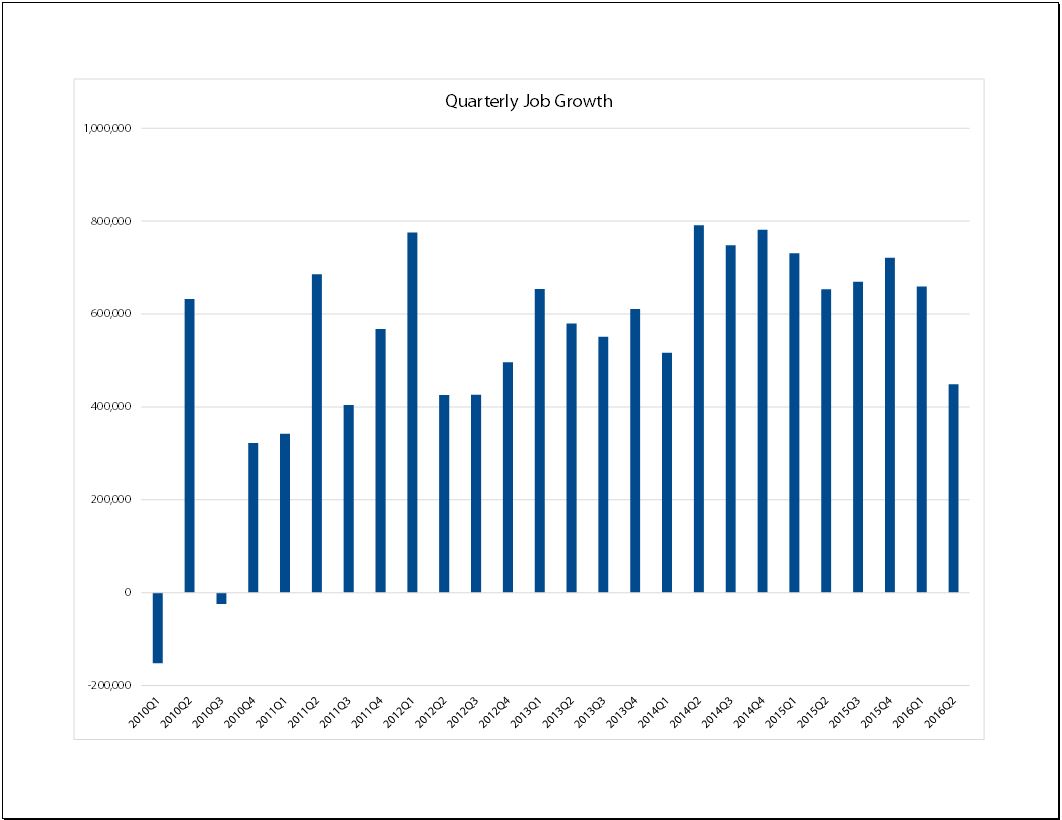

Following two consecutive months of less-than-expected employment growth, the labor market rebounded in June, adding 287,000 jobs for the month, according to data collected by Yardi Matrix. The reversal of the downward trend seen in April and May indicates that the job market remains strong, which is good news for the multifamily industry. Steady expansion in the labor market will support the growth in household creation and maintain elevated demand for housing.

Though the previous two months’ job reports were weak and were revised downward by a net 6,000 jobs, the second quarter averaged 147,000 jobs created per month. That’s down from the first-quarter average of 199,000 and the 200,000-plus average over the last six years, but it is to be expected that job creation will likely normalize at a lower level as the labor force reaches and surpasses full employment levels.

June employment expansion was led by the leisure and hospitality and health care sectors, which added 59,000 and 58,000 jobs, respectively. The information and the retail, professional and business services sectors were also strong in June, as each sector added 30,000 jobs or more. Mining continued to struggle, as 6,000 jobs were lost in the sector last month.

The unemployment rate increased to 4.9 percent from 4.7 percent in May, but there were positive elements as the work force expanded and wage growth inched upwards. Labor force participation grew to 62.7 percent from 62.6 percent, and the underemployment rate trended downward, reaching 9.6 percent, its lowest level since April 2008. Wage growth continued its modest and steady upward trend, as average hourly earnings increased 2.6 percent on a year-over-year basis.

Despite the greater-than-expected job growth, long-term Treasury rates remained relatively unchanged. The 10-year Treasury bond reached an all-time low of 1.32 percent on July 6 and closed the week at 1.37 percent. Commercial real estate has benefited from the low rate environment, and the low Treasury yields will continue to make the sector’s average 6 percent purchase yields look attractive to institutional investors.

While an average of 200,000 new jobs per month may be a thing of the past because the number of job seekers is shrinking, a sustainable level of between 150,000 and 175,000 average new jobs should allow the economy to continue its measured growth. Driven by the steadily advancing economy as well as historically low long-term interest rates, the real estate market will continue to improve and expand.

All in all, a strong June employment report provides something of a relief, as it comes in the wake of the Brexit vote, which has injected a fair level of uncertainty in the global economy. It demonstrates that the U.S. is likely to remain a haven.

You must be logged in to post a comment.